Automotive Industry Unable to Smile

Over 50% of Exports to the US Until April

US Presidential Election Nears, Concerns Over Strengthened Protectionism

This year, the proportion of the United States in South Korea's automobile exports has surpassed half. While it remains to be seen on an annual basis, the current situation suggests that strong exports to the U.S. are likely to continue in the second half of the year.

The increase is analyzed to be due to rising demand for Korean-made finished cars locally and the depreciation of the Korean won, which has improved profitability. Considering the U.S. presidential election in the second half of this year, there are concerns that this could actually act as a negative factor. This is because the spread of protectionist policies in the U.S. increases the likelihood of shifting blame to foreign countries. Depending on the election results, there is speculation that it could provide a pretext to demand a renegotiation of the Korea-U.S. Free Trade Agreement (FTA) to correct trade imbalances.

Automobile Exports to the U.S. Surpass Half for the First Time

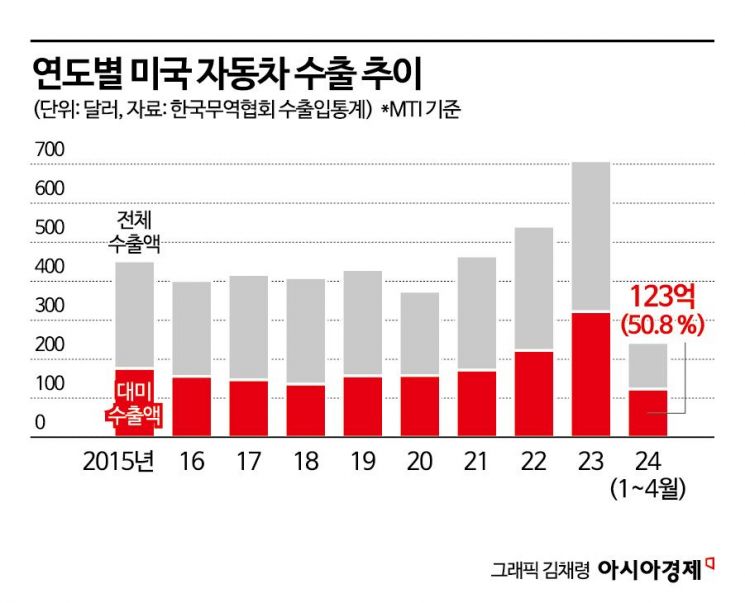

According to export-import statistics from the Korea International Trade Association on the 17th, automobiles exported to the U.S. from the beginning of this year through April amounted to $12.345 billion. Considering that South Korea's total automobile exports were $24.321 billion, the U.S. accounted for 50.8%, more than half. This is the first time since South Korea began full-scale automobile exports in the 1990s that the U.S. share of total automobile exports has exceeded half.

The U.S. has been a major automobile export market for domestic companies even before the FTA was signed. The share of exports to the U.S. in total automobile exports steadily increased from the 10% range in 2011, just before the Korea-U.S. FTA came into effect, to 39% in 2016, the year before former President Donald Trump took office. It first exceeded 40% in 2020, when major automakers faced production disruptions due to COVID-19, and surpassed 45% last year.

The increase in automobile exports to the U.S. is largely due to growing demand for Korean-made cars locally. Due to high oil prices, American consumers have shown a clear preference for vehicles with relatively high fuel efficiency. Demand for small sport utility vehicles (SUVs) and hybrids that use both engines and motors has also increased significantly in the U.S. Models such as the small SUVs (Trax Crossover and Trailblazer) produced by Hyundai, Kia, and Korean GM, which are largely exported, rank 1st and 4th in domestic car export rankings from January to April this year. These models are also considered best-selling in their respective segments in the U.S. market.

The relatively stronger dollar has also encouraged exports to the U.S. Even if the same car is sold, a 1 won increase in the won-dollar exchange rate results in an additional 10 billion won in export sales. For automakers, exporting to the U.S. has become more profitable.

The trend of expanding exports is expected to continue until the end of this year. With steady local demand for new cars and Japanese makers such as Toyota and Honda recently increasing their local sales, competition among Korean and Japanese automakers has intensified. Hyundai Motor Group's new electric vehicle plant being built in the U.S. is scheduled to be completed around the end of this year. Before that, to maintain market share, they have no choice but to increase exports from domestic factories.

Could Become a Pretext for U.S. FTA Renegotiation

However, trade experts do not view this export boom entirely positively. South Korea recorded a trade surplus of over $40 billion with the U.S. last year, with automobiles and parts (a $36.6 billion surplus) contributing significantly. From the U.S. perspective, this is a trade deficit. Among countries with which the U.S. has trade deficits, South Korea was outside the top 10 until 2019, before the COVID-19 outbreak, but rose to 8th place last year. Automobiles and parts played a decisive role in this process.

This year, the U.S. presidential election is a key issue. Both major party candidates have clearly expressed protectionist stances toward domestic industries, and the automobile industry is directly affected. Recently, the U.S. government raised tariffs on Chinese electric vehicles by 100%, quadrupling the previous rate, citing protection of domestic industries. The decision to relax emission regulations aimed at phasing out internal combustion engines is in the same context. This move is also mindful of the votes of the United Auto Workers (UAW) and the automotive sector. If exports of Korean-made cars to the U.S. increase, they could face backlash.

Previously, automobiles were a subject of renegotiation in the Korea-U.S. FTA. In 2017, then U.S. President Donald Trump pushed for renegotiation of the Korea-U.S. FTA, citing the U.S. trade deficit as a campaign promise. Although imports of U.S.-made cars increased after the FTA came into effect in 2012, South Korea's export volume was much larger. In the 2018 agreement, the U.S. delayed the tariff elimination schedule on Korean trucks by 20 years and revised safety and environmental standards to be more flexible.

Pressure for renegotiation is expected to increase depending on the election results. When the 2017 FTA renegotiations began, South Korea's trade surplus with the U.S. was $17.9 billion, less than half of last year's $44.4 billion. Considering that exports to the U.S. have actually increased since the renegotiation, the U.S. is likely to demand correction of the trade deficit.

Experts evaluate this as an issue likely to surface sufficiently during the remaining election period until the end of the year. Pyo In-su, a trade expert and attorney at the law firm Bae, Kim & Lee LLC, said, "If the U.S. government judges the trade environment to be unfair, it could push for FTA renegotiation at any time."

There is also speculation that the origin rules in the Korea-U.S. FTA could be challenged, as electric vehicles have become a key issue in the U.S.-China trade dispute. The origin recognition standard in the Korea-U.S. FTA is about 35%, which is relatively lax compared to other FTAs the U.S. has signed. Domestic automakers import a significant portion of Chinese parts in the manufacturing process of electric and other vehicles, which could become a point of contention.

An anonymous trade expert said, "The origin rules for automobiles in the Korea-U.S. FTA were a major internal concern even before the previous renegotiation. If renegotiations occur again, we, who are increasing our trade surplus, will be in a defensive position."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)