National Pension Fund Set at 14.7% for Next Year, Highest Ever

Pursuing Profitability Amid High Interest Rates, Increased Freedom in Alternative Investments

Mutual Aid Associations Engage in War to Recruit Alternative Investment Experts

The enthusiasm for alternative investments among pension funds and mutual aid associations is heating up even more. Most of the major players plan to increase the proportion of alternative investments in their investment assets this year, reaching an all-time high level. This is an effort to enhance profitability amid sustained high interest rates.

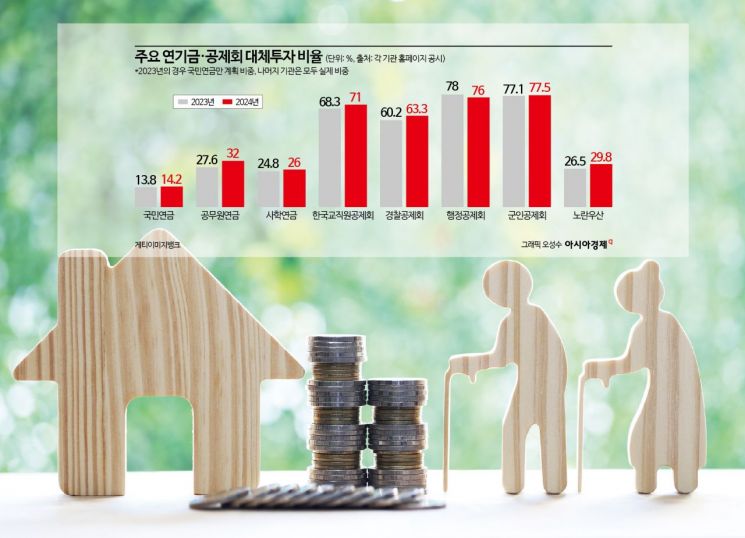

According to the annual plans and mid-term asset allocation proposals of the "three major pension funds (National Pension Service, Government Employees Pension Service, and Teachers' Pension)," as well as the Police Mutual Aid Association, Military Mutual Aid Association, Korea Teachers' Credit Union, Administrative Mutual Aid Association, and Yellow Umbrella Fund, all institutions except the Administrative Mutual Aid Association have decided to increase their alternative investment ratios this year compared to last year. The National Pension Service will increase from 13.8% to 14.2%, the Government Employees Pension Service from 27.6% to 32%, and the Teachers' Pension from 24.8% to 26%. The Korea Teachers' Credit Union (68.3→71%), Police Mutual Aid Association (60.2→63.3%), Military Mutual Aid Association (77.1→77.5%), and Yellow Umbrella Fund (26.5→29.8%) will also raise their proportions. Only the Administrative Mutual Aid Association will slightly retreat from 78% to 76%, but it still maintains the highest proportion among major institutions.

National Pension Service's Alternative Investment Ratio Approaches 15%

The largest player, the National Pension Service, plans to increase its alternative investment ratio to around 15% by 2029. Last year's target ratio was 13.8%, this year it is 14.2%, and it will rise to 14.7% next year. The fund has been increasing alternative investments annually at the largest scale since its establishment. The mid-term asset allocation plan for 2025?2029, which includes these details, was approved by the Fund Management Committee on the 31st. The target ratios for other asset classes in 2025 are domestic stocks 14.9%, foreign stocks 35.9%, domestic bonds 26.5%, and foreign bonds 8.0%. The target return over five years is set at 5.4%.

Additionally, the 'benchmark portfolio,' introduced for the first time this year, will be applied to the alternative investment sector starting next year. Currently, alternative investments are classified into four categories: real estate, infrastructure, private equity, and hedge funds, each with its own target investment ratio. Applying the benchmark portfolio will allow flexible management within the alternative investment ratio (14.7%) next year without distinguishing between real estate or infrastructure. The National Pension Service also established a real estate platform investment team this year, which is interpreted as an effort to invest in various alternative investment assets.

This year, the Board of Audit and Inspection has been conducting audits on alternative investments of pension funds and mutual aid associations. With overseas commercial real estate emerging as a risk, they are examining the actual conditions. However, the investment enthusiasm has not subsided. A mutual aid association official said, "With prolonged high interest rates and the delay in expected rate cuts, there is a growing trend toward alternative investments. Although these are riskier than stable assets, they offer opportunities for high returns, so their popularity will continue for the time being." At the National Pension Service's press briefing in March, Son Hyup, Director of the Investment Strategy Office, announced the expansion of alternative investments, stating, "We are focusing on expanding risky asset ratios and diversifying investments as the two pillars of management."

Mutual Aid Associations Hiring Alternative Investment Experts

The 4th National Pension Fund Management Committee was held on the 31st of last month at the Government Seoul Office Annex.

The 4th National Pension Fund Management Committee was held on the 31st of last month at the Government Seoul Office Annex. [Photo by Ministry of Health and Welfare]

Mutual aid associations, which have higher alternative investment ratios than pension funds, are even appointing Chief Investment Officers (CIOs) who are experts in alternative investments. Seo Won-cheol, recently appointed as CIO of the Yellow Umbrella Fund, is an expert who previously served in the National Pension Service's Overseas Alternative Investment Office and as head of the Government Employees Pension Service's Alternative Investment Department. The Yellow Umbrella Fund, which had a conservative investment stance, plans to increase its alternative investment ratio by 3.3 percentage points to 29.8% this year. Lee Do-yoon, the former CIO known as a bond expert, prioritized safety while achieving decent returns. As of the end of March, assets under management (AUM) had grown to 25 trillion won. However, with a stronger policy to expand alternative investments, he was eventually replaced. When announcing the recruitment for the new CIO, the Yellow Umbrella Fund unusually specified plans to expand alternative investments.

The Military Mutual Aid Association, which is also in the process of appointing a new CIO, is reportedly giving high scores to alternative investment experience. As of last year, the Military Mutual Aid Association's alternative investment ratio was 77.1%, the second highest after the Administrative Mutual Aid Association (78%). This year, the plan is to increase it to 77.5%, surpassing the Administrative Mutual Aid Association (76%). The Police Mutual Aid Association, which has been vacant since CIO Han Jong-seok stepped down in October last year, also plans to increase its alternative investment ratio by 3.1 percentage points to 63.3% compared to last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)