Last year, China dominated 92.6% of the secondary battery anode material market. Chinese companies occupied all positions from first to ninth in the global anode material market, with POSCO Future M being the only Korean company to rank 10th. Although the United States granted a two-year exemption for graphite anode materials under the Inflation Reduction Act (IRA) defined Foreign Entity of Concern (FEOC), replacing Chinese graphite remains a highly challenging task.

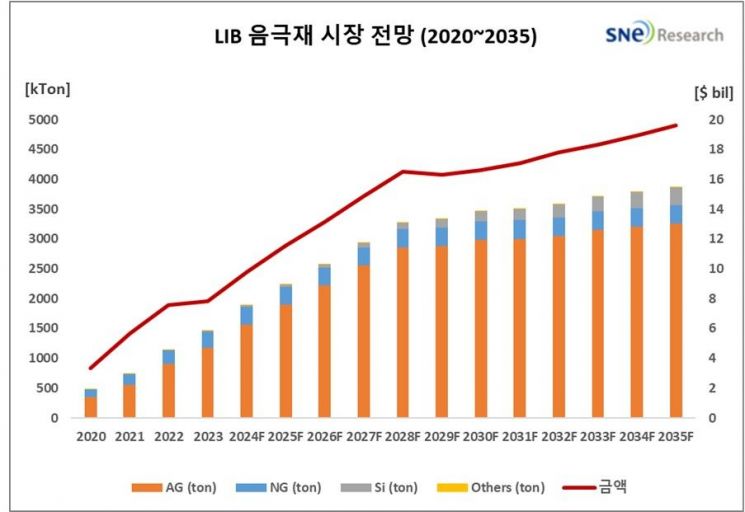

According to the market research firm SNE Research's "2024 Lithium-ion Battery Anode Material Technology Status and Market Outlook" report released on the 23rd, the lithium-ion battery anode material market is expected to grow more than 2.5 times from 1.6 million tons (10 trillion KRW) in 2023 to 3.9 million tons (25 trillion KRW) by 2035.

Market expansion centered on artificial graphite is expected to be prominent until 2028-2029. Artificial graphite has characteristics that increase battery charging speed and extend lifespan compared to natural graphite anode materials, and continuous growth is anticipated alongside the expansion of the electric vehicle market.

Source: May 2024 Lithium-ion Battery Anode Material Technology Status and Market Outlook, SNE Research

Source: May 2024 Lithium-ion Battery Anode Material Technology Status and Market Outlook, SNE Research

In the case of silicon anode materials, their share of the total anode materials is expected to increase from the current 1-2% to 7-10%. SNE Research predicts that demand for graphite anode materials will slow down or saturate after 2029-2030.

The share of Chinese companies in anode material shipments increased from 87.5% in 2021 to 92.6% in 2023. SNE Research explained that all of the top nine companies are Chinese, with the big three?BTR, Shanshan, and Zichen?accounting for 45% of the total. Outside China, Korea's POSCO Future M ranked 10th. Japan's Resonac (formerly Showa Denko) and Mitsubishi ranked 11th and 12th, respectively.

Source: May 2024 Lithium-ion Battery Anode Material Technology Status and Market Outlook, SNE Research

Source: May 2024 Lithium-ion Battery Anode Material Technology Status and Market Outlook, SNE Research

The U.S. government recently decided that when determining eligibility for electric vehicle subsidies under the IRA, graphite used in batteries sourced from FEOC will not be penalized until 2026. However, with over 90% dependence on Chinese anode materials, the battery materials industry urgently needs to reduce reliance on China.

SNE Research stated, "While restricting the supply of anode materials from Chinese companies is favorable for non-Chinese lithium-ion battery companies in the short term, replacing suppliers with non-Chinese companies is expected to be a significant challenge and may take a long time." POSCO Future M plans to produce 370,000 tons of graphite anode materials by 2030.

SNE Research forecasted, "Securing various technologies such as next-generation high-capacity, high-performance silicon anode materials, lithium metal, and hard carbon anode materials will be an important game changer in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.