Under Comprehensive Japan Public-Private Pressure

CEO Choi Su-yeon at One-on-One Negotiation Table

Interpretation of Naver Share Valuation Initiation

Naver and SoftBank CEOs sat at the negotiation table to discuss the sale of Line Yahoo shares. The CEOs of both companies engaged in one-on-one negotiations. This has been interpreted as Naver having effectively made internal arrangements to transfer its Line Yahoo shares.

According to the IT industry on the 10th, Naver CEO Choi Soo-yeon and SoftBank CEO Junichi Miyakawa recently engaged in one-on-one negotiations regarding the sale of Line Yahoo shares. At a performance announcement press conference the day before, CEO Miyakawa said, "We met yesterday trying to reach a conclusion by today, but no conclusion was reached," adding, "In discussions between CEOs, there is a shared recognition to 'resolve this somehow.'"

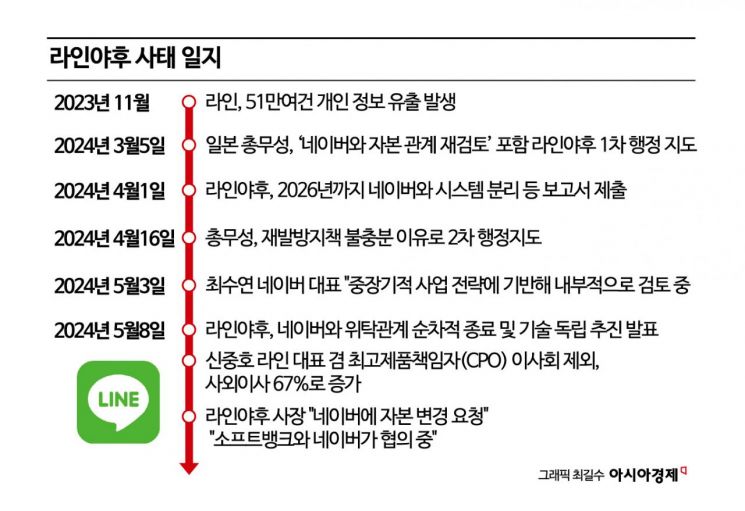

The CEOs' negotiations are evaluated as meaning that coordination between the two sides has moved beyond the stage of whether Naver will give up or keep its shares. Considering the increasing pressure from the Japanese government, Line Yahoo, and SoftBank as a triangular alliance regarding the sale of shares, it is highly likely that discussions with SoftBank will advance beyond the stage of Naver selling its shares to how much and under what conditions the shares held will be transferred. Regarding this, CEO Miyakawa also stated, "We are discussing adjustments to the shareholding relationship with Naver," and "We are keeping various possibilities open, from 1% (additional acquisition) to 100%." Naver responded by saying it is "under discussion," remaining extremely reserved.

The battle over how much of the shares to transfer appears even more difficult. The profit and loss of both companies vary greatly depending on how the shares are valued. As of the closing price on the 9th, Line Yahoo's stock price was 362.6 yen. The total value of Naver's shares is about 8 trillion won. If all shares are transferred, SoftBank would have to pay about 8 trillion won. SoftBank said, "It is not an easy situation to reach a conclusion," but expressed the intention to finalize the matter by early July, the deadline for the Japanese Ministry of Internal Affairs and Communications' administrative guidance report.

The partnership between Naver and SoftBank is also evaluated as having developed an irreparable rift. The two companies began "half management" in 2019. In 2019, they decided to integrate the management of Line and Yahoo Japan and established A Holdings and Z Holdings in 2021 for this purpose.

Some analysts suggest that SoftBank had planned to fully take over Line's management from the moment it initiated the management integration. At that time, SoftBank Group Chairman Masayoshi Son, who exclusively supplied iPhones in Japan, took an interest in Line and proposed a joint venture. Line was a coveted killer application in SoftBank Group, which was expanding its platform business through mobile payment business expansion and online commerce company acquisitions.

Line is also a good card to reverse the current situation of the group. SoftBank Group posted a deficit of 1.708 trillion yen (about 15 trillion won) in fiscal year 2021 due to consecutive investment failures, followed by a net loss of 970.2 billion yen (about 8.5 trillion won) in fiscal year 2022. Moreover, as it is driving forward with artificial intelligence (AI) as a future growth engine, it is eager to secure data obtained through Line.

It also seems that Naver has added the judgment that it can operate independently even if it completely withdraws from Line. Most development is already handled by local Japanese personnel, and infrastructure management entrusted to Naver can be supported by SoftBank. SoftBank provides cloud and solution services for enterprises in the enterprise and distribution business sectors. Professor Lee Chang-beom of Dongguk University Graduate School of International Information Security said, "Since Naver has mainly operated centered on data centers, technical independence is not impossible."

Experts point to the Japanese government's behind-the-scenes support as the background for SoftBank's unabashed ambition. The Japanese government took the lead in pressuring the sale of shares in the form of administrative guidance. Then, suddenly stepping back, it stated that deciding the shareholding structure is a private sector matter. Avoiding escalation into a diplomatic issue between Korea and Japan, it naturally passed the baton to Line Yahoo and SoftBank. This suggests that the public and private sectors are moving as one according to a well-planned script from the start.

Professor Hosaka Yuji of Sejong University’s Department of Liberal Arts, a Japan expert, said, "The Japanese government is using the Line issue for political interests," adding, "Companies cannot ignore this government intention, and from SoftBank's perspective, gaining Line's management rights would bring enormous profits."

It is analyzed that the ruling Liberal Democratic Party of Japan, whose approval ratings have plummeted due to a slush fund scandal, is trying to turn the tide by linking the Line issue with national security. Additionally, public sentiment has developed that views platforms not as private corporate property but as public goods tied to national security. The recent US-China conflict over data sovereignty issues has also had an impact.

Professor Lee Chang-beom said, "(If Naver does not sell its shares) the government could stir up concerns about information security or cause local Line partners to distance themselves," diagnosing, "It is certainly a difficult situation for Naver."

The Korean government is still standing by. It says it can intervene only if requested by Naver and has stepped back. Ultimately, under the all-out pressure from Japan’s public and private sectors, Naver appears to be left alone. Some evaluate that it may be too late to intervene. Professor Kim Hyun-kyung of Seoul National University of Science and Technology’s Graduate School of IT Policy said, "Not only Korea but countries around the world are trying to intervene in companies operating overseas due to their own data issues," emphasizing, "This should not be seen simply as a business issue between companies but as an issue between countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.