Orion's Q1 Operating Profit Rises 26%

Stock Price Falls 21% This Year Despite Growth Outlook for Second Half

Slow Recovery in Stock Price Drop After Rigachem Acquisition

Since Samyang Foods recorded a 'surprise performance' in the first quarter of this year, investors' attention has been drawn to the domestic food and beverage sector. Food and beverage companies with a high export ratio are preferred by investors, and Orion, which is growing mainly in the United States, has also emerged as a stock of interest. However, despite the increase in earnings, Orion's stock price has rather declined compared to the end of last year. After acquiring Ligachem Bio to secure new growth engines, concerns about additional investments seem to be hindering the stock price recovery.

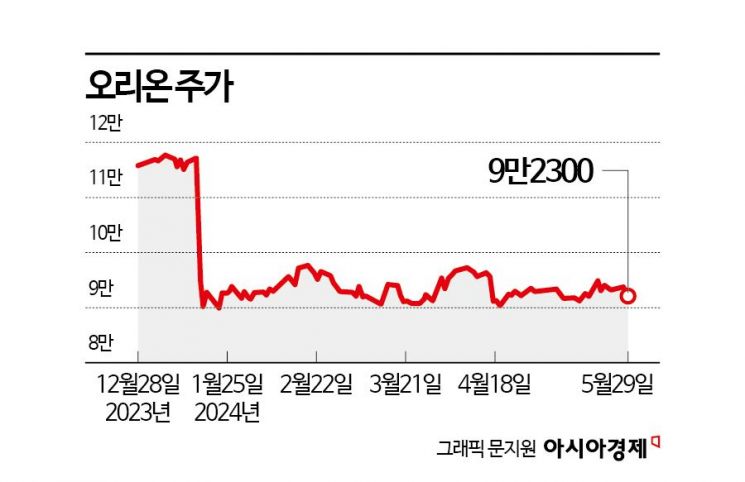

According to the financial investment industry on the 30th, Orion's stock price has fallen 20.5% since the beginning of this year. Considering that the food and beverage sector index rose 13.8% during the same period, the relative decline is even greater. The foreign ownership ratio decreased from 41.5% to 30.5%.

Orion recorded consolidated sales of 748.4 billion KRW and operating profit of 125.1 billion KRW in the first quarter of this year. This represents an increase of 12.7% and 26.2%, respectively, compared to the same period last year. Hyemi Kim, a researcher at Sangsangin Securities, explained, "The continuous growth in exports is a positive factor," adding, "Sales in China and Vietnam increased by 16% and 12%, respectively, compared to the same period last year."

Growth did not stop last month either. In April, sales were tentatively estimated at 243.8 billion KRW and operating profit at 43.4 billion KRW, up 2.8% and 15.7%, respectively, compared to the same period last year. Jiwoo Oh, a researcher at Ebest Investment & Securities, analyzed, "Profit margins improved as the local distributors (small wholesalers) in China replaced the previously loss-making discount store channels," and "In Vietnam, profits increased due to reduced sales commissions, advertising expenses, and other costs."

The outlook for the second half of this year is also bright. DS Investment & Securities estimated that Orion would achieve consolidated sales of 3.2 trillion KRW and operating profit of 557 billion KRW this year, representing increases of 9% and 13%, respectively, compared to last year. Ji-hye Jang, a researcher at DS Investment & Securities, predicted, "Steady performance improvement will continue through channel expansion strategies tailored to each country's market environment, new product launches, and increased production capacity," adding, "Sales are increasing in the U.S. through localization of Kkobuk Chip."

Despite the favorable performance trend, Orion's stock price has maintained a box range after falling below 100,000 KRW in January this year. It has been fluctuating between 80,000 and 90,000 KRW. On January 15, Orion invested 548.5 billion KRW to acquire a 25.7% stake in Ligachem Bio. It participated in a third-party allotment capital increase to acquire new shares and purchased existing shares held by the founder and management. Two days after the news of the Ligachem Bio acquisition was announced, Orion's stock price dropped from around 117,000 KRW to below 90,000 KRW.

Kyungshin Lee, a researcher at Hi Investment & Securities, explained, "Both the visibility of Orion's operating performance improvement and market expectations are solid," but added, "Concerns related to the acquisition of Ligachem Bio shares have been reflected, resulting in a slow recovery of the stock price adjustment." However, he added, "Considering the expanded shareholder return policy related to dividends, visible regional growth strategies, and investment plans, it seems that a foundation has been laid to resolve the factors that have acted as risks so far."

Regarding target stock prices for Orion by securities firms, Hi Investment & Securities maintains 160,000 KRW, DS Investment & Securities 150,000 KRW, and Ebest Investment & Securities 140,000 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)