Seomin Holds 1st TF Meeting to Prepare Support Measures for Self-Employed

Enhancing Fundamental Economic Independence through Employment Support

Customized Support Reflecting Characteristics of Debtors Including Self-Employed

Financial Services Commission to Develop Support Measures through 3-4 TF Meetings

The Financial Services Commission aims to enhance the economic self-reliance and repayment capacity of vulnerable groups through employment support, while also preparing customized support measures reflecting the characteristics of debtors such as self-employed individuals and vulnerable groups. The FSC plans to form a task force (TF) and, after 3 to 4 meetings, announce the 'Support Measures for Low-Income and Self-Employed Individuals.'

On the 28th, the FSC held the first meeting of the 'Task Force for Preparing Support Measures for Low-Income and Self-Employed Individuals' at the Government Seoul Office to discuss these support measures. The TF is composed of related organizations in the field of low-income finance, including the Financial Supervisory Service, Korea Inclusive Finance Agency, Credit Counseling & Recovery Service, Korea Asset Management Corporation, Industrial Bank of Korea, Korea Credit Guarantee Fund, Shinhan Card, and private members.

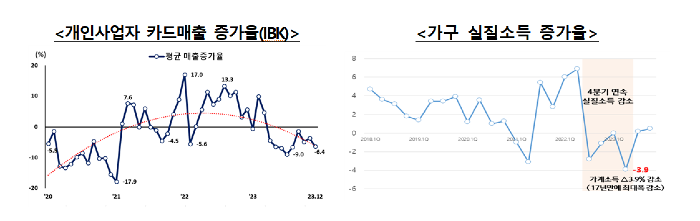

Lee Hyung-joo, Standing Commissioner of the FSC, who presided over the TF meeting, emphasized, "The difficulties faced by vulnerable groups are intensifying due to macroeconomic uncertainties such as sluggish household income and structural changes like the increase in online shopping," adding, "Robust protection for the self-employed and others is more necessary than ever." He further stated, "To address these issues, it is necessary to reassess policies comprehensively to enhance the repayment capacity of low-income and self-employed individuals and to ensure that inclusive finance functions properly."

Since COVID-19, the government has made various policy efforts to alleviate the ongoing difficulties of low-income and self-employed individuals, including expanding policy-based inclusive finance supply, strengthening proactive debt restructuring, and easing interest burdens for small business owners and the self-employed. Nevertheless, the recent economic conditions for low-income and self-employed individuals have been worsening. Amid persistent high interest rates and inflation, household real income is declining due to economic downturns, while individual business owners are experiencing decreased sales due to sluggish business conditions.

Last year, the closure rate increased by 0.8 percentage points from the previous year to 9.5%, with the number of closures rising by 111,000 to reach 911,000. Additionally, there have been ongoing demands for an active role of policy finance to address fundamental economic issues such as low birth rates, aging population, and income polarization.

Accordingly, the TF will prepare the 'Support Measures for Low-Income and Self-Employed Individuals' through 3 to 4 future meetings. Based on an in-depth analysis of the economic conditions of the self-employed and low-income groups, the plan is to specifically select sectors facing difficulties to enhance effectiveness.

First, alongside the supply of inclusive finance, the TF will consider measures to fundamentally improve the economic self-reliance and repayment capacity of vulnerable groups through employment support. Next, customized debt restructuring reflecting debtor characteristics, such as support for self-employed individuals at different business stages and proactive support for vulnerable groups, will be reviewed. Furthermore, the TF will examine strengthening financial support measures, including tailored financial support for borrowers such as the self-employed and youth, securing stable funding for policy-based inclusive finance, and improving the delivery system for sustainable and effective inclusive finance supply.

Kim Kwang-il, Director of the Inclusive Finance Division at the FSC, explained, "The recent difficulties of low-income and self-employed individuals stem from multiple factors such as income and sales declines. Therefore, we will review improvement measures in collaboration not only with financial-related organizations but also with relevant ministries such as the Ministry of Economy and Finance and the Ministry of SMEs and Startups."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)