Financial Supervisory Service Selects 36 Corporate Groups Exceeding Thresholds for Total Borrowings and Credit Extensions

Hyundai Department Store, Netmarble, DN, SeAH, Taeyoung, Daewoo Shipbuilding Excluded

Lead Banks Sign Financial Restructuring Agreements with Groups Needing Improvement and Conduct Regular Compliance Checks

Coupang achieved an operating profit of over 600 billion won last year, marking its first annual profit in 14 years since its founding in 2010. The photo shows Coupang headquarters in Songpa-gu, Seoul, on the 28th. Photo by Jinhyung Kang aymsdream@

Coupang achieved an operating profit of over 600 billion won last year, marking its first annual profit in 14 years since its founding in 2010. The photo shows Coupang headquarters in Songpa-gu, Seoul, on the 28th. Photo by Jinhyung Kang aymsdream@

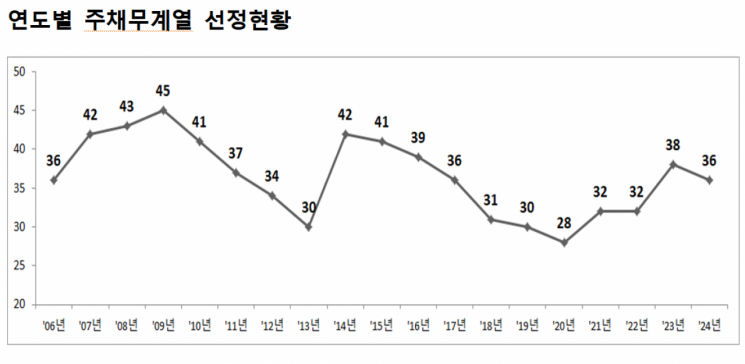

The Financial Supervisory Service (FSS) newly included four affiliated groups?Coupang, Hoban Construction, EcoPro, and Celltrion?this year among affiliated groups with total borrowings and bank credit exposures exceeding certain thresholds. Six affiliated groups?Hyundai Department Store, Netmarble, DN, SeAH, Taeyoung, and Daewoo Shipbuilding & Marine Engineering?were excluded.

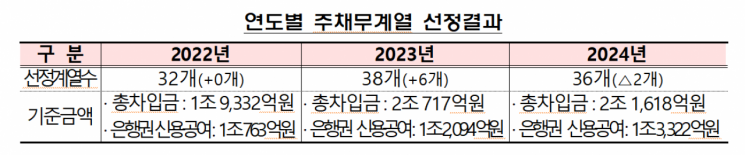

On the 2nd, the FSS announced that it selected 36 affiliated groups as "main debtor groups" this year, based on criteria as of the end of last year: total borrowings of 2.1618 trillion KRW or more and bank credit exposure balances of 1.3322 trillion KRW or more. The main creditor banks plan to systematically manage credit risks of large business groups by evaluating the financial structures of the newly included affiliated groups, signing financial structure improvement agreements with those requiring improvement, and regularly monitoring the implementation status.

The newly included groups such as Coupang, EcoPro, and Hoban Construction increased borrowings due to expanded new investments, and Celltrion raised funds for mergers with affiliates. On the other hand, the excluded groups this year?Hyundai Department Store, Netmarble, DN?repaid borrowings through operating profits; SeAH fell short of the total borrowing selection criteria; Taeyoung initiated joint management by creditor financial institutions; and Daewoo Shipbuilding & Marine Engineering was excluded due to acquisition by the Hanwha group.

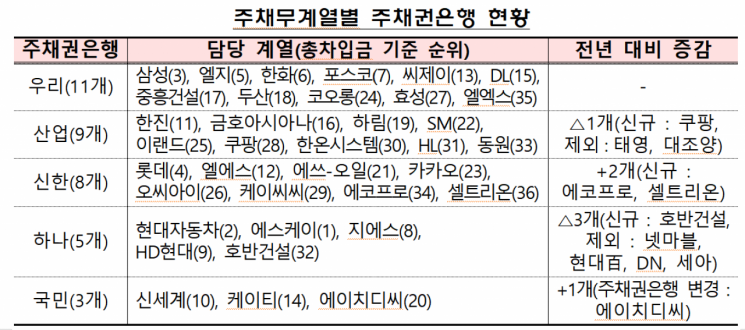

Among the main debtor groups included, the top five groups by total borrowings are SK, Hyundai Motor, Samsung, Lotte, and LG. Compared to the previous year, SK rose from 2nd to 1st place, Hyundai Motor dropped from 1st to 2nd, Samsung moved from 4th to 3rd, and Lotte shifted from 3rd to 4th. Among the 36 main debtor groups, the main creditor banks are Woori Bank with 11 groups, followed by Industrial Bank of Korea (9 groups), Shinhan Bank (8 groups), Hana Bank (5 groups), and Kookmin Bank (3 groups).

The number of affiliated companies in the 36 main debtor groups (as of the end of April) is 6,421, a decrease of 19 companies (-0.3%) compared to 6,440 companies in 38 main debtor groups last year. Domestic corporations numbered 1,794, down 65 (-3.5%) from 1,859 the previous year, while overseas corporations increased by 46 (1.0%) to 4,627 from 4,581 the previous year.

The number of affiliated companies by group was surveyed as follows: Hanwha (888 companies), SK (865 companies), Samsung (624 companies), Hyundai Motor (488 companies), CJ (406 companies), LG (338 companies), and Lotte (297 companies). The groups with significant changes in the number of affiliated companies compared to the previous year were SK (+119 companies), LG (-87 companies), and Hyundai Motor (+65 companies), mainly due to changes in overseas corporations.

Meanwhile, as of the end of last year, the bank credit exposure balance to companies was 1,875 trillion KRW, an increase of 98.7 trillion KRW (+5.6%) compared to 1,776.3 trillion KRW at the end of the previous year. The bank credit exposure amount for the 36 main debtor groups was 338.9 trillion KRW, up 16.3 trillion KRW (+5.1%) from the previous year’s main debtor groups, and total borrowings were 641.6 trillion KRW, up 31.9 trillion KRW (+5.2%) from the previous year’s main debtor groups.

At the end of last year, the top five groups’ bank credit exposure and total borrowings were 164.1 trillion KRW (48.4% of the total) and 369.6 trillion KRW (57.6% of the total), respectively, increasing by 5.4 trillion KRW (+3.4%) and 30.1 trillion KRW (+8.9%) compared to the previous year.

Going forward, the main creditor banks plan to conduct financial structure evaluations for the 36 groups selected as main debtor groups this year. They intend to ensure strict evaluations by sufficiently reflecting potential risks not captured in financial statements during qualitative assessments.

Based on the financial structure evaluation results, groups deemed to require financial structure improvement will sign agreements with the main creditor banks. Groups scoring below the benchmark score for each debt ratio range will enter into financial structure improvement agreements, while those scoring below 110% of the benchmark will sign information provision agreements.

Additionally, the main creditor banks will systematically manage credit risks of large business groups by regularly monitoring the implementation status of self-rescue plans for groups that have signed agreements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)