This Month, Holding Purpose Downgraded for 11 Stocks

General Investment Ratio Drops from 26.8% to 17.4% in Four Months

Subtle Shift in Atmosphere with 'Passive' Shareholder Rights Exercise

The National Pension Service (NPS) has downgraded the holding purpose of 11 stock items it holds from 'general investment' to 'simple investment' this month. Unlike general investment, simple investment is a passive form of investment that does not involve management participation. This marks another large-scale downgrade following 12 cases in March.

According to the Korea Exchange's disclosure system on the 11th, the NPS changed the holding purpose of a total of 11 stocks from general investment to simple investment from the 1st of this month to the 11th. These stocks are Samsung Fire & Marine Insurance, Korea Gas Corporation, GS Retail, Hanwha Ocean, Korean Reinsurance, Kumho Petrochemical, Wonik QnC, SeAH Besteel Holdings, Hanssem, IS Dongseo, and KEPCO Engineering & Construction. Among them, except for SeAH Besteel Holdings (7.11→7.40%) and Hanwha Ocean (5.01→5.54%), the shareholding ratios of the other nine stocks were also reduced. The stock with the largest decrease in shareholding ratio was Samsung Fire & Marine Insurance (7.5→6.8%).

29 Cases of General Investment → Simple Investment This Year

Institutional investors like the NPS are required by the Capital Markets Act to disclose the holding purpose for stocks where they hold more than 5% of shares. The holding purposes are divided into three levels according to the scope of shareholder rights exercise: simple investment, general investment, and management participation. General investment allows demands such as amendments to the articles of incorporation, remuneration determination, and dividend increases. Simple investment does not permit such actions. Only profit realization and voting rights on shareholders' meeting agendas are possible. Management participation is the most active form of investment, involving influence over corporate governance by participating in the appointment and dismissal of executives.

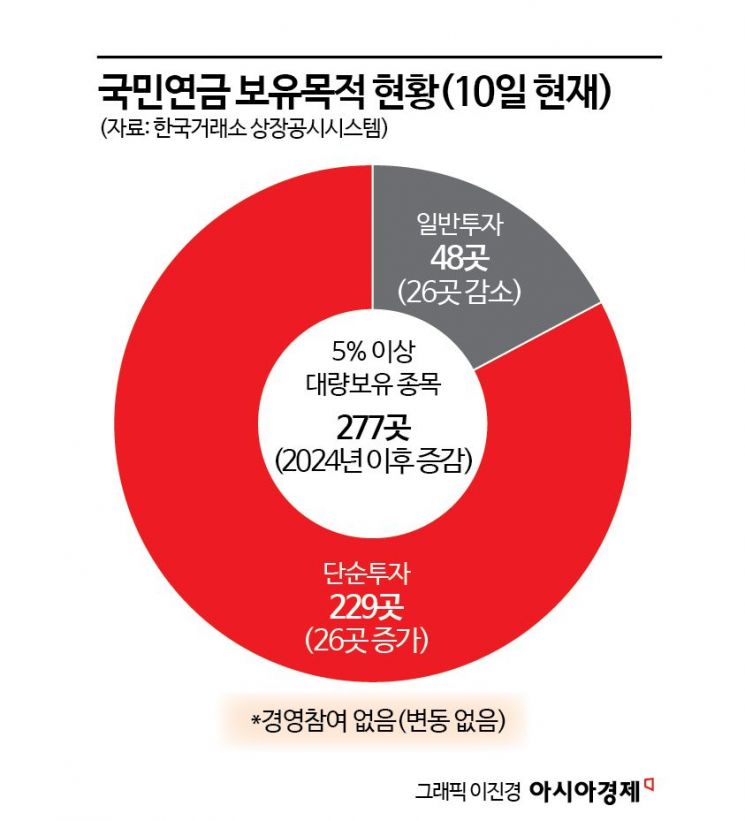

When changing the holding purpose, disclosure must be made within five business days. Currently, among 277 stocks with large holdings, 48 have a holding purpose of general investment, and 229 are simple investment. This year, simple investment increased by 26 cases, while general investment decreased by the same amount. There were only three cases of upgrading from simple investment to general investment. Conversely, 29 cases were downgraded from general investment to simple investment. Starting with five cases in January, 12 in March, one in April, and 11 in May (as of the 11th).

A Shift Toward 'Passive' Shareholder Rights Exercise

Coincidentally, the NPS took action after the 'Value-Up 2nd Seminar (May 2)'. This has led to interpretations that the NPS might be focusing more on capital gains rather than active shareholder rights exercise following the Value-Up measures. Regarding this, Moon Sung, a former head of the NPS shareholder rights exercise team and a lawyer at Yulchon LLC, said, "Linking this to the Value-Up measures is an excessive speculation," adding, "There is a mechanical process in place that automatically adjusts the holding purpose if no actions such as sending official letters to the company occur for about a year."

However, Lawyer Moon said, "If the proportion of simple investment has increased compared to the past and the proportion of general investment has decreased, it can be seen that the NPS is becoming more passive in exercising shareholder rights." At the end of last year, the ratio of simple investment to general investment was 73.2% to 26.8%, respectively. About four months later, the gap widened to 82.6% for simple investment and 17.4% for general investment. Two years ago, the NPS sometimes upgraded more than 10 companies to general investment within a month, but now a subtle change in atmosphere is being detected in its approach.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)