NVIDIA Earnings Beat Boosts AI Rally Optimism

Last Week's Unemployment Claims Below Expectations

May FOMC Minutes Suggest Delay in Rate Cuts

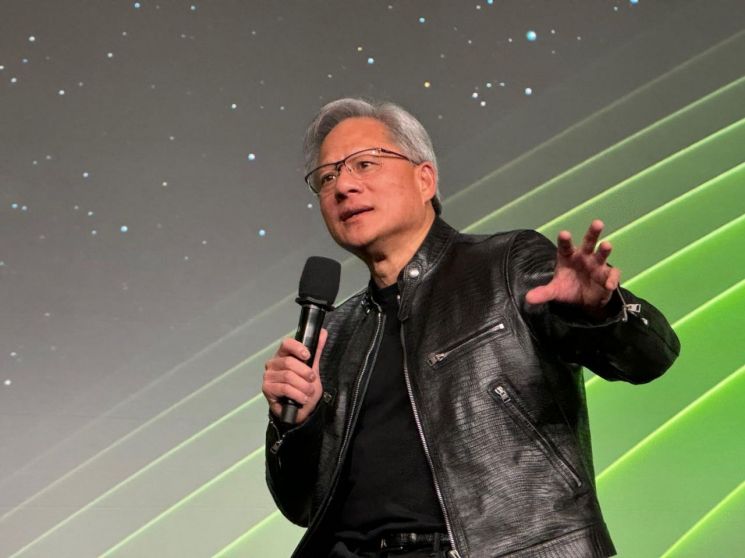

The three major indices of the U.S. New York stock market showed mixed trends on the 23rd (local time). With the strong earnings of AI leader Nvidia meeting market expectations and the anticipation that the AI rally will continue, the S&P 500 and Nasdaq indices reached intraday all-time highs.

As of 9:45 a.m. at the New York Stock Exchange (NYSE) on the day, the Dow Jones Industrial Average was down 0.34% from the previous close, standing at 39,535.38. The large-cap-focused S&P 500 index rose 0.32% to 5,323.91, and the tech-heavy Nasdaq index climbed 0.79% to 16,934.21.

Semiconductor stocks are on the rise, buoyed by Nvidia's strong earnings. Nvidia is up 9.34%. Super Micro Computer is up 8.23%, while Micron and AMD have risen 2.37% and 3.85%, respectively.

On the previous day, Nvidia announced its fiscal 2025 first-quarter (February to April) earnings after market close, reporting revenue of $26 billion, a 262% increase year-over-year, and adjusted earnings per share (EPS) of $6.12, up 461% from the same period last year. These figures exceeded market expectations. Earlier, market research firm LSEG had forecasted Nvidia's revenue at $24.65 billion and adjusted EPS at $5.59.

Revenue surged as Google, Microsoft (MS), Meta, Amazon, OpenAI, and others purchased Nvidia graphics processing units (GPUs) worth billions of dollars necessary for AI development. Nvidia's data center revenue reached $22.6 billion, a 427% increase year-over-year. Gaming revenue rose 18% to $2.64 billion.

Additionally, Nvidia decided to execute a 10-for-1 stock split. The quarterly cash dividend will be increased to $0.10 per share from $0.04 in the previous quarter.

The outlook for the second quarter (May to July) also exceeds market expectations. Nvidia projected second-quarter revenue of $28 billion, surpassing LSEG's estimate of $26.61 billion.

Ryan Detrick, Chief Market Strategist at Carson Group, commented, "Despite very high expectations, Nvidia once again delivered results. The always important data center revenue was strong, and the future revenue outlook was also impressive." He added, "The bar was set high, and Nvidia cleared it once again."

The previous day, the market closed lower across the board following the release of the May Federal Open Market Committee (FOMC) minutes, which confirmed a hawkish (preference for monetary tightening) tone. The U.S. Federal Reserve (Fed) indicated it would maintain current interest rates longer than initially expected due to inflation concerns, dampening investor sentiment. The minutes stated, "Participants were disappointed by the first-quarter inflation figures" and "It appears it will take longer than previously expected to gain greater confidence that inflation is moving steadily toward 2%."

Some officials expressed views that interest rates could be raised depending on circumstances. The minutes noted, "Many participants mentioned uncertainty about the degree of restraint," and some said, "If inflation risks materialize, they are willing to further tighten policy if appropriate."

On Wall Street, there are also views that there will be no rate cuts this year. David Solomon, CEO of Goldman Sachs, said immediately after the release of the May FOMC minutes, "I still believe in 'zero cuts' (no rate cuts)," adding, "We are in a more sticky inflation environment."

The market expects one to two rate cuts this year. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market on the day reflected nearly a 60% chance that the Fed will cut rates by at least 0.25 percentage points at the September FOMC meeting. The probability of a rate cut of at least 0.25 percentage points in November is about 72%. The April core Consumer Price Index (CPI) rose at its slowest pace in three years, fueling expectations for rate cuts.

The labor market remains robust. The number of new unemployment claims in the U.S. for the week of May 12-18, released that morning, was 215,000, below market expectations of 220,000. This is also lower than the previous week's 223,000. Continuing claims, which count those filing for unemployment benefits for at least two weeks, were 1,794,000 for the week of May 5-11, an increase of 8,000 from the previous week.

Government bond yields are steady. The U.S. 10-year Treasury yield, a global benchmark for bond yields, fell 1 basis point (1 bp = 0.01 percentage point) from the previous trading day to 4.42%, while the 2-year Treasury yield rose slightly to around 4.88%.

International oil prices are on the rise. West Texas Intermediate (WTI) crude oil increased $0.47 (0.6%) from the previous day to $78.04 per barrel, and Brent crude, the global benchmark, rose $0.50 (0.6%) to $82.40 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.