May Cosmetics Exports Increase 11% Year-on-Year

AmorePacific Prepares for Recovery After Recent Slump

Domestic Cosmetics Gain Global Popularity with Cost-Effectiveness

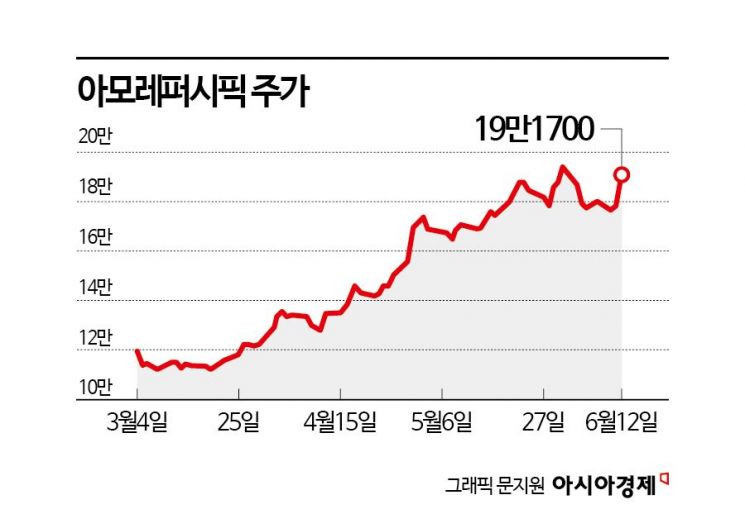

The rally in cosmetics-related stocks continues in the domestic stock market. Silicon2, which has been showing a steep upward curve after the first-quarter earnings announcement, is hitting new all-time highs day after day. Amorepacific and Kolmar Korea, which had briefly stalled earlier this month, have also rebounded, spreading warmth across the sector. Market experts believe that the steady increase in cosmetics export volume indicates further upside potential.

According to the financial investment industry on the 13th, Silicon2's stock price has risen 552% since the beginning of this year. It reached an intraday high of 50,900 KRW the previous day, setting a new all-time high. Its market capitalization exceeded 3 trillion KRW. Amorepacific's stock price, which had fallen 8.5% over six trading days from the 3rd to the 11th, rebounded 7.6% the previous day. Kolmar Korea also rose 8.7% the previous day.

The provisional cosmetics export amount for May was 740 million USD, an 11% increase compared to the same period last year. Both total export volume and color cosmetics export volume set monthly all-time highs. By country, exports to China accounted for the largest share at 27%. Although this was a 23% decrease compared to the same period last year, it increased 18% compared to the previous month. The share of exports to the United States was 19%, showing a 71% increase compared to the same period last year.

As of April, among cosmetics imported by the United States, the share of cosmetics imported from Korea rose 2.0 percentage points (p) to 22.0% compared to the previous month. Both import volume and market share reached all-time highs. Korea ranked first in market share among the United States' cosmetics import countries. This is because the growing U.S. online market has brought attention to cost-effective Korean cosmetics. Indie brand cosmetics are gaining high popularity on Amazon in the U.S. As Korean culture has started to gain worldwide popularity, the Korean Wave has also contributed to raising awareness of Korean cosmetics.

Myungjoo Kim, a researcher at Korea Investment & Securities, said, "Looking at the trend of Korea's market share in U.S. cosmetics imports, the popularity of Korean cosmetics continues to rise," adding, "It is still too early to discuss the peak-out (a slowdown in growth after reaching a peak) of U.S.-bound cosmetics companies." She continued, "The market share of Korean cosmetics in the U.S. cosmetics industry is still low," and "It is necessary to keep paying attention to U.S.-bound cosmetics companies."

Silicon2 sells domestic cosmetics brands directly to consumers in about 160 countries worldwide through its online mall 'StyleKorean.com.' As Korean cosmetics brands gain popularity globally, Silicon2's performance is improving. Amorepacific is expanding sales in North America, focusing on Laneige and Innisfree. Eunjeong Park, a researcher at Hana Securities, said, "Laneige holds a dominant No. 1 market share in the lip care segment," and "Amorepacific is expected to achieve consolidated sales of 1 trillion KRW and operating profit of 62.2 billion KRW in the second quarter." This represents increases of 6% and 956%, respectively, compared to the same period last year.

The fact that domestic cosmetics brands, popular mainly online, have started to enter offline channels in the North American region is also considered a positive factor. Researcher Kim explained, "Expanding the 'Total Addressable Market (TAM)' through offline entry in the U.S. is a factor that increases the corporate value of Korean cosmetics companies with a high proportion of U.S.-bound sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)