Partial Sale of SK Corporation Shares Unavoidable

'Confusion' Even Within SK Internal Circles

As the court ordered SK Group Chairman Chey Tae-won to pay the largest-ever property division amount of 1.38 trillion won in the divorce lawsuit with Noh So-young, director of Art Center Nabi, the business community's attention is focused on how Chairman Chey will raise the funds.

Since there appears to be no alternative other than selling shares of the unlisted company SK Siltron, the dilemma is expected to deepen. With concerns that the governance structure could also be affected, SK Group is contemplating internal control measures.

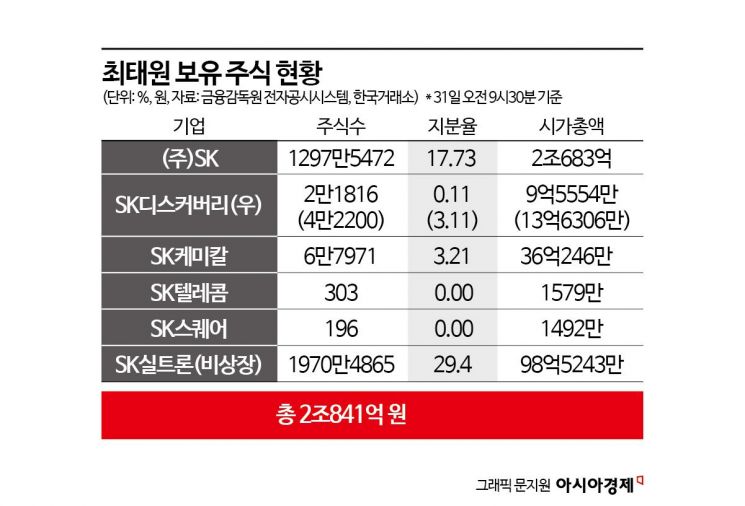

According to SK and others on the 31st, the value of SK affiliate shares held by Chairman Chey slightly exceeds 2 trillion won as of that day. The court estimated the total assets of the two parties at about 4.0115 trillion won and ruled that Chairman Chey and Director Noh should divide the assets at 65% and 35%, respectively.

Interest in Chairman Chey’s fundraising is heightened because the appellate court ruled for cash payment. Depending on how Chairman Chey secures the cash, SK Group’s management rights could be shaken.

There are not many options. It is expected that he will have to either sell shares or take out loans using shares as collateral. He may also sell personal cash or real estate. Most of Chairman Chey’s assets, as assessed by the court, are stocks, with the largest being 17.73% (12,975,472 shares) of SK Inc., the SK Group holding company.

However, the most likely card for sale is the 29.4% stake (about 19.7 million shares) in SK Siltron, which is unlisted. The largest shareholder of SK Siltron is SK Inc. (51.0%), so even if Chairman Chey sells all his shares, the management rights will not be affected.

In 2017, Chairman Chey participated in acquiring shares when SK purchased Siltron from LG. At that time, the share value was about 260 billion won, but it is estimated to have increased significantly now. The court valued it at about 750 billion won. To cover the division amount, an additional 700 billion won in funds is needed. However, since it is unlisted stock and Chairman Chey’s sale may not fetch the full value, there are concerns. Capital gains tax from the stock sale must also be paid.

For this reason, some believe that partial sale of SK Inc. shares will be inevitable to fill the remaining amount. As of 9:30 a.m. on the 31st, the value of Chairman Chey’s SK Inc. shares is about 2.0683 trillion won. However, since SK Group’s governance structure flows from ‘Chey Tae-won → SK Inc. → SK Innovation, SK Square, SKC,’ it is expected that Chairman Chey will avoid disposing of SK Inc. shares, which sit at the top of the group’s governance structure, as much as possible. There are concerns that the ‘Sovereign crisis’ of 2003 could be repeated.

Chairman Chey also holds 0.11% (21,816 shares) of SK Discovery common stock and 3.11% (42,200 shares) of preferred stock. Additionally, he owns 3.21% (67,971 shares) of SK Chemicals. These affiliates are effectively managed separately by his cousin, Chey Chang-won, chairman of the SK Supex Council, so there is no burden from stock disposal. As of this date, the value of Chairman Chey’s shares is only 900 million won (1.3 billion won) for SK Discovery preferred stock and 3.6 billion won for SK Chemicals.

Chairman Chey also holds 196 shares of SK Square and 303 shares of SK Telecom, but even if liquidated, the amounts are not large. It is also known that from 2022 to 2023, Chairman Chey received dividends worth about 200 billion won from SK affiliates, and other assets such as real estate and artworks are estimated at about 60 billion won.

A business insider said, “Even if all shares except SK Inc. are sold, it is insufficient to cover the division amount. To protect the holding company’s management rights, he will likely try to minimize sales and seek stock-collateralized loans.”

Stock-collateralized loans typically allow financing at 40-70% of the previous day’s closing price, and Chairman Chey has already pledged 7,499,030 shares (10.24%) of SK Inc. as collateral and borrowed 446.5 billion won.

With the court ruling exceeding initial expectations, Chairman Chey’s management activities face a crisis, plunging SK Group’s internal environment into turmoil. Internally, there are regrets that the division amount is unreasonably high and that the ruling’s inclusion of contributions from slush funds seems to deny the efforts of employees who have grown the company. SK Group is reportedly considering measures to reduce employee unrest.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)