Banking sector 0.03→0.035%... Insurance, mutual finance, credit finance, and savings banks at 0.045%

Policy to reduce differential contributions for financial companies actively handling policy-based microfinance

Financial Services Commission announces legislative notice for enforcement ordinance amendment

The Financial Services Commission plans to increase the contribution rates of financial companies until next year to supply policy-based microfinance steadily and continuously, while temporarily reducing contributions for financial companies that actively handle policy-based microfinance.

On the 20th, the FSC announced that it will give public notice of the amendment to the Enforcement Decree of the Act on Support for the Financial Life of the Underprivileged, which includes these measures. This move comes as the need to support policy-based microfinance for vulnerable groups such as low-income households is increasing due to the prolonged high interest rates and high inflation.

According to the amendment, the common contribution rate will be raised to 0.035% (+0.005%p) for banks and to 0.045% (+0.015%p) for insurance, mutual finance, credit finance, and savings banks until December 31 next year. For banks, considering the plan to separately contribute KRW 221.4 billion to the Korea Inclusive Finance Agency under the livelihood finance support plan, different common contribution rates will be applied by sector. Under the current system, a common contribution rate of 0.03% is imposed on the household loan amounts of financial companies.

The FSC explained, "As the economic difficulties of vulnerable groups intensify, additional funding is necessary to ensure the stable and continuous supply of policy-based microfinance," adding, "We expect to secure guarantee funds for policy-based microfinance supply and establish a stable foundation for policy-based microfinance provision."

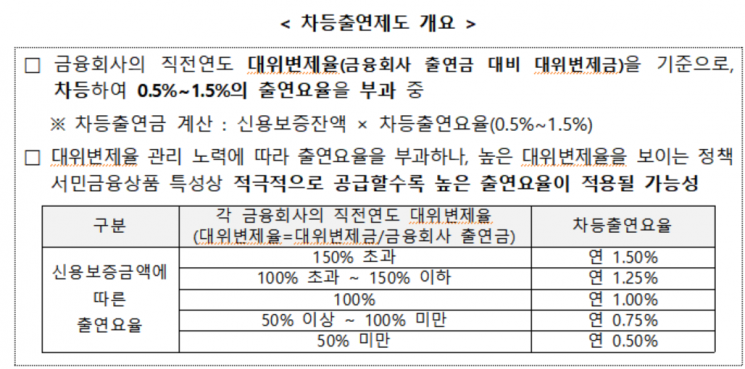

For financial companies that actively handle policy-based microfinance, contributions related to credit guarantee amounts from the Korea Inclusive Finance Agency will be temporarily reduced. Currently, differential contributions are imposed by applying differential contribution rates (0.5~1.5%) reflecting the level of subrogation for credit guarantee balances by financial company. Some financial companies expressed concerns that the increased contribution burden due to handling policy-based microfinance makes active participation difficult.

Accordingly, the amendment introduces a measure to temporarily raise the common contribution rate until the end of next year while reducing the differential contribution burden for financial companies with excellent performance in supplying policy-based microfinance, encouraging financial companies to actively handle policy-based microfinance.

The differential contribution rate will be reduced by 0.5 percentage points for selected financial companies based on their evaluation of supply performance of policy-based microfinance products. The specific evaluation method will be determined by the Korea Inclusive Finance Agency, considering the supply performance of financial companies' policy-based microfinance products.

The FSC estimated that the increase in the common contribution rate and the reduction in differential contributions will result in an additional contribution scale of KRW 103.9 billion to the Korea Inclusive Finance Agency from the financial sector. An FSC official stated, "The amendment to the Enforcement Decree of the Act on Support for the Financial Life of the Underprivileged is scheduled for public notice until July 1," adding, "Afterward, it will go through the Ministry of Government Legislation review, Vice Ministerial Meeting, and Cabinet approval procedures, and is expected to be implemented within the second half of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)