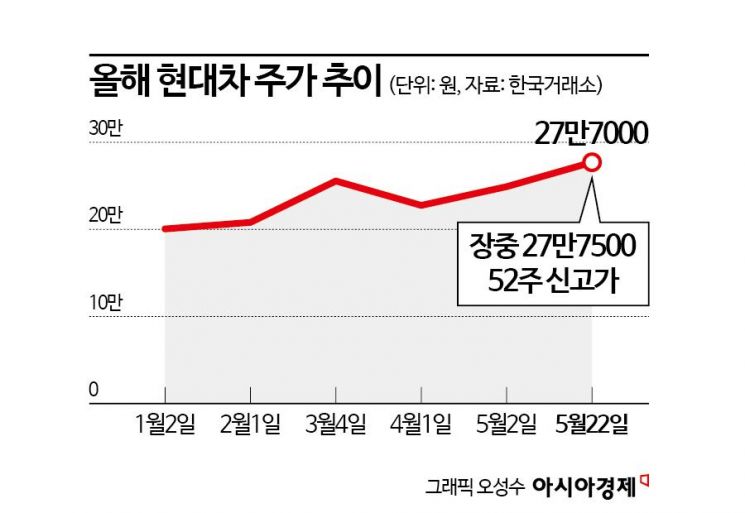

Hyundai Motor Company continued its strong stock performance, settling at the 270,000 KRW level and setting a new 52-week high. If the current trend continues, breaking the all-time high does not seem far off. With the stock price rising day after day, its market capitalization ranking also climbed to 4th place, surpassing Samsung Biologics.

According to the Korea Exchange on the 23rd, Hyundai Motor's stock price reached an intraday high of 277,500 KRW, marking a 52-week high. The stock surged by 9.49% in a single day, quickly climbing to the 270,000 KRW level. Hyundai Motor's stock price rose 10.36% this month. If the bullish trend continues, it is expected that the all-time high could be surpassed. Hyundai Motor previously recorded an all-time high of 289,000 KRW intraday on January 11, 2021.

The recent rise in stock price was driven by foreign investors. Foreign investors have maintained a net buying streak of Hyundai Motor for eight consecutive trading days. Since the beginning of this month, foreign investors have net purchased Hyundai Motor shares worth 421.3 billion KRW, making it the second most bought stock after SK Hynix. Institutional investors have also joined the net buying trend recently, purchasing shares for three consecutive days. During this period, they bought shares worth 141.7 billion KRW, ranking first in net purchases.

Hyundai Motor's strength appears to be driven by solid earnings and expectations for shareholder returns. In the first quarter of this year, Hyundai Motor recorded sales of 40.6585 trillion KRW and operating profit of 3.5573 trillion KRW. Sales increased by 7.6% compared to the same period last year, while operating profit decreased by 2.3%. The sales figure reached an all-time high for a first quarter. Hyundai Motor Group's operating profit in Q1 surpassed that of Volkswagen Group, the world's second-largest automaker, for the first time, and its operating profit margin ranked first among the global top five automakers.

Expectations for second-quarter earnings are also high. Yoo Ji-woong, a researcher at Daol Investment & Securities, said, "Strong second-quarter earnings momentum is expected to level up the current stock price," adding, "The second quarter is concentrated with Hyundai Motor's largest sports utility vehicle (SUV) model cycles, with production of the Santa Fe in the U.S. and the Palisade in Korea rapidly increasing, each recording record volumes, which will act as key drivers for profitability improvement."

Although second-half earnings are expected to slow compared to the first half, the growth trend in earnings is projected to continue this year compared to last year. Lee Jae-il, a researcher at Eugene Investment & Securities, said, "Despite the high base effect last year, it is possible to increase annual earnings this year," estimating, "The expected operating profit for this year is 15.1 trillion KRW, a 0.2% increase compared to last year."

Additional expectations for shareholder returns are also acting as a driving force for the stock price increase. The securities industry expects Hyundai Motor to announce additional shareholder return measures at the 2024 CEO Investor Day (CID) event, expected to be held around June. Lee Byung-geun, a researcher at Ebest Investment & Securities, said, "There is a high possibility that additional shareholder return policies will be announced through the CID, and expectations for this will gradually rise," adding, "Previously, Toyota announced dividends of 1 trillion yen and share buybacks of 1.1 trillion yen through its earnings report, which corresponds to a shareholder return ratio approaching 40%. In the long term, Hyundai Motor is also expected to raise its shareholder return ratio to around 40%." Shin Yoon-chul, a researcher at Kiwoom Securities, also said, "There is a possibility of announcing a strategy to strengthen shareholder returns based on expanded share buybacks and cancellations," adding, "The best-case scenario is that the direction converges toward a shareholder return ratio at the level of Toyota in the mid to long term." Earlier, Hyundai Motor decided on a dividend of 2,000 KRW per share for the first quarter of this year, which is a 33.3% increase from the 1,500 KRW dividend per share in the same quarter last year.

.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.