16% Increase from Previous Quarter, 52% Rise Compared to Last Year

M7 Holdings Up by at Least 5% Each Over One Year

41 Stocks Newly Added in Large Numbers in Q1

The asset value of the National Pension Service's (NPS) direct investment in U.S. stocks has surpassed 100 trillion won for the first time in history. It has increased by more than 50% in just one year. The stock with the highest holding ratio also changed to Microsoft (MS) for the first time.

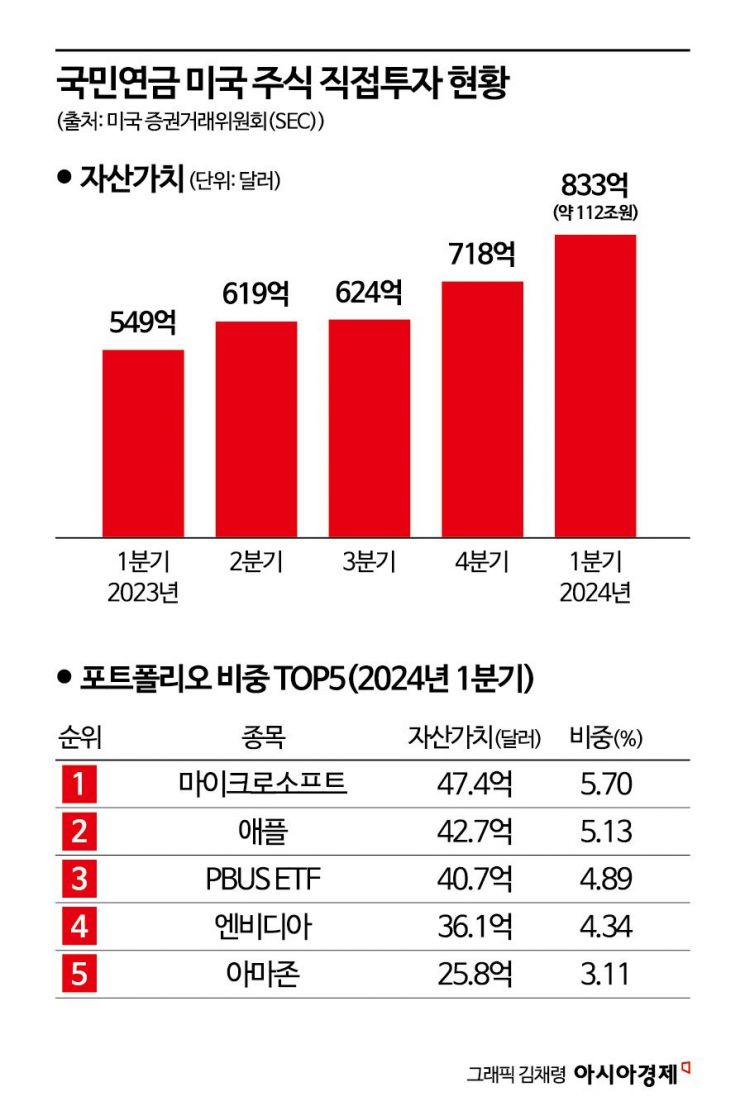

According to the NPS's first-quarter 13F filing (disclosure of institutional investors holding more than $100 million) submitted to the U.S. Securities and Exchange Commission (SEC) on the 17th, the asset value of NPS's direct investment in U.S. stocks at the end of the first quarter was $83.3 billion (approximately 112 trillion won). This marked the fourth consecutive quarter of record highs. Compared to $54.9 billion (approximately 74 trillion won) a year ago, it increased by about 38 trillion won (52%). Compared to the previous quarter ($71.8 billion, approximately 97 trillion won), it grew by about 15 trillion won (16%).

MS, First Time as Largest Holding... Nvidia Moves from 5th to 4th

The significant increase in asset value is due to the bullish U.S. stock market and active buying. From the end of March 2023 to the end of March 2024, the Dow Jones Industrial Average rose 20%, the S&P 500 increased 28%, and the Nasdaq index climbed 34%. During this period, the NPS focused on buying the 'Magnificent 7 (M7, Apple, Microsoft, Google Alphabet, Amazon, Nvidia, Meta, Tesla),' which led the market rally, thereby growing its assets. The holdings of Microsoft (MS), Nvidia, Amazon, and Tesla increased by more than 10% over the year. Apple, Meta, and Google also grew by more than 5% each.

In the first quarter of this year, the NPS increased its holdings in all M7 stocks. Among them, Apple had the smallest increase at 1.6%, while Tesla had the largest increase at 2.58%. The net purchase volume for each stock did not differ significantly.

However, due to the differing stock price performances, the portfolio rankings changed. In terms of asset proportion, MS (5.70%) surpassed Apple (5.13%) to become the largest holding stock for the first time. Apple's stock price fell 11% compared to the previous quarter, while MS rose 12%. This is the first time MS has ranked first since the NPS began disclosing SEC data in the third quarter of 2014. Apple held the top spot for 30 consecutive quarters from the third quarter of 2016 to the fourth quarter of last year. Nvidia (4.34%), which rose 82% during the same period ($495 → $903), moved up from 5th to 4th place, overtaking Amazon (3.11%), which dropped one rank. The 3rd place is held by the PBUS Exchange-Traded Fund (ETF), which tracks the Morgan Stanley Capital International (MSCI) U.S. Index and the S&P 500 Index.

New Inclusions such as Linde PLC and Accenture... Slight Increase in IT Proportion

There were 41 newly included stocks in the first quarter. The stock with the largest purchase amount by valuation was Linde PLC, with $382.56 million bought. It is the world's largest industrial gas company. Next was the management consulting firm Accenture, with $379.02 million purchased. Additionally, over $100 million each was bought in Medtronic, the global leader in medical devices; Chubb Limited, a property and casualty insurer; NXP Semiconductors, an automotive semiconductor company; and Aon, an insurance brokerage firm. Sector-wise, changes in proportions were minimal. IT remained the largest sector at 28.56%, slightly up from 28.27% in the previous quarter. Financials (18.68%) and healthcare (10.69%) followed.

Meanwhile, the total overseas stock asset value as of the end of February, recently disclosed on the NPS website, is 351 trillion won. This amount includes direct investments, entrusted management, and holdings of foreign stocks other than those in the U.S. The valuation of domestic stock holdings is 147 trillion won. Since the fund's establishment in 1988 until last year, the average annual return for overseas stocks was 11.04%, while domestic stocks yielded 6.53%. Narrowing down to the recent three-year period (2021?2023), the 'period return' gap widened further, with overseas stocks at 11.96% and domestic stocks at 0.21%. The planned asset allocation for this year is 15.4% for domestic stocks and 33% for overseas stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)