Considered Likely Sale but Faced Obstacles

Not Easy to Transfer All Shares

Overseas Business Also Dominated by Line Yahoo

Naver's plan to sell its stake in Line Yahoo is wavering. With the South Korean government and political circles effectively putting the brakes on the sale, Naver now faces a situation where it must reconsider the stake sale itself. Initially, Naver had been contemplating selling under favorable conditions by keeping the option open, but now finds itself in a difficult position.

Government Effectively Opposes Sale

On the 14th, a senior government official told Asia Economy in a phone interview, "If Naver sells its stake in Line Yahoo, there is nothing the government can intervene in or assist with, but if they decide not to sell, we will support them." This promise of support on the assumption that Naver would not proceed with the sale is interpreted as an effective opposition to the sale.

With the government putting the brakes on the Line sale, it is assessed that Naver is now in a position where it is burdensome to make a sudden decision to sell. The day before, Sung Tae-yoon, the Policy Chief of the Presidential Office, urged a decision excluding the stake sale during a briefing, saying, "If Naver has any additional positions, the government will provide all possible support."

With even the Presidential Office stepping in, Naver finds itself caught between the Japanese government urging it to sell its stake and the South Korean government opposing it, leaving the company unable to act decisively. Although the stake sale was seriously considered as part of a broader overseas business restructuring, the issue has now returned to square one. Regardless of Naver's intentions, the sale issue has leaked, leading to criticism about communication problems with the government.

The Naver labor union also clearly opposed the sale. In a statement released the day before, the union said, "Protecting the Line group members and the technology and know-how they have accumulated is the top priority," adding, "The best choice to protect them is not to sell the stake." As a publicly listed company, shareholders must also be considered. Lee Yong-woo, a member of the Democratic Party of Korea and former co-CEO of KakaoBank, pointed out, "If Naver responds passively to this issue, it means failing to take measures to prevent shareholder value decline," warning, "They could face shareholder lawsuits for breach of fiduciary duty."

Looking back to square one, Naver has the option to focus on strengthening information protection measures, such as addressing the initial problem of personal information leakage, instead of selling its stake. Professor Hosaka Yuji of Sejong University's Department of Liberal Arts predicted, "Since the information leakage occurred not at Naver's headquarters but at its subsidiary Naver Cloud, if only Naver Cloud Japan is taken over by Japan, the problem can be resolved without selling the stake."

Global Business Restructuring ‘One Mountain After Another’

However, there is also analysis that Naver still insists on the sale. Regarding the announcements from the Presidential Office and the government the day before, Naver maintained its position, stating, "We will prioritize increasing corporate value in the mid-to-long term and make important decisions accordingly." This stance is unchanged from the official position released last week. Because of this, the interpretation that Naver is focusing on preparing a stake sale strategy rather than communicating with the government gains credibility.

If the sale proceeds, it is unlikely to end with transferring just 1% of the shares. Naver and SoftBank each hold half of the shares in A Holdings, the major shareholder of Line Yahoo, so even transferring just 1% would give majority control. Regarding this, Junichi Miyakawa, CEO of SoftBank, said, "We are keeping various possibilities open from 1% to 100%," adding, "If expanded to 100%, various strategies can be considered, but if it is around 51 to 49, almost nothing will change."

However, it is expected to be difficult to transfer all shares. Including the management premium, Line's valuation is estimated to exceed 10 trillion won. Currently, SoftBank's cash and cash equivalents amount to about 17 trillion won, so acquiring all of Line Yahoo could be a financial burden. CEO Miyakawa also said, "There is a size we can enter," and "We will do it within a range that does not affect other businesses and is commensurate with the investment." This is interpreted as a sign that SoftBank will not overextend itself or lose bargaining power to secure most of the shares.

Will Southeast Asian Business Be Protected?

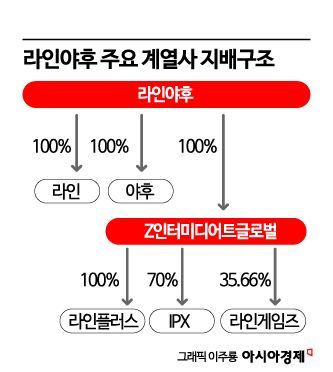

If only part of the stake is sold, the best option for Naver might be to separate the Japanese business while retaining other global businesses. However, this is also difficult because overseas businesses outside Japan are controlled by Line Yahoo. Line Yahoo owns 100% of the shares of the intermediate holding company Z Intermediate Global, which in turn owns 100% of Line Plus, responsible for Line's overseas businesses. Line Plus has subsidiaries operating online and mobile services in Indonesia, Vietnam, Taiwan, and other countries. Moreover, Naver and Line Yahoo also share ownership of Webtoon Entertainment, a U.S. corporation overseeing the webtoon business, so if capital relationships become tangled, the entire global business could be destabilized.

Even if overseas businesses are separated, since most services have succeeded under the Line brand, trademark issues must be resolved. Apart from business separation, technology license fees could be charged in exchange for transferring part of the stake, but since SoftBank has announced plans to pursue technological independence, it is unlikely to be a long-term arrangement.

Professor Hwang Yong-sik of Sejong University's Department of Business Administration said, "Naver's muted voice in this situation can be seen as a strategy to secure practical benefits such as receiving a management premium and maintaining overseas businesses like those in Southeast Asia," emphasizing, "Ultimately, minimizing losses depends on Naver's exit plan and bargaining power."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)