Rising Cloud and AI Boost SaaS Usage

Ministry of Science and ICT Establishes SaaS Sector in VC Mother Fund

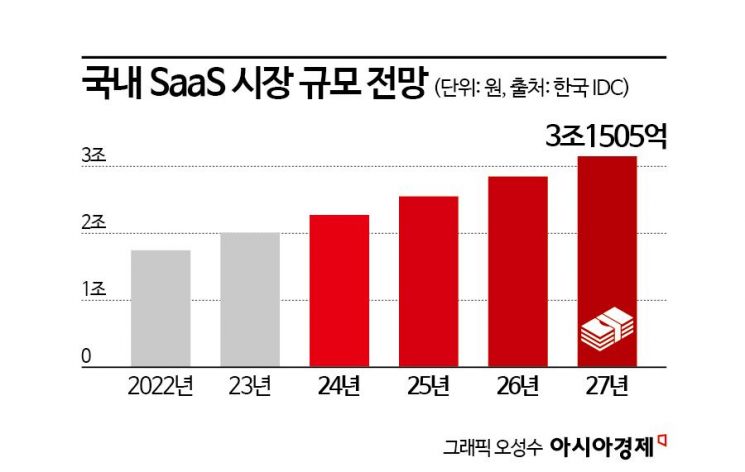

SaaS Market Expected to Surpass 30 Trillion Won by 2027

As cloud (virtual storage space) infrastructure expands and AI (artificial intelligence) technology advances, the utilization of Software as a Service (SaaS) is also increasing. Accordingly, the venture capital (VC) industry is actively moving to make proactive investments in SaaS-related startups. SaaS is a service that allows users to subscribe and use software through the cloud without installing it on electronic devices such as computers.

On the 3rd, according to the VC industry including Korea Venture Investment Corp., a total of six VCs applied for the fund general partner (GP) recruitment process of the SaaS sector’s mother fund under the Ministry of Science and ICT (MSIT) account, and three VCs recently passed the first document screening. After subsequent evaluations, a total of two VCs will be selected as GPs. The selected GPs will raise a fund of at least 33.3 billion KRW by attracting private capital based on the MSIT’s investment of 20 billion KRW.

"Software Paradigm Shifts from Purchase and Installation to SaaS Utilization"

This is the first year that a mother fund for the SaaS sector has been established. A mother fund refers to a fund created by government ministries such as the Ministry of SMEs and Startups and MSIT, which invest in privately formed funds rather than directly investing in companies. MSIT prepared this fund to help SaaS startups establish themselves stably in the market and gain international competitiveness. The goal is to discover and support SaaS startups that have innovative ideas but face difficulties due to lack of funding.

The domestic and international software usage paradigm is already shifting from "building and purchasing services" to "utilizing SaaS." Users who were accustomed to purchasing and installing individual software licenses are gradually adopting SaaS through the cloud, regardless of time and place. According to Korea IDC’s "Domestic Public Cloud Service Market Outlook 2022?2027," the domestic SaaS market size is expected to expand from 1.7456 trillion KRW in 2022 to 3.1505 trillion KRW in 2027. The report noted, "Companies are transitioning software such as virtual desktop infrastructure (VDI), customer relationship management (CRM), and enterprise resource planning (ERP) to the cloud, and demand for related cloud security software is also increasing."

Kim So-hye, a researcher at Hanwha Investment & Securities, said, "Once a certain customer base is secured, it becomes a predictable business model capable of generating stable revenue growth and cash flow," adding, "From the perspective of government policies and linguistic differentiation, companies that have a thick customer base in specific areas or possess killer software services have a competitive advantage over global companies." She also mentioned, "The movement of B2B software companies embedding generative AI functions into their products is accelerating rapidly."

"Focus on Differentiation and Competitiveness of Domestic SaaS Startups"

VC investments in competitive SaaS startups are also continuing. Kakao Ventures made a seed (early-stage) investment in February in Omlet, the developer of Solver, which develops generative AI-based decision automation solutions. Solver is a service that automatically solves complex decision-making problems in industrial sites. It determines the optimal work sequence and resource allocation method through generative AI.

Actnova, the developer of Actverse, which provides AI and machine learning-based behavioral monitoring of non-clinical trial animal models, successfully raised 3.3 billion KRW in a pre-Series A round. Actverse analyzes complex behaviors exhibited by laboratory animals using machine learning technology, reducing the number of animals and labor costs. This investment was led by Hana Ventures, with participation from AVentures and Fast Ventures.

Modusign, a specialized electronic contract company, completed a Series C investment round of 17.7 billion KRW last month. Modusign provides a service that enables legally binding contracts to be concluded online. This round was led by existing investor SBVA (formerly SoftBank Ventures Asia), with new participation from Atinum Investment, Industrial Bank of Korea, and DSC Investment.

Park Eun-woo, a partner at Mashup Ventures who recently invested in Mile Corporation, the developer of the office space management SaaS Mile, said, "Korean companies facing rising labor costs and a declining workforce are very proactive in adopting SaaS for work efficiency," adding, "With the rise of AI technology following ChatGPT, the areas that can be automated through SaaS are rapidly expanding."

Park added, "Especially, Korean startups have an advantage over English-speaking startups in that they create products that are also applicable in Asian cultural spheres including Japan. Domestic investors will actively discover and invest in SaaS startups."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)