Indian Stock Market Plummets After General Election

Indian ETFs Showing Good Returns This Year Also Weaken

Individuals Net Buyers of Indian ETFs

Betting on India's Growth Over Political Uncertainty

As the Indian stock market sharply declined following the general election, India-related exchange-traded funds (ETFs) listed domestically also showed weakness, while individual investors moved to buy India ETFs at low prices. They bet on India's steady growth momentum rather than political uncertainty. Experts analyzed that although volatility due to political uncertainty may appear in the short term, the medium- to long-term growth momentum remains intact.

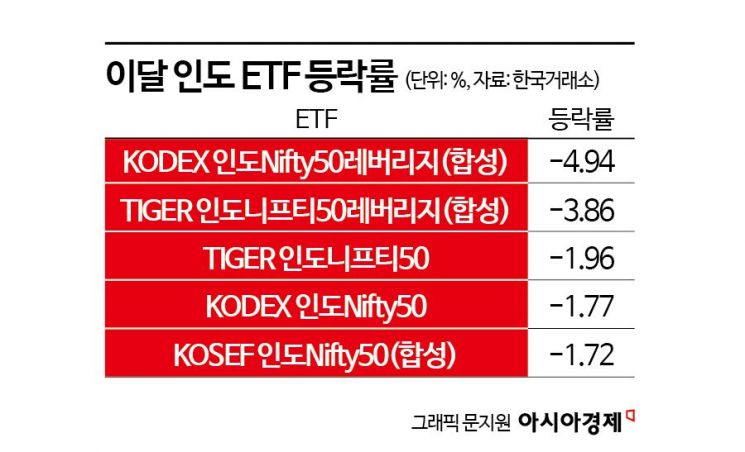

According to the Korea Exchange on the 7th, India ETFs have posted poor returns so far this month. KODEX India Nifty50 Leverage (synthetic) fell 4.94%, and TIGER India Nifty50 Leverage (synthetic) dropped 3.86%. In addition, TIGER India Nifty50 declined 1.96%, KODEX India Nifty50 1.77%, and KOSEF India Nifty50 (synthetic) 1.72%, respectively.

The reason India ETFs, which had shown strength earlier this year, turned weak like this is interpreted as being influenced by the sharp decline in the Indian stock market following the general election results.

On the 4th (local time), the Indian Nifty50 index fell 5.93%, and the Sensex index dropped 5.74%. The Indian general election results led to a sharp plunge in the stock market. Although the ruling coalition led by the Bharatiya Janata Party (BJP), headed by Prime Minister Narendra Modi, won the election announced on the 4th, the BJP secured only 240 out of 543 seats, failing to achieve an outright majority. For the first time since 2014, the BJP did not secure a majority of seats. While Prime Minister Modi succeeded in his third term, he is expected to rely on smaller parties participating in the coalition. The Indian stock market had closed at an all-time high the day before, anticipating Modi's overwhelming victory in exit polls, but turned sharply downward in just one day due to the election results. This was influenced by concerns that the pro-business ruling party might lose political dominance. As a result, volatility in the Indian stock market is expected to increase for the time being. Shin Seung-woong, a researcher at Shinhan Investment Corp., said, "The market has so far given strong trust to Prime Minister Modi and tolerated multiple re-rating," adding, "However, if the driving force of 'Modinomics' is lost, the possibility of multiple damage should also be considered." He further noted, "Moreover, the current price-to-earnings ratio (PER) is 20.1 times, exceeding the five-year average of 19.6 times, which also poses a valuation burden."

Although volatility is expected to increase for the time being, individual investors bought India ETFs. It is interpreted that they anticipated future price increases and engaged in bargain buying. On the 5th, individuals net purchased TIGER India Nifty50 worth 6.56744 billion KRW and KODEX India Nifty50 worth 6.66284 billion KRW, respectively. These two ETFs ranked 4th and 5th, respectively, in total individual ETF net purchases this month.

Capital inflows into India funds also continued. According to financial information provider FnGuide, 8.4 billion KRW flowed into India funds in the past week. Since the beginning of the year, 455 billion KRW has flowed in.

Individual investors seem to be placing more weight on India's steady growth momentum rather than volatility caused by political uncertainty. Baek Chan-gyu, a researcher at NH Investment & Securities, said, "From a medium- to long-term perspective, India's growth momentum has not been damaged," adding, "The two factors that have driven the Indian stock market's rise since 2020?the benefits from supply chain restructuring and high economic growth rate?remain intact. India's economic growth forecast for this year is 7%, leading emerging market economies, and it is expected to maintain a growth rate around 6.5% in 2025." He further recommended, "From this perspective, it is advisable to respond by gradually purchasing index ETFs during the volatility phase of the Indian stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)