Han & Company Selected as National Pension Fund's First Entrusted Asset Manager

Strategy Shift from Overseas to Domestic Fundraising

UCK Partners, Newly Entering Top 10, Also Noted for Aggressive Investment

Hanwha & Company, a domestic private equity fund (PEF) management firm, ranked first in fund commitment amount for the second consecutive year. The committed capital increased by approximately KRW 2.6 trillion compared to the year before last.

According to the Financial Supervisory Service's 'Status of Institutional Private Collective Investment Vehicles' as of the end of last year, Hanwha & Company's total fund commitment amount was the highest among PEF management firms at KRW 13.6052 trillion.

Institutional private equity funds refer to large funds where only domestic and foreign institutional investors such as pension funds and financial companies can entrust their money. The commitment amount is the amount that limited partners (LPs), such as pension funds, have pledged to give to the general partner (GP) managing the fund, which indicates the scale of the private equity fund.

The general partner searches for investment targets and, when investment opportunities arise, receives the pledged amount from investors through a 'capital call' to make investments.

Hanwha & Company, ranked first by commitment amount, is known as a powerhouse in 'smokestack industries' due to its significant investments in manufacturing sectors such as cement, automotive parts, and shipping. Its major portfolio companies include Ssangyong C&E, K Car, SK Shipping, and Namyang Dairy Products. A senior official at Hanwha & Company explained the sharp increase in commitment amount by stating, "We believe it reflects the amount closed in the first closing of the 4th blind fund last year."

Until now, Hanwha & Company had raised blind funds with overseas investors' capital, but for the first time, it received commitments from domestic LPs in the currently raising 4th blind fund. As it has begun actively raising funds domestically, strategic changes are observed, including being selected as a private investment management firm for the National Pension Service for the first time.

MBK Partners ranked second with KRW 11.8413 trillion, an increase of KRW 1.1137 trillion from KRW 10.7276 trillion at the end of 2022. MBK, which receives investments from over 150 pension funds worldwide including the National Pension Service, holds a diverse portfolio of companies familiar to domestic consumers such as Homeplus, Lotte Card, BHC, NEPA, Modern House, and Osstem Implant.

Stick Investment ranked third with KRW 6.4757 trillion. Backed by ample capital, Stick has invested in various companies including Musicow, Juvis Diet, Lotte Energy Materials, and Orkestro. Notable companies in its portfolio also include Chaebi, an electric vehicle charging infrastructure company, and Coup Marketing, a mobile platform company.

IMM Private Equity and IMM Investment ranked fourth and fifth with KRW 6.4709 trillion and KRW 5.5879 trillion, respectively.

Within the IMM Investment Group, IMM PE and IMM Investment are separate corporate groups distinguished by holding companies, voting rights, boards of directors, and core investments. IMM PE, which focuses on large companies, has invested in various firms such as Hanssem, Missha, Airfirst, Genewon Science, and Megazone Cloud, achieving notable results. IMM Investment, which has nurtured companies like Celltrion, Krafton, Musinsa, and EcoPro, invests in various venture companies including Farmate, CrowdWorks, and MotionToAI.

Ranked sixth was Union Asset Management (UAMCO) with a commitment amount of KRW 3.4568 trillion, and seventh was Korea Development Bank with KRW 3.2657 trillion.

Significant ranking changes were observed in the 8th to 10th positions. UCK Partners newly entered the top 10, while Korea Investment Private Equity and SoftBank Ventures, which were in the top 10 at the end of 2022, fell out of the rankings.

Macquarie Asset Management ranked eighth with KRW 2.9398 trillion, VIG Partners ninth with KRW 2.6294 trillion, and UCK Partners tenth with KRW 2.5343 trillion.

Australian PEF Macquarie Asset Management was recently selected as a delegated manager for the National Pension Service. It is actively making moves, including appointing a Korean female executive as head of the PEF division, a first among foreign PEFs.

VIG Partners expanded its fund size due to its recently established 5th fund and credit fund. It is accelerating the sale of companies such as the funeral service company Freed Life, used car platform Reborn Car, and food ingredient distribution company Foodist.

UCK Partners, which stood out last year with the investment recovery of Medit, has attracted attention with active investments such as acquiring Osstem Implant, an implant manufacturer, in a consortium with MBK Partners, and purchasing 100% of the shares of Sulbing, a dessert cafe famous for shaved ice.

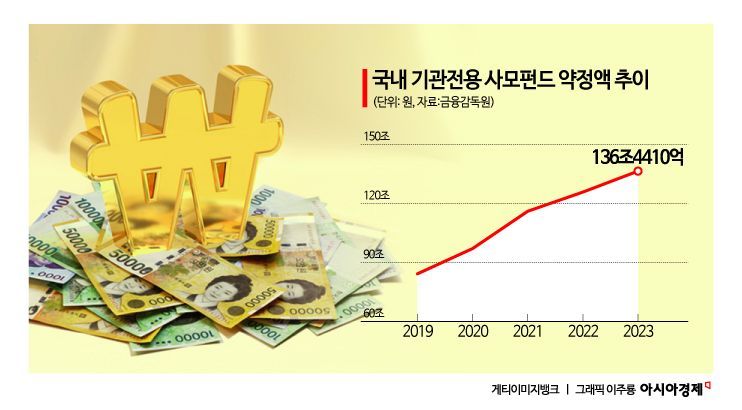

Meanwhile, the total commitment amount of PEFs at the end of last year was KRW 136.4411 trillion, an 8.5% increase compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)