Oasis to Introduce AI Unmanned Payment Solution in October

Long-Term Plan to Reduce Labor Costs and Strengthen Profitability

Kurly Launches 'Quick Commerce' Service in First Half

Diversifying Profitability Strategy to Increase Transaction Volume and Sales

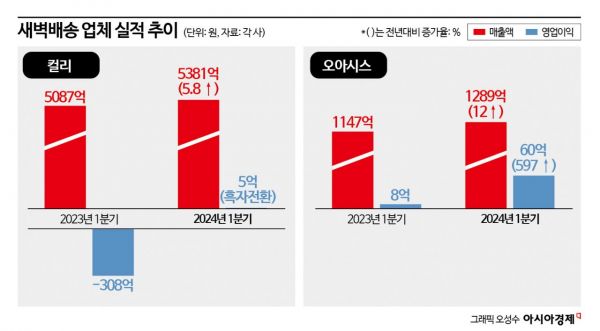

ㅇAs dawn delivery companies Kurly and Oasis both recorded strong performances in the first quarter of this year, their contrasting business strategies are drawing attention. Kurly is diversifying its business with a ‘quick commerce’ venture in the first half of the year, while Oasis is focusing on enhancing profitability by introducing ‘AI unmanned stores’ in the second half.

According to the distribution industry on the 23rd, Oasis plans to unveil its first unmanned store equipped with AI cameras in October. They will initially pilot the store at one location, then expand the number of stores equipped with AI unmanned payment devices after making improvements. Candidate stores for entry include large stores over 100 pyeong such as Seocho Branch, Wirye Main Branch, and Gildong Branch.

Payments are made by the device recognizing the product’s weight and image. Customers do not need to scan the product barcode themselves; placing items on the conveyor belt automatically calculates the total. Oasis has devoted years to developing unmanned payment solutions, and its parent company, GieoSoft, obtained a patent for this device in the first half of this year. An Oasis representative said, “Because the device is large-scale, it will be introduced mainly in large stores, starting with a pilot operation at one location and then adding more one by one. The AI unmanned device was developed in-house, and overseas expansion is also being considered.”

Once the device is introduced, Oasis’s growth strategy focused on profitability is expected to gain more momentum. Although labor costs cannot be drastically reduced in the short term after introducing unmanned payment, as the number and size of stores increase, the burden on manpower can be eased in the long term.

Oasis is currently concentrating on strengthening profitability rather than expanding its scale. For example, Oasis officially entered the quick commerce business in July 2021 but still maintains a cautious stance regarding the operation of this service. They have prepared pickup counters in stores and developed a beta version of a mobile application for quick commerce, but currently consider it premature.

An Oasis representative said, “The company’s operational strategy is to focus on making profits even if small,” adding, “We are continuously reviewing the business feasibility of quick commerce while providing same-day delivery.” Oasis’s sales in the first quarter of this year were 128.9 billion KRW (12% growth), with an operating profit of 6 billion KRW. This is a record high, with operating profit growing 597% compared to the same period last year.

Kurly, considered a rival in dawn delivery, will launch its quick commerce service ‘Kurly Now’ next month, delivering fresh food orders within about an hour. They are securing PP (Picking & Packing) centers at major hubs in Seoul and adjusting the service coverage area. The delivery method is similar to the ‘Baeman B Mart’ service currently offered by Baedal Minjok. Products are picked immediately upon ordering via the application (app) and delivered to consumers.

Kurly’s strength lies in offering the same products available through its Dawn Delivery service via quick commerce. They aim to leverage Kurly’s product selection capabilities through quick commerce as well. A Kurly representative explained, “Specific areas have not been decided yet,” adding, “We will not simply deliver mass-produced goods available on the market but will pay attention to the quality of products sold and deliver them quickly.”

Kurly’s bet on quick commerce aligns with its business direction this year. Kurly recorded sales of 538.1 billion KRW and an operating profit of 500 million KRW in the first quarter, marking its first quarterly profit. Although it posted operating losses of -30.8 billion KRW in Q1 last year and -48.3 billion KRW in Q2, it rapidly reduced losses and achieved profitability faster than expected. This was thanks to increased transactions on Beauty Kurly and significant cuts in management expenses, maximizing profitability. Having achieved its profitability goal early this year, Kurly plans to pursue growth strategies in transaction volume and sales while maintaining the cash flow break-even point (BEP). It appears that the quick commerce new business card was drawn to boost sales and rapidly increase transaction volume.

The distribution industry still holds many concerns about Kurly’s quick commerce new business. This is due to the bitter experiences of large companies such as E-Mart, GS Retail, and Lotte Shopping, which previously entered the market.

The biggest risk of quick commerce is cited as high maintenance costs. Additionally, if the service area cannot be rapidly expanded, scaling up the business size may be limited. A distribution industry insider said, “Kurly will stake its life on making this quick commerce business succeed,” adding, “While it is a service where Kurly can have strengths, the fact that it is not partnering with offline retailers but securing PP centers independently to operate quick commerce is a concern.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)