Financial Services Commission Holds Review Meeting on Financial Regulation Flexibility Measures

Bank LCR Applied at 97.5%, Gradual Normalization Underway

On the 9th, officials were busy moving in the corridor of the Financial Services Commission at the Government Seoul Office in Jongno-gu, Seoul, where financial authorities decided to include mortgage loans (Judaemae) in the 'debt refinancing' infrastructure scheduled to be launched in May by the end of the year. Financial authorities explained that they aim to reduce the interest burden on mortgage loans by establishing a debt refinancing platform that allows users to compare financial sector loan interest rates at a glance and switch loans easily. Photo by Dongju Yoon doso7@

On the 9th, officials were busy moving in the corridor of the Financial Services Commission at the Government Seoul Office in Jongno-gu, Seoul, where financial authorities decided to include mortgage loans (Judaemae) in the 'debt refinancing' infrastructure scheduled to be launched in May by the end of the year. Financial authorities explained that they aim to reduce the interest burden on mortgage loans by establishing a debt refinancing platform that allows users to compare financial sector loan interest rates at a glance and switch loans easily. Photo by Dongju Yoon doso7@

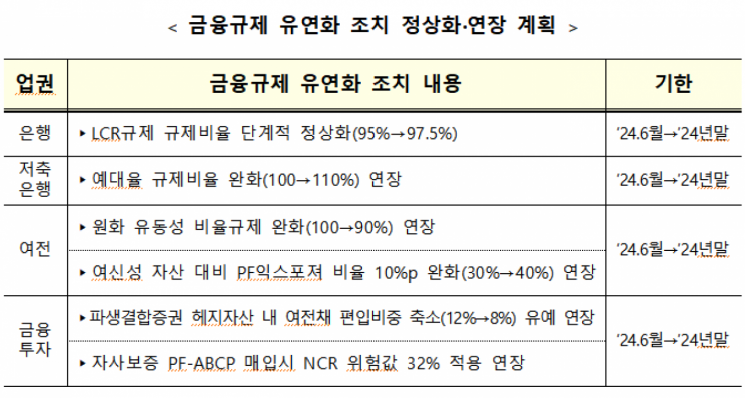

The Financial Services Commission will raise the liquidity coverage ratio (LCR) regulatory ratio for banks from 95% to 97.5% starting in July and gradually normalize it. On the other hand, the regulatory easing measures applied to specialized credit finance companies and the financial investment sector, including savings banks, will be extended for an additional six months.

On the 21st, the Financial Services Commission announced that it held a meeting to review the financial regulatory easing measures, chaired by the Director of the Financial Industry Bureau, with the Financial Supervisory Service, the Bank of Korea, and financial associations. At the meeting, the current soundness and liquidity status of the banking, financial investment, specialized credit finance, and savings bank sectors, as well as future plans for the financial regulatory easing measures expiring at the end of June this year, were discussed.

The attendees agreed that considering the currently stable market conditions and the financial sector's capacity to respond, most financial companies are expected to comply with regulatory ratios even after the regulatory easing measures end. However, taking into account the possibility of increased uncertainty in the future, they concurred that some financial regulatory easing measures need to be extended for the time being.

The easing of bank LCR regulations, which began in April 2020 in response to COVID-19, is set for gradual normalization with a 97.5% application until the end of the year. This is based on the fact that most banks are already operating above an LCR of 100%, and although bank bond issuance has somewhat increased, considering the bond market situation and future funding demand, the likelihood of it causing market liquidity disruption is low.

Additionally, the financial regulatory easing measures for savings banks (loan-to-deposit ratio), specialized credit finance sector (KRW liquidity ratio and real estate PF exposure ratio), and financial investment sector (relaxation of the inclusion ratio of specialized credit bonds in hedge assets for derivative-linked securities and easing of NCR risk values when purchasing self-guaranteed ABCP) will be further extended until the end of this year, considering the project financing (PF) market situation and the continuation of high interest rates in the financial market.

A Financial Services Commission official explained, "Regarding the above financial regulatory easing measures, we plan to comprehensively review the financial market conditions and the soundness and liquidity status of each financial sector in the fourth quarter of this year to determine whether to further extend or normalize them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)