Rapid Increase in Power Demand Due to AI Industry Growth

Nuclear Power Expected to Sustain Growth Contributing to Carbon Neutrality

Investment in nuclear power, which supplies carbon-free energy for ESG (environmental, social, and governance) management while responding to the rapidly increasing electricity demand due to the growth of the artificial intelligence (AI) industry, continues. The securities industry analyzes that attention should be paid to companies that can benefit from the future expansion of nuclear power generation, such as new nuclear power plant construction.

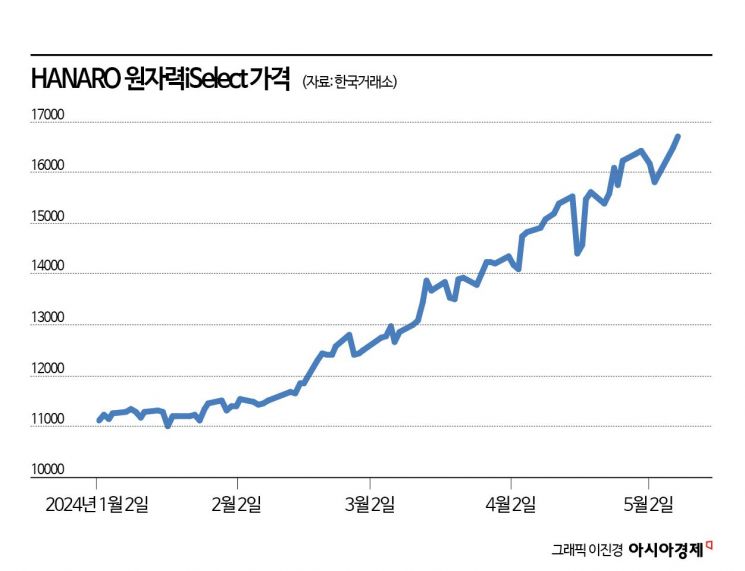

According to the Korea Exchange on the 9th, HANARO Nuclear iSelect, an exchange-traded fund (ETF) investing in the top 20 market capitalization stocks related to the nuclear industry, rose 50.18% year-to-date as of the closing price on the 8th, recording the highest return among ETFs investing in domestic stocks. In addition, ACE Nuclear Theme Deep Search rose 36.37%, and KBSTAR Global Nuclear iSelect increased 31.35%, showing that ETFs investing in the nuclear industry have all achieved good performance.

Demand for nuclear power has steadily increased over the past few years. After Russia invaded Ukraine in February 2022, dealing a blow to the energy supply chain, countries around the world began to change their previously maintained nuclear phase-out policies. Furthermore, as the AI industry requires massive amounts of energy, steady funding is flowing into the nuclear industry to ensure sufficient power supply.

Moreover, nuclear power is evaluated as competitive in ESG management because it is a power source that does not emit carbon. Unlike renewable energy, which has high variability in power supply depending on the weather, nuclear power has the advantage of providing stable supply 24 hours a day. Accordingly, on the 25th of last month, the European Union (EU) passed the Net Zero Industry Act (NZIA), including nuclear energy, such as small modular reactors (SMRs), in the list of carbon-neutral industries. Additionally, global big tech companies like Google and Microsoft have set goals to go beyond achieving carbon neutrality annually to supplying all electricity carbon-free in real time.

Se-yeon Park, a researcher at Hanwha Investment & Securities, explained, "Until just before the opening of the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) at the end of last year, the prevailing opinion worldwide was to reduce the share of nuclear power, but many agreed with the argument that expanding renewable energy, which has problems such as high interest rates, the burden of expanding transmission and distribution networks, and energy storage inefficiency, is not easy." She added, "The opinion that expanding the share of nuclear power, which can supply stable electricity, is the most realistic gained support." She further analyzed, "Financial institutions like the World Bank now have justification to support funding for nuclear power generation. To achieve the goal of tripling nuclear capacity by 2050, commercializing SMRs and continuing to operate decommissioned nuclear plants are alternatives."

Accordingly, the industry expects that Korean companies in the nuclear industry value chain will benefit. Min-jae Lee, a researcher at NH Investment & Securities, evaluated, "Doosan Enerbility has a possibility of winning a nuclear power plant order in the Czech Republic in the second half of the year," adding, "Amid the long-term expansion of electricity demand and restrictions on fossil fuel use for carbon neutrality, it is strengthening competitiveness as an SMR manufacturer." He also added, "In the domestic situation, there is a possibility that two or more new nuclear power plants will be included in the working draft of the 11th Basic Plan for Electricity Supply and Demand within this year."

Regarding Korea Electric Power Corporation KPS (KEPCO KPS), a power plant maintenance specialist company, Hye-jeong Jeong, a researcher at KB Securities, said, "Following Shin-Hanul Unit 1, which began commercial operation at the end of 2022, Shin-Hanul Unit 2 started operation last month, and Saeul Units 3 and 4 are scheduled to be sequentially operated by October 2025." She predicted, "With the continuous increase in nuclear power plant maintenance work and growing possibilities of new nuclear power plant orders domestically and internationally, stable revenue growth is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)