Emart Offers "Will Repay Instead" Support

Brokerages Targeting High Interest Rates Execute Large-Scale Self-Funding

Limitations in Credit Improvement Despite Lower Debt Ratios

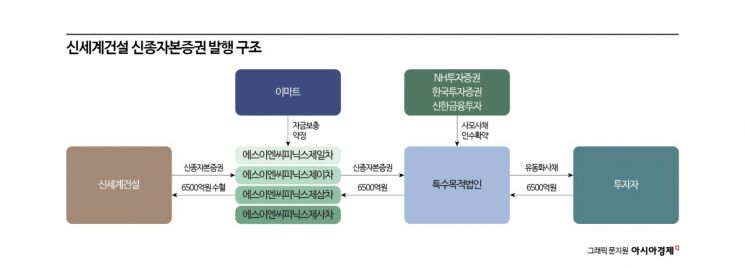

Shinsegae Construction extinguished an urgent fire by securing liquidity through the issuance of new hybrid capital securities (perpetual bonds) worth 650 billion KRW. Its parent company, Emart, provided side support by extending large-scale credit to Shinsegae Construction, and securities firms aiming for interest income trusted Emart and fully subscribed to the perpetual bonds, resulting in a big deal.

With this transaction, Shinsegae Construction succeeded partially in improving its financial condition, significantly lowering its debt ratio. However, concerns have been raised that it is difficult to expect substantial financial improvement such as credit rating enhancement, as the company will incur an annual interest burden of 46 billion KRW and an increased borrowing burden.

A Joint Effort of Securities Firms Targeting High Returns Backed by Shinsegae Group Support

Emart’s side support played a crucial role in Shinsegae Construction’s successful capital increase. Emart provided capital increase commitments to four special purpose companies (SPCs) established to acquire Shinsegae Construction’s perpetual bonds. This is a kind of guarantee that if Shinsegae Construction fails to properly repay principal and interest, Emart will support the shortfall. This is interpreted as large-scale group-level support for Shinsegae Construction following the merger with Shinsegae Yeongrangho Resort and the acquisition of private bonds by affiliates.

Securities firms also responded positively to Emart’s support for Shinsegae Construction. NH Investment & Securities, Korea Investment & Securities, and Shinhan Investment Corp., the lead managers of this fundraising, trusted Emart’s creditworthiness and undertook large-scale subscriptions of the perpetual bonds. Although Emart’s financial condition has deteriorated recently, turning to losses and experiencing credit rating downgrades, it is still considered a high-quality company with an AA- rating.

Additionally, they acquired the perpetual bonds aiming for relatively high interest rates. They invested large sums in high-interest bonds with an annual interest rate in the 7% range issued based on Emart’s credit. If the purchased bonds are held as is, it is calculated that an annual interest income of approximately 46 billion KRW can be earned. Even if the perpetual bonds are sold to the market through asset securitization (sell-down), it is expected that a profit of over 20 billion KRW annually will be generated.

An industry insider in investment banking said, "Since securities firms have not been able to significantly increase credit extensions for project financing (PF) projects that were highly profitable in the past, they are expanding investments and credit extensions in high-interest bonds such as new hybrid capital securities of large corporations as an alternative," adding, "The 7%-range perpetual bonds issued based on Emart’s credit are highly attractive investments in terms of risk-return."

Limitations in Credit Improvement Despite Lower Debt Ratio

Shinsegae Construction will increase its capital by 650 billion KRW through this perpetual bond issuance. New hybrid capital securities are recognized as capital in accounting, which helps reduce the debt ratio. Shinsegae expects that although Shinsegae Construction’s debt ratio reached 807% in the first quarter of this year, it will fall below 200% after this capital increase.

Furthermore, it is expected to cope with liquidity burdens caused by loan maturities, unsold inventory, soaring construction costs, and contingent liabilities from unstarted projects. Shinsegae Construction stated, "Based on financial stabilization, we will steadily improve performance by continuously securing profitable projects such as the construction of Starfield Cheongna and the modernization of Dongseoul Terminal."

On the other hand, there are criticisms that issuing perpetual bonds alone will not lead to substantial financial improvements such as credit rating upgrades. Although the debt ratio will be significantly lowered, interest expenses and borrowing burdens will increase.

Shinsegae Construction must pay an annual interest expense of 46 billion KRW on the perpetual bonds. If an interest payment is missed even once, the company must pay double interest plus additional interest for the delayed period to investors at the next interest payment date. A bond market official evaluated, "Given that Shinsegae Construction recorded an operating loss of 23.3 billion KRW last year and its performance is deteriorating, the interest expense of 46 billion KRW is not a small burden."

Actual borrowings will also increase. Although perpetual bonds are accounted for as capital, due to their high repayment enforceability, a significant portion is considered debt in credit evaluations. The perpetual bonds issued by Shinsegae Construction have no maturity, but if the call option is not exercised to redeem them early after three years, the interest rate is designed to increase sharply. If the call option is not exercised to repay the full 650 billion KRW, an additional 2.50 percentage points (P) will be added, resulting in a total interest burden of 9.5%. Each year thereafter, an additional 3%P, 3.5%P, and 4%P will be added, continuously increasing the interest burden.

A credit rating agency official said, "Issuing perpetual bonds will not significantly help improve credit ratings," adding, "Substantial financial structure improvement depends on how much performance and financial strength can be enhanced over the three years until the call option is exercised."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)