Automatic Resumption with the Product at Suspension Upon Discharge

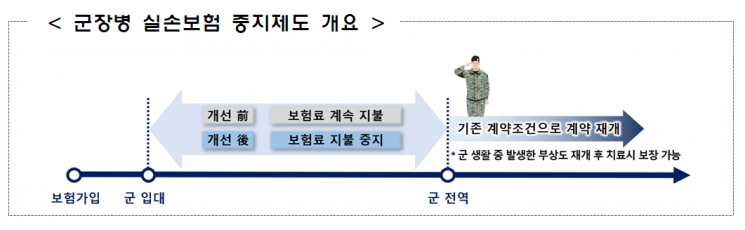

Starting from July, military personnel will be able to maintain their indemnity insurance without paying premiums during their military service period.

On the 13th, the Financial Supervisory Service announced plans to implement the "Military Personnel Indemnity Medical Insurance Suspension and Resumption System" from July 1. This is part of the "Insurance Industry Win-Win Plan" announced by financial authorities last December.

With the implementation of the military personnel indemnity suspension system, the policyholder does not have to pay premiums during the service period if the insured is enlisted as an active-duty soldier, while the coverage is suspended.

The system applies to insurance contracts where the insured is an active-duty soldier under the Military Service Act. The policyholder can apply for suspension of personal indemnity medical insurance with the consent of the insured.

During the suspension period of personal indemnity, premiums do not need to be paid, but insurance coverage is generally suspended. However, medical expenses incurred after resuming the contract for injuries caused by military service during the suspension period are covered. It should be noted that ▲medical expenses incurred during the suspension period due to injuries caused by military service are not covered ▲medical expenses from injuries unrelated to military service, such as during leave, are not covered during the suspension period and after resumption.

If the policyholder wishes, personal indemnity insurance can be resumed during the service period, and if no claim event occurs during the resumed period, suspension can be applied again. To resume personal indemnity insurance during military service, the policyholder must obtain the insured’s consent and submit a resumption application to the insurance company, and resumption is confirmed after the insurer’s approval.

Suspended insurance contracts are, in principle, automatically resumed on the discharge date stated by the policyholder at the time of suspension without separate examination, using the product at the time of suspension. To facilitate this, the insurance company requests confirmation of the resumption date from the policyholder one month prior to the scheduled resumption date and provides an estimate of the expected premium payment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)