"He is back." "Here we go again~." The stock price of GameStop, a representative 'meme stock' in the US New York Stock Exchange, surged more than 70% on the 13th (local time). This happened as the investor 'Roaring Kitty,' who led the 'ant rebellion' against short sellers in 2021, reappeared after about three years. It is estimated that short sellers suffered losses approaching $1 billion in a single day due to the GameStop surge.

On that day, GameStop closed at $30.45 per share, up 74.4% from the previous close on the New York Stock Exchange. During the session, GameStop's stock price surpassed the $38 mark, and trading was halted several times due to extreme volatility. Another meme stock, AMC Entertainment, also closed up 78.4% at $5.19. Reddit, which was the gathering place for retail investors during the previous GameStop incident, saw its stock price rise about 9%.

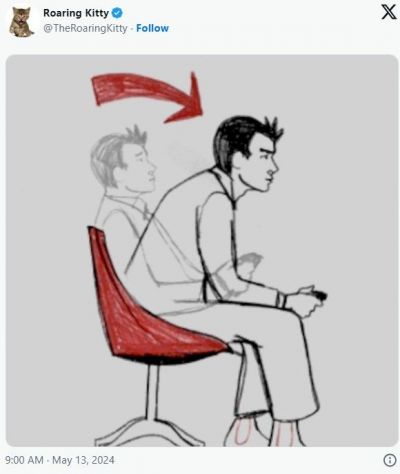

Why Did One Image Cause GameStop's Stock Price to Surge?

The surge in these meme stocks was driven by a post on X (formerly Twitter). An image was posted on the account of Keith Gill (account name Roaring Kitty), the 'leader ant' who led the 2021 GameStop incident. The image showed a man holding a game joystick, comfortably leaning back in a chair, then straightening his upper body with a serious expression as if saying he was going to do it properly from now on. CNN, citing the website NoYourMeme that tracks internet trends, reported that it "signifies when things get serious."

When a new image appeared on his account, which had been inactive since June 2021, followers went wild saying, "Roaring Kitty is back." Such enthusiastic responses from retail investors immediately led to concentrated buying of GameStop and AMC stocks. The image on X surpassed 20 million views. Afterward, Gill continued to post video tweets containing drama lines such as "It's going to be a busy few weeks, brother."

Is the GameStop Incident Resuming?

Currently, Wall Street is flooded with analyses suggesting that the so-called 'GameStop incident,' which heated up the New York Stock Exchange in 2021, might be resuming. The Reddit stock discussion forum, upon confirming Roaring Kitty's reappearance, is buzzing with posts and comments like "I have $100,000 and am ready to take all risks" and "Here we go again." Kevin Gordon, Chief Investment Strategist at Charles Schwab, said, "It shows that stock worship still exists," describing the atmosphere.

The past GameStop incident began in 2021 when individual investors united mainly through Reddit's stock discussion forum to buy GameStop shares intensively against Wall Street institutional investors' short selling. Keith Gill, known by the account name Roaring Kitty, promoted the GameStop buying campaign through Reddit and YouTube channels, mentioning the high short interest ratio of GameStop and the resulting hedge fund short squeeze prospects.

During 2021, GameStop's stock price surged by a staggering 2400%. Not only GameStop but also AMC and Bed Bath & Beyond led a meme stock boom. Melvin Capital, which shorted GameStop stock, suffered huge losses and liquidated its fund. This incident was also made into the movie "Dumb Money."

"Short Sellers Face $1 Billion Loss Due to Massive Rally"

Due to the massive rally of GameStop on this day, short sellers are estimated to have already suffered losses approaching $1 billion. Economic media CNBC reported, citing data from S3 Partners, that the total short selling losses in May, including losses on this day, reached $1.24 billion. Aiho Dusanisiki, Managing Director at S3 Partners, advised cautious investment, saying, "GameStop stock prices above $30 per share are attractive for new short selling entries." GameStop still has a high short interest ratio, exceeding 24%.

Concerns have also been raised that this speculative meme stock craze could lead to unfavorable outcomes. Michael Pachter, an analyst at Wedbush, told CNBC, "I don't know the fundamental reason that can drive the stock price this high," pointing out that "GameStop is not in a position to make a profit." He added that GameStop's core business is declining and that losses this year alone will reach $100 million. Wedbush's target price for GameStop is $5.60, which is far below both the intraday high ($38.2) and the closing price ($30.45) on this day.

Economic media CNBC reported, "The renewed frenzy around GameStop is confusing Wall Street," adding, "Roaring Kitty's return triggered GameStop's remarkable rally. However, the speculative rally of an unprofitable company is likely to end badly again."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)