ValueUp Integrated Page Launched... Enables Comparison of Corporate Disclosures

ValueUp Index to Be Developed in Q3, "Usable by Pension Funds and Others"

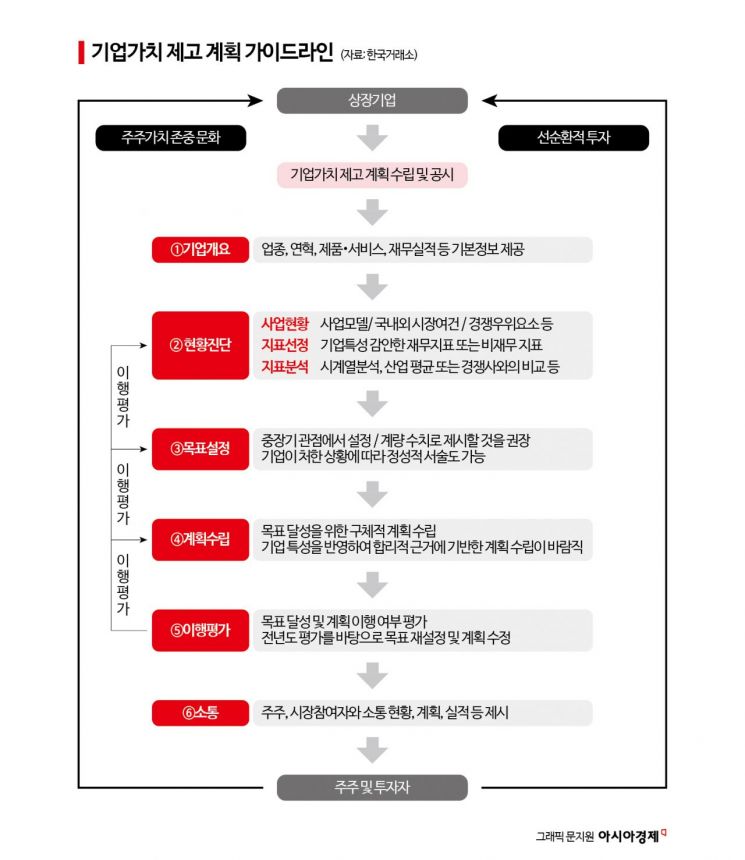

The Korea Exchange announced on the 26th that it has finalized the guidelines and explanatory booklets for corporate value enhancement plans aimed at corporate value-up.

The finalized guidelines reflect opinions gathered over three months from various market participants, including domestic and international institutional investors, listed companies, and corporate value-up advisory groups, following the first joint seminar held in February. Answers to questions and concerns raised during the feedback process are presented in an FAQ, and sample drafts are provided to help companies refer to them when formulating their plans.

In addition, in line with the implementation of the guidelines, an integrated corporate value-up page has been launched to provide information on listed companies' value-up disclosure status and content, various support programs, and investment indicator comparison services. The integrated page offers data such as price-to-book ratio (PBR), price-to-earnings ratio (PER), return on equity (ROE), dividend payout ratio, and dividend yield for the past five fiscal years by industry and stock.

After the draft corporate value enhancement plan guidelines were released, experts and market participants expressed opinions emphasizing that companies with diverse characteristics should be able to establish plans tailored to their individual traits. They also suggested the need to show various comprehensive sample drafts rather than segmented examples by section.

The finalized guidelines announced this time reflect these opinions by adding research and development (R&D) investment-related indicators to the growth section of key financial indicators in the 'Current Status Diagnosis' to emphasize that value enhancement through investment is also a method. Furthermore, among governance indicators, disclosures on the independence of internal audit support organizations and major activities of internal audit bodies were added to present diverse examples.

Moreover, in the 'Plan Formulation' stage, it was emphasized that companies can establish plans suited to themselves among various examples such as shareholder returns like treasury stock cancellation and dividends, and disposal of inefficient assets.

Director Chung said, "The part I especially want to emphasize from the communication results with various market participants, including listed companies, is the core feature of the guidelines: autonomy and the possibility of choice and focus." He added, "We hope that listed companies will autonomously and intensively establish and implement the best plans tailored to their individual characteristics so that the value-up program can spread quickly and the Korean capital market can be re-evaluated." He also stressed the responsibility of the board of directors, a key feature mentioned in the guidelines, saying, "It will also be important for the board of directors, which is the responsible body for corporate management, to play an active role in this process."

Companies Ready Can Disclose Immediately... 'KRX Korea Value-Up Index' to Launch in the Second Half

With the finalization of the corporate value enhancement plan guidelines, companies that are prepared will be able to disclose immediately. Companies preparing disclosures can also announce their disclosure schedules in advance in a notice form to actively communicate with investors.

An exchange official stated, "From the end of this month, we will hold corporate value enhancement plan disclosure training and regional briefing sessions for disclosure officers and staff to support voluntary disclosure of corporate value enhancement plans by listed companies." He added, "Starting next month, to assist small and medium-sized listed companies in smoothly preparing disclosures, we will provide one-on-one customized consulting and English translation services, and to encourage active participation of boards of directors, we will conduct guidance for directors of listed companies."

He continued, "By the third quarter, we plan to develop the KRX Korea Value-Up Index, which can be used by institutional investors such as pension funds, and promote global marketing considering market interest and expectations." He also announced, "In the fourth quarter, we plan to develop financial products such as index-linked exchange-traded funds (ETFs) and hold joint investor relations (IR) sessions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)