Holding Off Carbon Credit Sales Amid Price Drop

Q1 Operating Profit Down 97% Year-on-Year

Potential for Sharp Profit Surge if Carbon Credit Prices Rebound

The stock price of EcoEye, a carbon emission trading company, has fallen more than 60% from its peak. When it was listed on the KOSDAQ market on November 21 last year, it attracted attention as the number one company in the greenhouse gas reduction business sector's initial public offering (IPO). The stock price surged on the day of listing and the following day, surpassing 80,000 won, but then fell below 30,000 won.

According to the financial investment industry on the 10th, EcoEye's stock price has dropped 41% since the beginning of this year. EcoEye closed trading at 28,150 won on the 7th. This is a 65% decrease compared to the highest price of 80,900 won recorded on November 22 last year. EcoEye was listed on the KOSDAQ market with a public offering price of 34,700 won.

Founded in 2005, EcoEye is a specialized company in the greenhouse gas reduction business that reduces greenhouse gases generated from corporate activities or daily life. The greenhouse gas reduction business is a project that reduces greenhouse gases in accordance with international standards. The amount of reduction and absorption recognized through the business is certified and verified by international organizations such as the United Nations Framework Convention on Climate Change (UNFCCC) and private certification bodies, and then issued as carbon emission rights. The issued emission rights can be sold to companies that need emission rights through exchanges or over-the-counter markets.

Overseas greenhouse gas reduction projects take an average of 3 years and 6 months from the initial registration of the carbon emission rights project with the UNFCCC to the monitoring, certification, and verification of the actual greenhouse gas reduction amount, and finally to the issuance of carbon emission rights (CERs).

EcoEye reduces greenhouse gas emissions by replacing stove-type cooking tools (cookstoves) used in developing countries with high-efficiency products. High-efficiency cookstoves not only have a greenhouse gas reduction effect but also reduce firewood consumption and toxic gas emissions caused by incomplete combustion. The types of carbon emission rights issued to EcoEye include Certified Emission Reductions (CERs) and external project certification achievements (KOC).

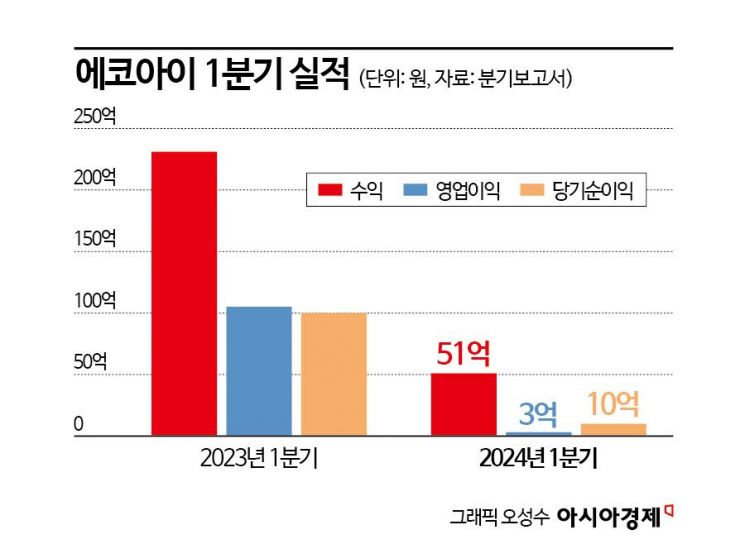

EcoEye has rapidly grown in scale over the past three years. Operating revenue was 9.5 billion won in 2020, 27 billion won in 2021, and 60.1 billion won in 2022, recording an average growth rate of 149.8% over three years. The growth rate slowed down as operating revenue reached 64.8 billion won last year. The growing concerns about growth slowdown can be interpreted as a reason why the stock price is also weak. In the first quarter of this year, operating revenue was 5.1 billion won, and operating profit was 300 million won. Compared to the first quarter of last year, operating revenue decreased by 78%, and operating profit decreased by 97%. The company explained that due to changes in the climate change regime, the certification standards for greenhouse gas reduction projects are being reestablished, and there is a delay in the conversion of domestic emission rights until 2026. They are withholding the sale of KOC volumes that could be sold in anticipation of price increases and expect performance recovery. The high volatility of performance depending on carbon emission trading prices is a risk factor but also means that dramatic performance improvement cannot be ruled out.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.