Foreigners Sell Samsung Electronics the Most This Month

First Net Selling of Samsung Electronics by Foreigners This Year

Meanwhile, SK Hynix Hits Record High Amid Foreign Buying Pressure

Foreign investors who had been steadily buying Samsung Electronics this year have turned away. For the first time this year on a monthly basis, they became net sellers of Samsung Electronics. Instead, foreign investors bought the most SK Hynix this month. High Bandwidth Memory (HBM) has effectively changed the shopping list of foreign investors.

According to the Korea Exchange on the 28th, foreign investors have net sold Samsung Electronics by 1.139 trillion KRW so far this month, making it the most sold stock, while SK Hynix was the most net purchased with 1.6861 trillion KRW.

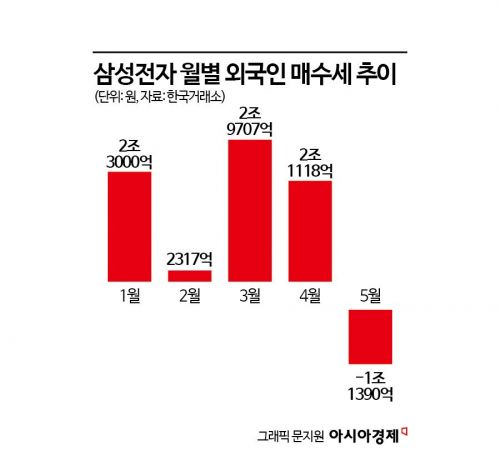

This month is the first time this year that foreign investors have net sold Samsung Electronics on a monthly basis. Except for February, foreign investors have been net buyers of Samsung Electronics every month this year, purchasing more than 2 trillion KRW each month and ranking first in net buying. Even in February, the net buying scale was in the 200 billion KRW range, but the net buying trend continued. Up to the end of April this year, foreign investors net purchased 19.1423 trillion KRW in the KOSPI market, of which Samsung Electronics alone accounted for 7.6143 trillion KRW. Although foreign investors have maintained a net buying trend in the domestic stock market this month, Samsung Electronics was not their top preferred stock.

The change of heart by foreign investors toward Samsung Electronics is interpreted as being influenced by HBM competitiveness. As Nvidia, a leader in AI semiconductors, posted strong earnings and its stock price soared to an all-time high, foreign investors turned their attention to SK Hynix, a key supplier of Nvidia's HBM. There are expectations that SK Hynix will continue to benefit as a core supplier in Nvidia's supply chain, leading to a re-rating trend in its stock price. Minhee Lee, a researcher at BNK Investment & Securities, said, "SK Hynix is expected to occupy 60% of the HBM production volume compared to the expected demand this year. The production volume of competitors, whose entry into the HBM3 and HBM3E markets has been delayed, is expected to be about half that of SK Hynix, so the market share gap between the two companies will widen significantly this year, and supply shortages will continue in the second half." BNK Investment & Securities raised SK Hynix's target price from 210,000 KRW to 250,000 KRW.

On the other hand, Samsung Electronics appears to have lost favor with foreign investors due to delays in passing Nvidia's quality tests. Recently, foreign media reported that Samsung Electronics' HBM has not yet passed Nvidia's quality tests due to issues such as heat generation, causing Samsung Electronics' stock price to fall more than 3% on the 24th. On that day alone, foreign investors sold 566.1 billion KRW worth of Samsung Electronics shares.

The change of heart by foreign investors also affected stock prices. Supported by foreign buying, SK Hynix succeeded in stabilizing above the 200,000 KRW level. It even reached an intraday high of 290,000 KRW, marking a 52-week high. Meanwhile, Samsung Electronics, which had raised expectations of stabilizing above 80,000 KRW earlier this month, saw its stock price stagnate and fall back to the 77,000 KRW range.

However, the market still holds a positive outlook on Samsung Electronics' future HBM supply potential. Donghee Han, a researcher at SK Securities, said, "Amid strong AI demand, supply constraints caused by the increased difficulty of HBM processes and the limited short-term additional response capacity of competitors are increasing the importance of Samsung Electronics' HBM response. Stable supply of HBM is essential to smoothly meet customers' AI demand, so HBM supply shortages are factors that increase the necessity of Samsung Electronics' market entry." SK Securities raised Samsung Electronics' target price from 100,000 KRW to 105,000 KRW. Younggun Kim, a researcher at Mirae Asset Securities, commented on the reports related to Nvidia's quality tests, saying, "Hasty judgments are to be avoided. If Samsung Electronics' HBM fails, the stakeholder who will feel the loss as much as investors is Jensen Huang. The volume is too large to be handled by SK Hynix alone, the sole vendor approach carries risks, and using Micron as a second vendor is limited by its production capacity of only 20K (20,000 wafers)."

The gap left by foreign investors has been filled by institutional investors. On the previous day, institutions net purchased Samsung Electronics by 253.1 billion KRW, leading to a rebound in its stock price.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)