Emart Falls for Four Consecutive Days to Record Low

Foreign and Institutional Selling Breaks 60,000 Won Level

Performance Recovery and Offline Integration Synergy Must Become Visible

Emart's stock price has fallen to its lowest level since its listing. Opinions suggest that structural performance improvement and visible synergy in offline business are necessary to restore corporate value.

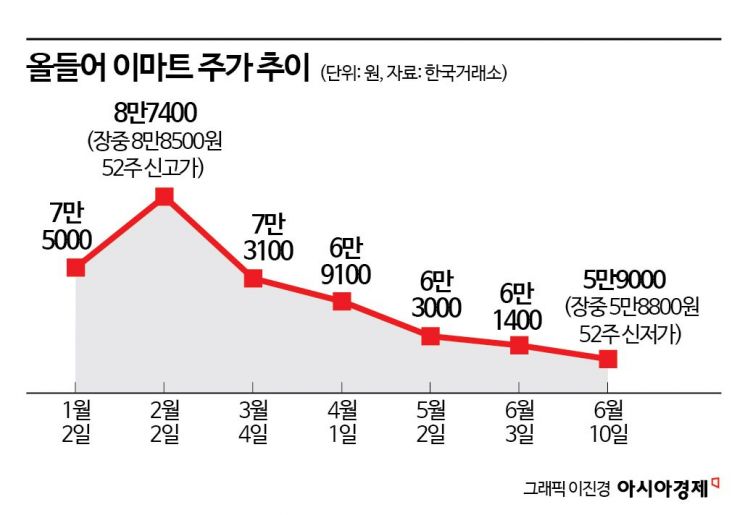

According to the Korea Exchange on the 11th, Emart's stock price dropped to 58,800 KRW during the trading session, marking a 52-week low. This is a 33.56% decrease compared to the 52-week high of 88,500 KRW recorded on February 2 this year. Emart's stock price has fallen for four consecutive days recently, breaking below the 60,000 KRW level. This is the first time since its listing in 2011 that Emart's stock price has dropped to the 60,000 KRW range.

Since the beginning of the year, low price-to-book ratio (PBR) stocks have shown strength, and Emart seemed to be recovering above the 80,000 KRW level. However, after hitting the 52-week high in early February, the stock price has continuously declined, showing only a brief rise. By the end of March, it had fallen to the 60,000 KRW range, and this month it broke below the 60,000 KRW level.

Foreign investors and institutions have driven the stock price down. Foreign investors have sold Emart shares for eight consecutive trading days, and institutions have maintained a selling trend for five consecutive days. This month, foreign investors sold Emart shares worth 14.2 billion KRW, and institutions sold 11.6 billion KRW.

Despite recent evaluations that the potential debt risk has been resolved as Shinsegae Group concluded disputes over the put option with financial investors (FI) of SSG.com, the stock price continues to weaken daily, indicating that market trust has not been fully restored. On the 4th, Emart and Shinsegae announced that they had signed a contract for the sale of shares held by Hong Kong-based private equity firms Affinity Equity Partners and BRV Capital Management. Accordingly, the FI will sell all 1,316,492 common shares (30%) of SSG.com they currently hold to one or more third parties designated by Emart and Shinsegae by December 31 of this year. The repurchase price is reported to be around 1.15 trillion KRW.

Nam Seong-hyun, a researcher at IBK Investment & Securities, said, "The biggest burden for Emart was the shareholder agreement related to the SSG.com business division, which could have led to an increase in potential debt and had a high possibility of expanding into legal issues recently, which was negative." He added, "However, with the announcement on the 4th that the FI will sell the invested shares to a third party or that Shinsegae Group will acquire them, the related risk is considered resolved." He further explained, "Considering that the potential debt size has decreased, the possibility of exit through an IPO is low, and a new clause for third-party sale has emerged, with related matters expected to be resolved by the end of the year, the risk can be seen as reduced."

Above all, performance improvement is expected to follow for a stock price rebound. The market believes that since most negative factors have disappeared, it is now time to focus on fundamental improvement. Researcher Nam said, "It is time to focus on the possibility of structural performance improvement. In particular, attention should be paid to the third-quarter results because of one-time costs related to Shinsegae Construction's bad debt provisions last year, efficiency improvements from voluntary retirement and store scrap, basic strength improvements shown in the first-quarter results, effects from the closure of inefficient Emart24 stores, and the continued reduction of losses in the online business division." IBK Investment & Securities estimates Emart's third-quarter operating profit to increase by 42.9% year-on-year to 111.4 billion KRW. Nam added, "Although there is likely to be a cost burden from voluntary retirement in the second quarter, this is ultimately a variable that can lead to future performance improvement and will not prevent corporate value recovery."

Since it will take time for performance improvement to become clear and for synergy from offline business integration to become visible, a conservative approach is expected to be necessary for the time being. Cho Sang-hoon, a researcher at Shinhan Investment Corp., said, "Concerns include the fundamental decline in the attractiveness of discount store channels amid threats from C-commerce (Chinese e-commerce) and the decreasing visibility of Shinsegae Construction's performance." He added, "For an upgrade in investment opinion, synergy from offline business integration must become visible, which is expected to begin in earnest from 2025, so a conservative approach is needed for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.