'Semiconductor Leader' Nvidia Earnings Announcement Imminent

Caution: Market Outlook for Second Half May Change if Results Fall Short of Expectations

Market attention is focused on Nvidia's earnings announcement next week. It is believed that this will have a greater impact on the current market direction than the results of the U.S. Federal Open Market Committee (FOMC). Amid the accelerating AI competition among big tech companies, interest is centered on whether Nvidia will maintain its leading stock status by delivering earnings that exceed expectations. Some analysts suggest that Nvidia's growth may slow down, potentially leading to a reshuffling of the stocks driving the market.

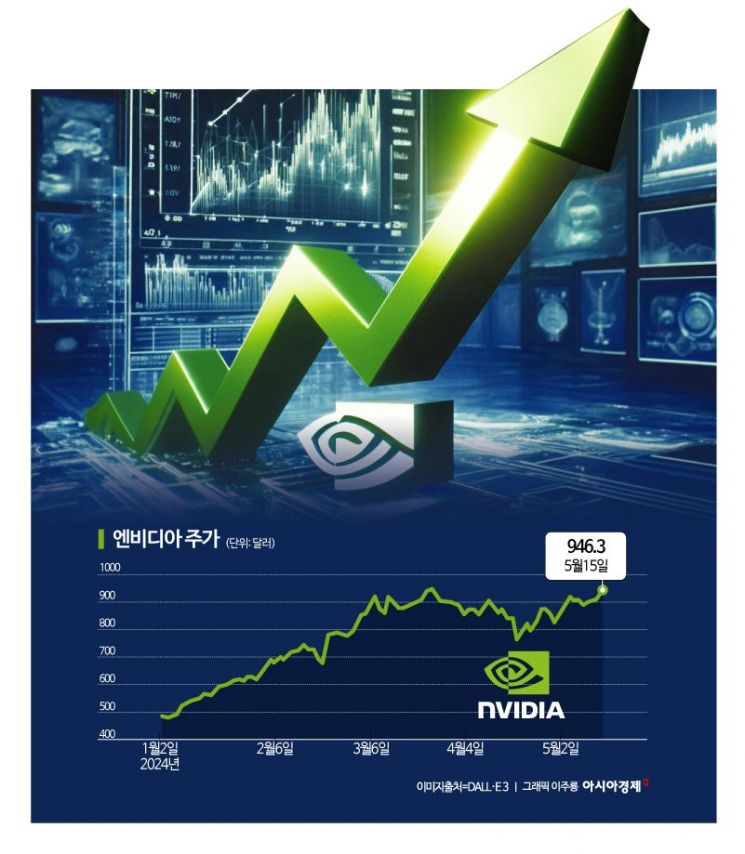

According to the financial investment industry on the 17th, Nvidia, the leading AI semiconductor stock, closed at $946.30 on the 15th (local time), up 3.6% from the previous day. This price is just 0.4% below the all-time high of $950.02 reached in March.

The enthusiasm for AI, which has propelled Nvidia as a leading stock, shows no signs of cooling. On the 13th, OpenAI, the developer of ChatGPT, announced GPT-4o, an upgraded AI model capable of natural, human-like conversations. This announcement has intensified AI competition among big tech companies such as Microsoft and Google. Consequently, the proportion of AI servers in Nvidia's total sales is expected to increase from 20% last year to over 50% this year.

In the securities industry, Nvidia's earnings are seen as a more critical variable for the current market direction than the U.S. FOMC results. Sung-hwan Kim, a researcher at Shinhan Investment Corp., stated, "Based on market expectations, the gap between leading and non-leading stocks is likely to narrow gradually, but earnings upgrades are expected to be concentrated only in leading stocks." He explained, "Leading stocks do not easily relinquish their dominance in a bull market, and a change in leading stocks occurs only after a bear market caused by a recession or earnings collapse." He added, "Since AI-related sectors accounted for 60% of the S&P 500's earnings growth over the past year, if their earnings expectations collapse, we should first worry about the arrival of a bear market rather than a change in leading stocks." While some express concerns about Nvidia's earnings peaking, he noted that the capital expenditure (CAPEX) guidance upgrades from global big tech and other AI buyers remain positive. He predicted, "After a smooth earnings announcement, the market will return to an upward trend centered on existing leading stocks."

If Nvidia continues to play the role of a leading stock, interest in domestic companies belonging to the high-bandwidth memory (HBM) value chain is expected to persist. So-jeong Lim, a researcher at Eugene Investment & Securities, said, "High-performance computing (HPC), AI, and data centers equipped with HBM remain key market drivers." She added, "Competition among companies to supply HBM3E to Nvidia is particularly active." She further emphasized, "It is necessary to pay attention to companies involved in front-end equipment for through-silicon via (TSV) bonding or inspection and measurement, as well as those attempting to localize the HBM EDS (Electronical Die Sorting) test process for probe card quality testing." Considering companies that may newly enter this area, she mentioned Oros Technology, Jusung Engineering, Wonik IPS, PMT, Microtuna, and TSE.

On the other hand, there are opinions that Nvidia's rise, which plays an infrastructure role in this AI semiconductor cycle, may slow down, and growth may come from hardware utilizing generative AI. Seung-young Park, a researcher at Hanwha Investment & Securities, analyzed, "It is questionable whether the capital expenditures of big tech companies, which are likely to be linked to Nvidia's stock price, can continue at the rapid pace seen over the past year." He noted, "The capital expenditure growth rates of Microsoft, Google, Meta, and Amazon declined in the first quarter, suggesting that investments may slow down in the second half of this year." He added, "Now, hardware is needed to further increase AI penetration." He recommended, "Attention should be paid to domestic value chains related to wearables, autonomous driving, and robotics, as well as companies like Apple and Tesla that produce devices capable of on-device AI."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.