CMA Balance Hits 82.6 Trillion, Deposits Reach 56 Trillion

MMF Assets Increase by 6.7 Trillion in One Day to 207 Trillion

KOSPI Expected to Remain in Box Range Market

Funds hovering around the stock market are increasing. The scale of investor deposits, which can gauge investment enthusiasm, is decreasing, while the balance of Comprehensive Asset Management Accounts (CMA), which serve as standby funds for the stock market, is at an all-time high. This is interpreted as investors adopting a cautious stance due to ongoing uncertainty in U.S. interest rate policies and the absence of clear leading stocks following value-up and semiconductors.

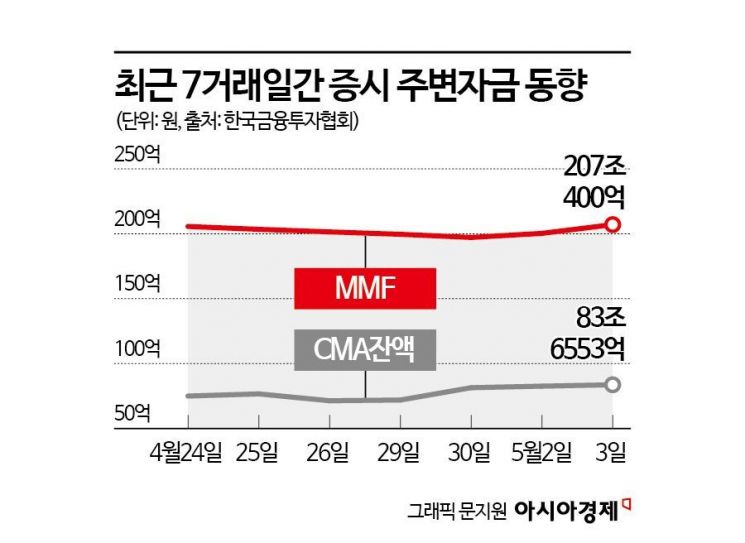

According to the Korea Financial Investment Association on the 8th, as of the 3rd, the balance of Comprehensive Asset Management Accounts (CMA) reached 82.6553 trillion won, marking the largest scale since statistics began in 2006. CMA accounts are accounts where securities firms invest customers' funds daily in financial products such as commercial paper (CP), government bonds, or money market funds (MMF), and return the earnings to investors. Funds can be freely deposited and withdrawn, and interest is earned even if money is held for just one day. For this reason, they are used as standby funds before investing.

At the beginning of this year, the CMA balance was 74.7813 trillion won, but it broke the record to 81.4164 trillion won at the end of April and has maintained around 80 trillion won for three consecutive trading days. An increase in CMA, considered standby funds for the stock market, can be interpreted in two ways: either funds are tied up because there are no suitable investment options, or investors are preparing to enter the stock market. Experts place more weight on the former given the recent market trends and environment.

Shin Su-yeon, team leader of NH Investment & Securities Premier Blue Samsung-dong Center, said, "The increase in ultra-short-term funds is best seen as a reflection of market watchfulness," adding, "Although May is traditionally sluggish, organic responses are needed depending on the financial environment of the year. This year, a certain proportion of cash is held while maintaining a buying perspective during market corrections."

The decrease in investor deposits also supports this interpretation. As of the 3rd, investor deposits stood at 55.9449 trillion won, down 4.84% from 58.7908 trillion won on the 2nd. More than 2.8 trillion won was withdrawn in a single day. Investor deposits refer to money entrusted to securities firms by investors for stock investments. Like CMA, they are classified as standby funds for the stock market. Typically, a decrease in investor deposits is interpreted as individual investors withdrawing from the stock market.

The amount set in short-term financial funds (MMF), another form of standby investment funds, also increased rapidly. On the 3rd, MMF assets reached 207.04 trillion won, up about 6.7 trillion won from 200.2874 trillion won the previous day. Uncertainty about the timing of interest rate cuts remains, and with no clear leading stocks after value-up and semiconductors, investors who have lost direction appear to be placing short-term funds in MMFs to respond to the market. Notably, the significant increase in funds such as CMA and MMF occurred around the 2nd, the day the draft of the value-up guidelines was released, suggesting that market disappointment with the value-up guidelines influenced this fund flow.

There is a prevailing forecast that the KOSPI will continue its 'Boxpi' trend in May. There are no clear leading stocks to drive the market. Accordingly, investors are expected to maintain a wait-and-see attitude for the time being. Lee Woong-chan, a researcher at Hi Investment & Securities, said, "There are no clear candidates for the next leading stocks after value-up, artificial intelligence (AI), and semiconductors, and it seems difficult for the index to surpass previous highs," adding, "The KOSPI is expected to show rapid rotation without leading stocks within a narrow box range of about 2,600 to 2,850 points, with 2,850 points?the previous high in dollar terms?as the upper limit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)