ELS Compensation Amounts to 1.8 Trillion Won

In the first quarter of this year, the performance of domestic banks in South Korea was reduced to a quarter compared to the same period last year. This was due to unexpected losses, including compensation payments related to Hong Kong H-index equity-linked securities (ELS) amounting to nearly 2 trillion won.

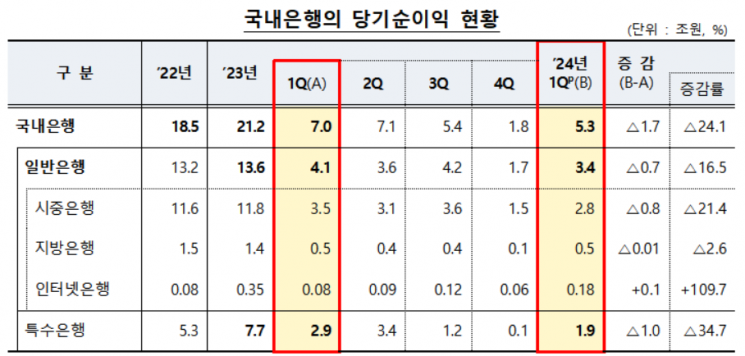

According to the Financial Supervisory Service on the 17th, the net profit of domestic banks in the first quarter of this year was 5.3 trillion won, a decrease of 1.7 trillion won (24.1%) compared to 700 billion won in the same period last year.

By type of bank, the net profit of commercial banks in the first quarter of this year was 2.8 trillion won, down 800 billion won (21.4%) from the same period last year. During the same period, the net profit of regional banks was 500 billion won, down 10 billion won (2.6%), and the net profit of internet banks was 180 billion won, up 100 billion won (109.7%). In the case of special banks, the net profit in the first quarter of this year was 1.9 trillion won, a sharp decrease of 1 trillion won (34.7%) compared to the same period last year.

The performance of domestic banks was hampered by ELS compensation payments. In the first quarter of this year, domestic banks recorded 2.2 trillion won in non-operating losses, of which 1.8 trillion won was ELS compensation payments. Selling and administrative expenses were 6.4 trillion won, an increase of 200 billion won (2.7%) compared to 6.2 trillion won in the same period last year. Compared to the previous year, labor costs (salaries, retirement benefits, etc.) increased by 100 billion won, and material costs (rent, research expenses, etc.) increased by 40 billion won.

Interest income was 14.9 trillion won, an increase of 200 billion won (1.6%) compared to 14.7 trillion won in the same period last year. This was due to a 3.3% increase in interest-earning assets during the same period. The net interest margin (NIM) contracted by 0.05 percentage points.

Non-interest income was 1.7 trillion won, down 400 billion won (19.3%) from 2.1 trillion won in the same period last year. This was due to a 1 trillion won decrease in securities-related gains, such as gains on securities valuation, caused by rising market interest rates compared to the same period last year.

The return on assets (ROA) was 0.57%, down 0.22 percentage points from 0.79% in the same period last year. The return on equity (ROE) was 7.79%, down 3.26 percentage points from 11.05% in the same period last year.

Loan loss provisions were 1.1 trillion won, down 600 billion won (34.6%) from 1.7 trillion won in the same period last year. The decrease in loan loss provisions is explained by the Financial Supervisory Service as a base effect due to a significant increase in loan loss reserves in the first quarter of last year in preparation for economic uncertainty. Additionally, in the first quarter of this year, a reserve reversal of about 400 billion won related to Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering) was recorded.

An official from the Financial Supervisory Service stated, "Although a solid level of interest income continues, ELS compensation payments acted as a factor reducing net profit," adding, "We will continue to encourage the expansion of loss absorption capacity through sufficient provisioning of loan loss reserves so that banks can faithfully perform their fundamental function of financial intermediation even in the event of unexpected risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)