SK Hynix, "HBM Competitive Edge to Continue in Second Half"

Samsung Electronics, DS Division CEO Change... "Turning Point for Semiconductor Sentiment"

The securities industry continues to maintain a buy recommendation on semiconductors. This is because annual profit estimates are expected to keep rising, supported by a robust market environment through the second half of this year. Investors are now focusing on whether the profit improvement trend of semiconductor companies, which has continued since the first quarter, will actually persist.

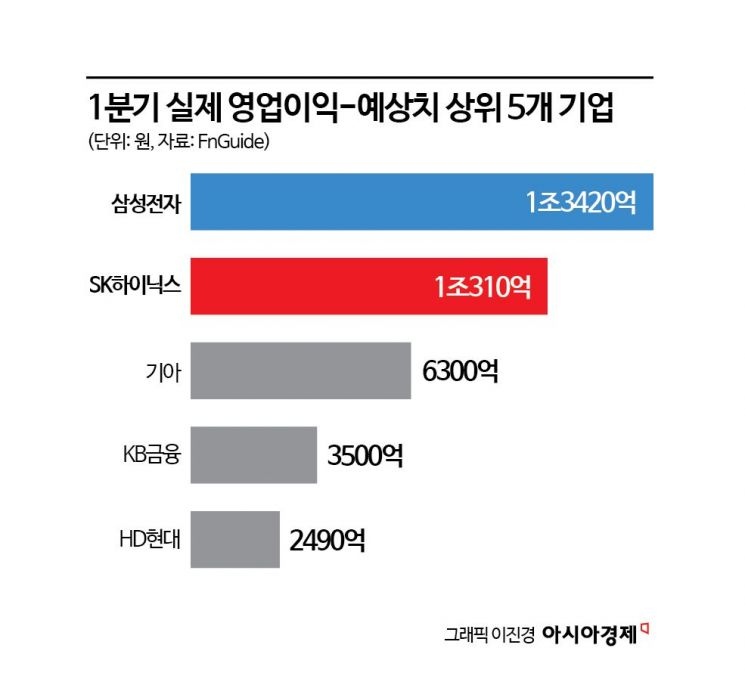

According to the financial investment industry on the 23rd, the operating profit and net profit of domestic listed companies in the first quarter were 6.9% and 11.4% higher than initially expected, respectively. In particular, the IT sector, including Samsung Electronics and SK Hynix, accounted for 5.0% and 6.3%, respectively, leading the upward revision of profit estimates for the entire market. As a result, Samsung Electronics and SK Hynix ranked first and second, respectively, among companies with the largest gaps between actual recorded operating profits and estimates.

The securities industry maintained an overweight opinion on large semiconductor companies such as Samsung Electronics and SK Hynix, analyzing that the semiconductor performance improvement seen in the first quarter will continue into the second half of the year. Yeom Dong-chan, a researcher at Korea Investment & Securities, said, "Annual profit estimates have shown a continuous upward adjustment trend after the first-quarter earnings season," adding, "In particular, after SK Hynix announced its results, operating profit estimates increased by about 5 trillion won." He also said, "The market expects better performance in the second quarter than in the first quarter, and better in the third quarter than in the second," and "We maintain a positive view on large IT sectors that will support future profit improvement trends."

Experts unanimously agreed that SK Hynix will continue to maintain its competitive edge in high-bandwidth memory (HBM). Kim Hyung-tae, a researcher at Shinhan Investment Corp., analyzed, "SK Hynix is estimated to hold more than 60% market share in the HBM market this year and is expanding its footprint with new products targeting the on-device artificial intelligence (AI) market," adding, "Because it has built a solid reference base, high preference from client companies will continue." He further forecasted, "Benefiting the most from the expansion of AI demand, the competitive advantage in the high-value DRAM market is being prolonged," and "A higher HBM ratio compared to competitors will drive differentiated profitability."

Additionally, Samsung Electronics is aiming to revitalize its atmosphere to overcome the decline in memory semiconductor market share and sluggish foundry business by replacing the head of the DS Division on the 21st. In the industry, Vice Chairman Jeon Young-hyun, appointed as the new head of the DS Division, is known to prioritize proactive development of new technologies and technological competitiveness, so it is expected that he will focus on developing new memory products centered on HBM and improving yield in advanced foundry processes. Ryu Young-ho, a researcher at NH Investment & Securities, predicted, "Samsung Electronics has been relatively undervalued due to weakened HBM competitiveness, but visibility of entering the HBM market is expected to improve as the year progresses," adding, "With the development of the AI industry and the expansion of global companies' moves to produce their own chips, the foundry sector will also continue to benefit." He continued, "Along with the overall recovery of memory prices, valuation attractiveness may be highlighted," but pointed out, "However, until demand recovery in the front-end industry is secured, HBM-related events will be the main variables affecting the stock price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)