TrendForce Announces 1Q Foundry Market Share

TSMC-Samsung Electronics Market Share Gap at 50.7%P

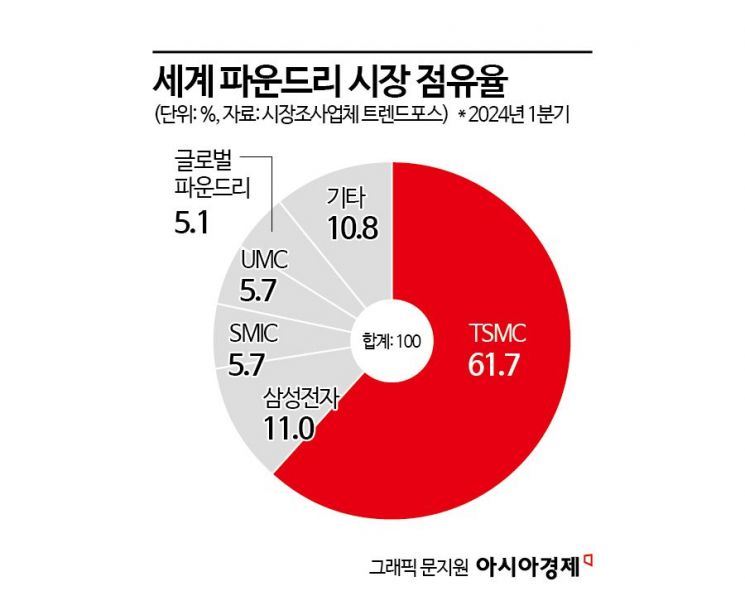

In the first quarter foundry (semiconductor contract manufacturing) market, the gap in market share between Taiwan's TSMC and Samsung Electronics, which hold the first and second positions respectively, has widened. The U.S.-based GlobalFoundries, which had maintained third place, dropped two ranks to fifth, swapping places with China's SMIC.

On the 12th, market research firm TrendForce announced that in the global foundry market for the first quarter, TSMC maintained its top position with a market share of 61.7%, up 0.2 percentage points from the previous quarter. TSMC posted sales of $18.847 billion in the first quarter, down 4.1% from the previous quarter. Although sales increased due to demand for high-performance computing (HPC) related to artificial intelligence (AI), this was offset by the off-season impact in the smartphone industry, including Apple.

Samsung Electronics ranked second with an 11.0% market share. Samsung's share fell by 0.3 percentage points from the previous quarter. Its first-quarter sales recorded $3.619 billion, down 7.2% from the previous quarter. As a result, the gap between first and second place widened from 49.9 percentage points in the fourth quarter of last year to 50.7 percentage points in the first quarter.

TrendForce stated, "With Apple's inventory replenishment cycle starting and continued demand for AI server-related HPC, TSMC's second-quarter sales are expected to grow by a single-digit percentage compared to the previous quarter." They also forecasted, "Samsung Electronics' sales may remain at the previous quarter's level or increase slightly."

SMIC ranked third with a 5.7% market share. Although it had the same market share as Taiwan's UMC, SMIC surpassed UMC in detailed sales figures, securing third place for the first time.

TrendForce noted, "SMIC showed solid performance supported by domestic production of integrated circuits (ICs) and demand for OLED display driver ICs (DDI) used in new Chinese smartphones," and predicted that SMIC is likely to maintain its ranking in the second quarter as well.

Consequently, GlobalFoundries, which had maintained third place, dropped to fifth with a 5.1% market share. This was due to halted customer orders in sectors such as automotive and industrial equipment, as well as the off-season in smartphones, causing first-quarter sales to plunge 16.5% from the previous quarter.

The total sales volume of the global foundry market in the first quarter was $29.172 billion, down 4.3% from the previous quarter. In the second quarter, the sales of the top 10 foundry companies are expected to increase by a single-digit percentage compared to the first quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)