Indie Brand Boom... Kolmar & Cosmax 'Soar'

Amore & LG Household 'Prepare for Rebound'... North America & China Online Improve

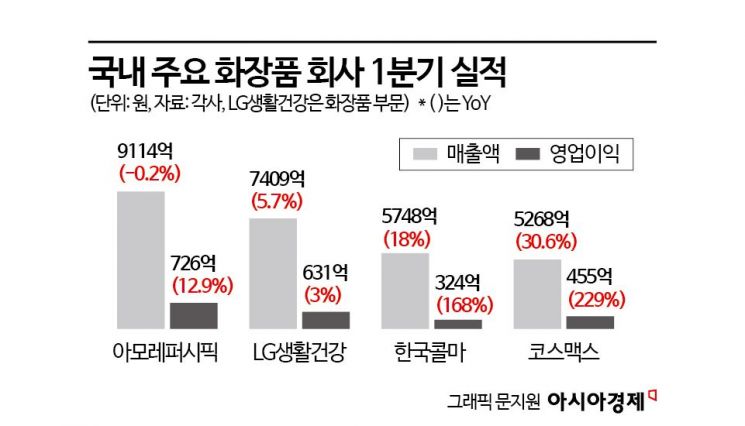

Major cosmetics companies recorded strong performances in the first quarter of this year. Original Equipment Manufacturer and Original Design Manufacturer (OEM·ODM) companies Korea Kolmar and Cosmax achieved record quarterly results as both domestic and overseas sales increased evenly. Amorepacific and LG Household & Health Care, which had poor results last year due to the consumption slump in China, showed profit growth, signaling a rebound.

According to the distribution industry on the 13th, OEM·ODM cosmetics companies Cosmax and Korea Kolmar recorded their highest quarterly sales ever in the first quarter. With significant sales growth, operating profits showed triple-digit growth rates. Cosmax, which announced its results on the day, posted first-quarter sales of 526.8 billion KRW and operating profit of 45.5 billion KRW, up 30.6% and 229% year-on-year, respectively. Earlier, Korea Kolmar reported sales of 574.8 billion KRW and operating profit of 32.4 billion KRW, growing 18% and 169% over the same period last year.

Boom in Cosmetics Manufacturers... Operating Profit Grows by Triple Digits

The strong performance of cosmetics manufacturers was driven by small and medium indie brands. More than 90% of the total sales of Cosmax and Korea Kolmar come from ODM, where they directly develop and produce indie brand products. As consumers increasingly purchase indie brand products at multi-brand shops (MBS) like Olive Young rather than from large cosmetics companies, the performance of cosmetics manufacturers has also risen accordingly.

The growing interest in K-beauty and foreign tourists seeking indie brands have also positively impacted performance. According to Olive Young, cumulative foreign sales at 60 global tourist district stores with a high proportion of foreign customers increased by 221% as of the 5th of this year.

Reflecting this, Cosmax's domestic market sales reached 351.4 billion KRW, and operating profit was 30.1 billion KRW, up 30% and 130% year-on-year, respectively. A Cosmax representative said, "Sales generated from foreigners visiting Korea increased," adding, "Indirect exports and direct exports performed well, driving the growth in results." Korea Kolmar recorded sales of 247.8 billion KRW, up 23%, and operating profit of 22.8 billion KRW, up 69%, during the same period.

The overseas market is expected to be a key area for future performance improvement. Manufacturers are strengthening local sales through subsidiaries established abroad. The first-quarter results also show improvement. Cosmax posted a 28% sales growth rate in the Chinese market, with sales also increasing in the U.S. (43%), Indonesia (26%), and Thailand (88%). Operating profit from four subsidiaries surged 877% year-on-year to 12.9 billion KRW from 1.3 billion KRW.

Korea Kolmar recorded an operating profit of 1.8 billion KRW at its Wuxi subsidiary in China, marking increases of 5% and 212% year-on-year, respectively. A Korea Kolmar representative said, "Major clients have expanded their product lineups, and new clients have increased," adding, "As sunscreen products enter their peak season, order volumes are expected to rise further."

Changed Atmosphere at Amorepacific and LG Household & Health Care... Targeting 'U.S.' and 'China'

LG Household & Health Care and Amorepacific, which faced difficulties last year due to the slump in the Chinese market, succeeded in improving profitability. Amorepacific recorded an operating profit of 72.6 billion KRW in the first quarter, a 13% increase year-on-year, while LG Household & Health Care's cosmetics division posted sales of 740.9 billion KRW and operating profit of 63.1 billion KRW, up 5.6% and 3.1%, respectively, compared to a year earlier. Operating profit turned positive for the first time in 10 quarters.

Amorepacific benefited domestically from diversifying the product lineups of 'Sulwhasoo' and 'Hera.' 'Laneige' and 'Aestura' saw increased sales at multi-brand shops (MBS). LG Household & Health Care leveraged the rebranding effect of 'The History of Whoo' in the Chinese online market, boosting Chinese cosmetics sales by 9%. Starting with the renewal of Hwanyu & Cheongidan in August last year, the company launched renewed products of Bicheop and Gongjinhyang in the first quarter of this year. According to the company, brand indicators on Tmall and Douyin channels showed triple-digit growth compared to the end of August last year.

The overseas market is a key area to watch for the future performance of both companies. Amorepacific is focusing on increasing sales mainly in the U.S. market. The company’s operating profit in the U.S. market in the first quarter was 87.8 billion KRW, a 40% increase compared to a year ago. Laneige (lip category) and Innisfree (suncare) are being promoted prominently, while Sulwhasoo is strengthening marketing in the luxury market.

For LG Household & Health Care, expanding the interest gained in the online market after the rebranding of The History of Whoo to duty-free shops and offline channels in the Chinese market has become important. An LG Household & Health Care representative explained, "We are expanding the Wanghong pool centered on the high-growth channel Douyin to strengthen collaboration," adding, "We are also expanding department store sampling events, VIP customer beauty classes, and spa service offerings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.