Shinhan 5.2 Billion and Lotte 3.5 Billion Deficit in Vietnam

Industry: "Operating Environment This Year Is Not Bad"

The card industry, which ventured into overseas markets to discover new revenue sources, recorded sluggish performance. This was due to deteriorating business conditions caused by prolonged high interest rates and local economic recessions.

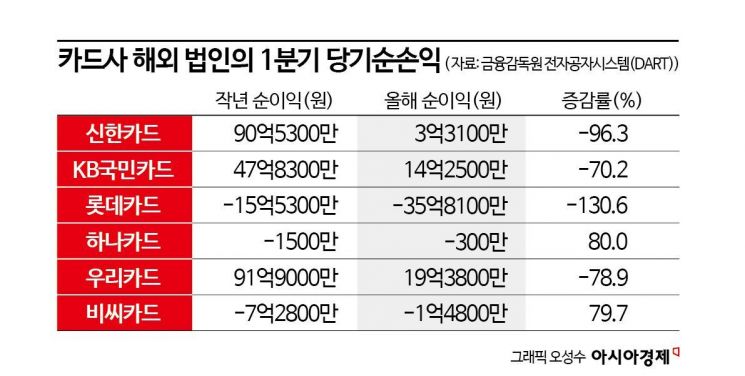

According to each card company on the 27th, 15 overseas subsidiaries of six domestic card companies (Shinhan, KB Kookmin, Lotte, Hana, BC, and Woori Card) recorded a total net loss of 38 million KRW in the first quarter of this year. While they posted a net profit of 20.73 billion KRW in the first quarter of last year, they switched to a net loss within a year.

By company, Shinhan Card’s four overseas subsidiaries (Vietnam, Myanmar, Indonesia, Kazakhstan) posted a net profit of 331 million KRW in the first quarter of this year. This represents a 96.3% decrease compared to 9.053 billion KRW in the same period last year. This deterioration in performance was mainly due to the profitability slump of the Vietnam subsidiary. Shinhan Card’s Vietnam subsidiary, ‘Shinhan Vietnam Finance,’ posted a net profit of 5.586 billion KRW in the first quarter of last year but recorded a net loss of 5.269 billion KRW in the first quarter of this year.

During the same period, KB Kookmin Card’s four overseas subsidiaries’ net profit decreased by 70.2%, from 4.783 billion KRW to 1.425 billion KRW. KB Kookmin Card operates general loans, installment finance, and leasing businesses in Thailand, Cambodia, Indonesia, and other regions. The largest decline was seen in the Indonesian subsidiary ‘PT KB Finansia Multifinance’ with an 83.9% drop, followed by KB Daehan Special Bank (Cambodia) at 52.9%, and KB J Capital (Thailand) at 38.7%.

Woori Card’s overseas financial subsidiaries (Myanmar and Indonesia) recorded a combined net profit decrease of 78.9%, totaling 1.938 billion KRW, while Lotte Card’s overseas subsidiary ‘Lotte Finance Vietnam’ saw its net loss increase from 1.553 billion KRW to 3.581 billion KRW.

However, Hana Card and BC Card’s overseas subsidiaries reduced their losses. Hana Card’s Japanese subsidiary ‘Hana Card Payments’ posted a net loss of 15.87 million KRW in the first quarter of last year, but the net loss narrowed to 3.09 million KRW in the first quarter of this year. Hana Card Payments is a local subsidiary that purchases sales slips from WeChat Pay transactions made by Chinese customers in Japan and acts as an intermediary for payment to the Japanese merchants, earning transaction fee income.

BC Card’s three overseas subsidiaries recorded a total net loss of 14.816 million KRW in the first quarter of this year, a 79.7% decrease from 72.8 million KRW in the same period last year. BC Card operates overseas subsidiaries mainly focused on software development and supply in China, Vietnam, Indonesia, and other regions.

The prolonged high interest rate environment is a key reason these card companies are struggling in overseas markets. A card industry insider said, “Since the end of 2022, the high interest rate trend has continued, increasing financial costs and leading to poor performance.” Another insider added, “The U.S. raising its benchmark interest rate has also caused borrowing costs to rise in the countries where we operate.”

The impact of local economic slowdowns is also significant. The Southeast Asian markets, where domestic card companies have focused, faced difficulties due to high interest rates compounded by the downturn in the Chinese economy. As the economy faltered, local financial consumers’ repayment ability declined, causing card companies’ bad debt expenses to soar. A card industry official explained, “As the unfavorable business environment persisted, we also took preemptive measures by increasing provisions.”

Some card companies have drawn a line on direct entry into emerging markets. Jung Tae-young, Vice Chairman of Hyundai Card, said at a press conference held on the 21st at Hyundai Card Cooking Library in Apgujeong-ro, Seoul, “We bought a bank in Vietnam in the past but sold it after six months,” adding, “Emerging markets have many unseen risks, including political factors.” He further stated, “Hyundai Card will target emerging markets by exporting solutions.” Hyundai Card had planned to acquire a 50% stake in FCCOM, a consumer finance subsidiary of Vietnam Maritime Bank (MSB), in 2021 but ultimately gave up.

The card industry expects the business environment this year to be not unfavorable. A KB Kookmin Bank official said, “This year, we will prioritize recovering profitability and strengthening fundamentals of overseas subsidiaries to prepare for an economic turnaround,” adding, “Specifically, in Indonesia, we plan to expand operations beyond the metropolitan area to regional areas, and in Thailand, we aim to establish a growth base focused on high-quality customers.” A Hana Card official explained, “Due to amendments in Japan’s installment sales law, we can now obtain licenses and plan to resume business within this year.”

Lotte Card has begun actively expanding its business by increasing capital by 68 million USD (93.7 billion KRW) in its Vietnam subsidiary. The investment will be used to secure stable growth potential through business structure reorganization and expansion of operating assets. A Lotte Card official said, “Based on differentiated competitiveness such as developing proprietary credit evaluation models, big data-based digital sales, and expanding BNPL (Buy Now Pay Later) services, we aim to return to profitability this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.