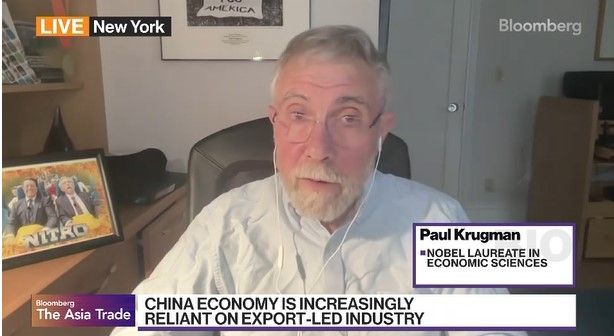

Paul Krugman, Nobel laureate in Economics and professor at the City University of New York, pointed out that China’s economic model, which focuses on production expansion, is no longer sustainable. He also diagnosed that the weak Japanese yen would have a positive effect on the Japanese economy and is not the cause of panic.

In an interview with Bloomberg TV on the 3rd, Professor Krugman stated, "The fact that the Chinese side seems to completely lack a realistic perception poses a threat to all of us."

In the interview, he reiterated remarks by U.S. Treasury Secretary Janet Yellen and others that China cannot simply solve its economic problems through exports. This criticism has drawn attention amid rising concerns in the U.S., Europe, and elsewhere about China’s overproduction and excessive subsidy support.

Professor Krugman diagnosed that China’s economic model is unsustainable due to "very inappropriate" domestic spending and a lack of investment opportunities. He then pointed out that Chinese authorities should support demand rather than production expansion. He mentioned that Chinese leaders "strangely hesitate" to increase government spending to support consumer demand.

Along with this, Professor Krugman also expressed doubts about the recent weak yen, saying, "I wonder why Japanese authorities are so worried about the decline in the yen’s value." He said, "A weaker yen positively affects demand for Japanese goods and services with a slight time lag," and added, "It is puzzling why the weak yen causes such a big panic as it appears to."

These remarks came shortly after Japanese foreign exchange authorities admitted on the 31st of last month that they intervened in the foreign exchange market to defend the exchange rate. Earlier, the Japanese Ministry of Finance announced that it intervened in the foreign exchange market with about 9.7885 trillion yen (approximately 86 trillion won) from April 26 to May 29, about a month. In Japan, there were reports that Prime Minister Fumio Kishida was concerned that the rapid yen depreciation might escalate into a situation similar to the British pound crisis.

Professor Krugman also said that looking at current indicators, he is not convinced that Japan is under inflationary pressure to sustain a 2% target. He evaluated, "Japan’s long-term weakness is related to demographics and an extremely low birth rate," adding, "Although Japan is more open to immigration than before, there is no significant change yet. There is still a long way to go."

Bloomberg News noted that even after the Bank of Japan (BOJ) ended its large-scale monetary easing, momentum remains insufficient, citing the interest rate gap with the U.S. Federal Reserve (Fed) as the biggest cause of the weak yen. In the interview, Professor Krugman reaffirmed his previous view that the Fed should cut interest rates since concerns about inflation rebounding are low.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.