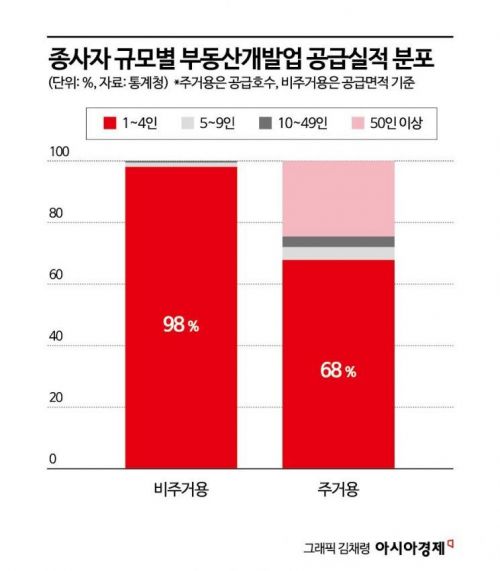

Residential 68%, Non-Residential 98% Small Businesses Developing

Risk of Bankruptcy if Costs Rise and Sales Slump

Real Estate Developers Must Secure Initial Capital with Financial Firms

An analysis revealed that most companies undertaking real estate development projects worth hundreds of billions to trillions of won are small businesses with four or fewer employees. To prevent the proliferation of small-scale companies vulnerable to project failures, measures such as strengthening capital requirements for real estate developers and expanding initial capital between developers and investment institutions are needed.

On the 5th, Hana Financial Management Research Institute explained in its report titled "Improvement Measures for the Capital Structure of Domestic Real Estate Development Projects" that "domestic real estate development projects are often carried out by small-scale developers with a 'low capital, high leverage (borrowed investment)' structure," adding, "overseas, real estate developers invest more than 20% of the total project cost in equity to secure land, but domestically, they typically invest less than 5% of the project cost."

According to the report, in terms of 'number of employees,' small businesses with four or fewer employees accounted for 68.1% of the supply performance in residential real estate development, including apartments, single-family homes, multi-family homes, and row houses. For non-residential properties such as factories, offices, stores, and warehouses, 98.1% were handled by small businesses with four or fewer employees.

As of 2022, there were 41,000 registered companies in the domestic real estate development and supply industry, with total industry sales reaching 132.2 trillion won. The average sales per company were only 500 million won. The sales share of large developers was relatively low. The report stated, "The combined sales of the four major developers (MDM (including MDM Plus), DS Networks, Shinyoung, and SK D&D) accounted for only 2.5% of the total real estate development supply industry sales."

Small-scale companies cannot survive if costs rise and sales slump

The prevalence of small businesses with four or fewer employees stems from the distorted structure of the real estate development industry. Even companies that are not of adequate scale can secure project financing (PF) or cover project costs with pre-sale income, leading to an increase in small-scale companies.

The report warned that the recent economic downturn could worsen the management difficulties of small developers. It noted that such crises could be transferred to construction companies. If additional PF loans or pre-sale income are insufficient, the financial burden on construction companies responsible for building increases, potentially causing a vicious cycle where the developer's insolvency affects the construction company. The report emphasized, "Since most domestic real estate development projects are handled by small businesses with four or fewer employees, changes in business conditions such as rising costs and sluggish sales increase the likelihood of developer insolvency."

The concentration of real estate developers' sales on pre-sales and property sales is also cited as a reason for vulnerability to crises. The report analyzed, "More than 80% of domestic companies' sales come from investment and sales profits through pre-sales," adding, "During market downturns when pre-sale and purchase demand decline, developers tend to face greater risks of business contraction and insolvency." It further explained, "Large overseas real estate developers earn half of their sales from rental and management income," noting, "Rental and management income usually comes from multi-year contracts, making it less affected by real estate market fluctuations."

Taeyoung Construction, which is experiencing a liquidity crisis due to real estate project financing (PF), has applied for a workout. On the 5th, the construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul, has come to a halt. Photo by Jinhyung Kang aymsdream@

Taeyoung Construction, which is experiencing a liquidity crisis due to real estate project financing (PF), has applied for a workout. On the 5th, the construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul, has come to a halt. Photo by Jinhyung Kang aymsdream@

Real estate developers need to create initial capital together with financial institutions

The report stressed the need to secure the soundness of domestic real estate development projects by stating, "Along with the financial authorities' plan to strengthen capital requirements for developers, it is necessary to explore ways to form partnerships between real estate developers and investment institutions to expand initial capital." It also mentioned, "Expanding markets for trading stocks and shares issued by project corporations, operating companies, REITs, and real estate funds can enable continuous fundraising." The report introduced that in the U.S., investment districts like REITs directly conduct real estate development, while in Japan and Singapore, real estate developers become key investors in REITs and operate multiple REITs and real estate funds.

Financial authorities are considering strengthening regulations on developers' equity ratios to improve the low-capital, high-leverage financing structure of real estate development projects. However, except for some leading companies, it is difficult for developers to increase capital independently. The recent performance of the real estate development market has been very poor. According to Statistics Korea's survey on operating profits in the real estate development and supply industry, losses were recorded for two consecutive years: -27.3 trillion won in 2021 and -5.8 trillion won in 2022.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.