Authorities Hold First Working Meeting on 'Syndicate Loan'... Participation from 10 Banks and Insurance Companies

Support Scale Gradually Expanded to 5 Trillion Won... Financial Institutions Must Finalize Contribution Amounts

Accelerated Preparations Ahead of 'PF New Evaluation Criteria' Application from June

Financial authorities are accelerating efforts to supply 'new money' to the real estate project financing (PF) market. With the goal of a smooth landing for the real estate PF market, they have announced new 'feasibility evaluation criteria' and plan to apply them immediately from June, aiming to quickly conduct practical discussions with related industries and address any shortcomings.

According to the financial sector on the 16th, financial authorities held the first practical meeting by inviting practitioners from 10 banks and insurance companies participating in the formation of a 1 trillion won syndicated loan, including the Korea Federation of Banks and the Life Insurance Association. This effectively launched a 'consultative body' right after the policy direction announcement containing the new feasibility evaluation criteria on the 13th.

The initial syndicated loan of 1 trillion won (up to 5 trillion won) will involve the five major commercial banks (Kookmin, Shinhan, Hana, Woori, NongHyup) and the five major insurance companies (Samsung, Hanwha Life, Meritz, Samsung Fire & Marine, DB Insurance). Since the feasibility evaluation of real estate PF projects nationwide, worth approximately 230 trillion won, is scheduled for June, and based on the evaluation results, projects requiring urgent restructuring or disposition through auctions and sales will enter the market, it is necessary to finalize each financial institution's contribution and complete preparatory steps for execution.

To this end, financial authorities, banks, and insurance companies have agreed to hold weekly practical consultations going forward. Since support will be provided in three types?auction loan financing, NPL (non-performing loan) purchase support, and temporary liquidity crisis support?depending on borrower types such as developers and NPL specialized investment companies, as well as the purpose of funds, more detailed demand forecasting is required. A financial authority official explained, "Following the recently announced real estate PF policy direction, we held practical consultations aiming to activate the syndicated loan in June," adding, "We plan to review more detailed composition plans and procedures."

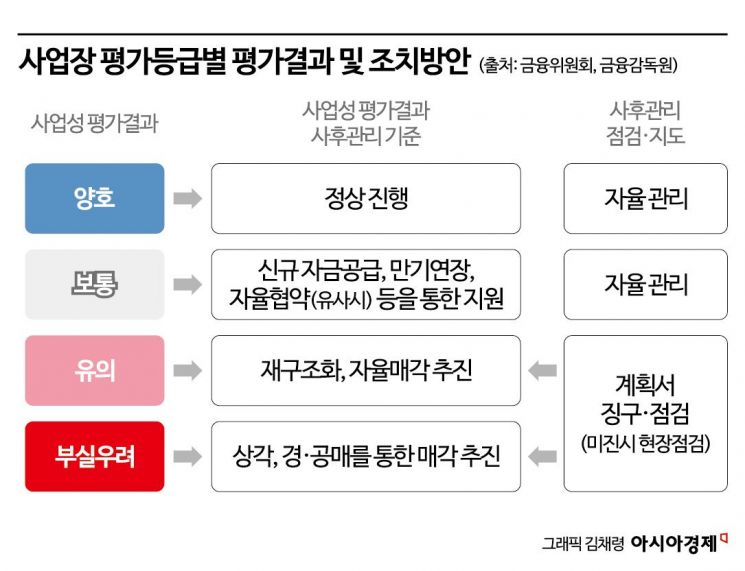

The newly established feasibility evaluation procedure will commence in June. Financial institutions will first conduct feasibility evaluations and submit them to the Financial Supervisory Service (FSS), which will review the results in July and conduct on-site inspections if necessary. Based on this, in August, the FSS and financial institutions will adjust the evaluation results, after which financial institutions must immediately proceed with restructuring, voluntary sales, write-offs, and auctions for projects rated as cautionary or at risk of default.

Feasibility evaluations will be conducted quarterly, with the initial June evaluation targeting delinquent projects and those that have extended maturity three or more times. Financial authorities plan to gradually expand the scope of feasibility evaluations quarterly according to PF maturity schedules. The syndicated loans being formed will first be allocated to PF projects selected for disposition and auction, while normal projects will be selectively included.

Meanwhile, financial authorities plan to meet next week with related ministries including the Ministry of Land, Infrastructure and Transport, as well as the construction industry, to share the policy direction again and discuss measures to address any shortcomings. Previously, financial authorities announced plans to operate a joint task force (TF) involving related agencies, the financial sector, and the construction industry to prevent instability in real estate PF and regularly monitor and supplement progress.

Regarding the impact of this policy direction on the construction industry, Kwon Dae-young, Secretary General of the Financial Services Commission, stated, "With the improvement of the feasibility evaluation criteria, most projects lacking new feasibility are expected to be bridge loans and land-secured loan projects, so the burden on construction companies will be limited," adding, "We will maintain ongoing communication with the construction industry and identify and implement any necessary additional measures."

Kwon Dae-young, Secretary General of the Financial Services Commission, is announcing the future policy direction for an orderly soft landing of real estate PF at the Government Seoul Office in Jongno-gu, Seoul on the 13th. Photo by Jo Yong-jun jun21@

Kwon Dae-young, Secretary General of the Financial Services Commission, is announcing the future policy direction for an orderly soft landing of real estate PF at the Government Seoul Office in Jongno-gu, Seoul on the 13th. Photo by Jo Yong-jun jun21@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)