'Introduction of "Standard Portfolio" Enables Flexible Investment'

Claims "Seoul Office Also Needed" for Fund Personnel Management

"No Greater Sacrifice for Future Generations through Pension Reform"

"The existing alternative investments of the National Pension Service were largely limited to four areas: real estate, private equity, infrastructure, and hedge funds. Now, it is significant in that a systemic foundation has been established to diversify the portfolio."

When asked about the recently approved introduction of the 'standard portfolio' by the National Pension Fund Management Committee (Fund Committee), Lee Seuran, Director of the Pension Policy Bureau at the Ministry of Health and Welfare, explained it this way. It was introduced with the intention of eliminating the 'investment partition' by simplifying asset allocation combinations into risky assets and safe assets, moving away from the method of investing only in predetermined assets. The ratio of risky assets to safe assets is 65 to 35, and the standard portfolio will be applied starting next year in the alternative investment sector. This marks a major change in the National Pension's fund management system after 18 years.

Expectations for 'Investment Diversification'... "A Seoul Office Is Also Needed"

Lee Se-ran, Director of Pension Policy at the Ministry of Health and Welfare, is being interviewed on the 2nd at Seoul City Tower in Jung-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Lee Se-ran, Director of Pension Policy at the Ministry of Health and Welfare, is being interviewed on the 2nd at Seoul City Tower in Jung-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Director Lee illustrated the changed management system with the recent trend of 'building labs.' "Nowadays, many research institutes are being established in buildings. There is much debate about whether to classify them as real estate or labs. Under the existing system, alternative investments were limited, so investing in building labs was difficult, but now, as long as the proportions of risky and safe assets are considered, investment is fully possible." This means 'investment diversification' is expected. The same applies to other fields. "Even if you want to buy a lot of bonds from a specific country, previously you had to consider the already set proportions, but now you don't have to worry about that," Director Lee explained.

The introduction of the standard portfolio took about three years since the initial discussion began. Director Lee, who took office as the Director of the Pension Policy Bureau in August 2022, was deeply involved in this process. The Ministry of Health and Welfare is the department that manages and supervises the National Pension, and the Pension Policy Bureau Director is the practical control tower related to it. He is also an ex officio member of the Fund Committee. Overseeing basic pension and national pension policies and overall fund management, he is currently immersed in work, including the hottest topic of 'pension reform.' It was Director Lee who was entrusted with the important task of pension reform by the Yoon Seok-yeol administration two years ago.

The National Pension plans to open an office in San Francisco, USA, in July to strengthen its overseas and alternative investment capabilities. This will be the fourth overseas office after New York, London, and Singapore. Director Lee said, "Alternative investments require a lot of hands-on work, so I am somewhat worried whether the fund management headquarters staff can handle it well and whether their capabilities can keep up." Moreover, the National Pension has been experiencing continuous talent outflow. Since the decision to relocate to Jeonju in 2016, about 30 fund managers have resigned annually. Regarding this, Director Lee said, "We operate a smart work center with about 30 people, but there are many shortcomings," and added, "Just as there are overseas offices, it would be good to have a 'Seoul office' as well." Although the occasional suggestion of relocating the fund management headquarters to Seoul is difficult due to political controversy, he expressed the view that an office is necessary.

"Pension Reform That Increases Sacrifice of Future Generations Should Not Happen"

The recent issues of the National Pension are intertwined with macroeconomic factors. In April, when the exchange rate rose, the National Pension had already secured foreign currency for overseas investment through advance procurement. Director Lee said, "If we buy a lot of foreign currency, the market could fluctuate, and it would be expensive, so it is not easy to make contributions these days," adding, "If the exchange rate overshoots, we are prepared to respond in cooperation with the Bank of Korea." The National Pension has a currency swap agreement with the Bank of Korea worth $35 billion annually, and the strategic foreign exchange hedge ratio can be up to 10%. Although foreign exchange hedging is not usually used, if the won-dollar exchange rate worsens, it can convert 10% of its overseas assets, about $40 billion out of the current $400 billion, into won and engage in foreign exchange hedging. This would increase the supply of dollars and relatively lower the dollar's value. Although there are quite a few unfavorable opinions within the pension regarding the 'National Pension utilization theory,' Director Lee emphasized, "If necessary, we must cooperate with the foreign exchange authorities."

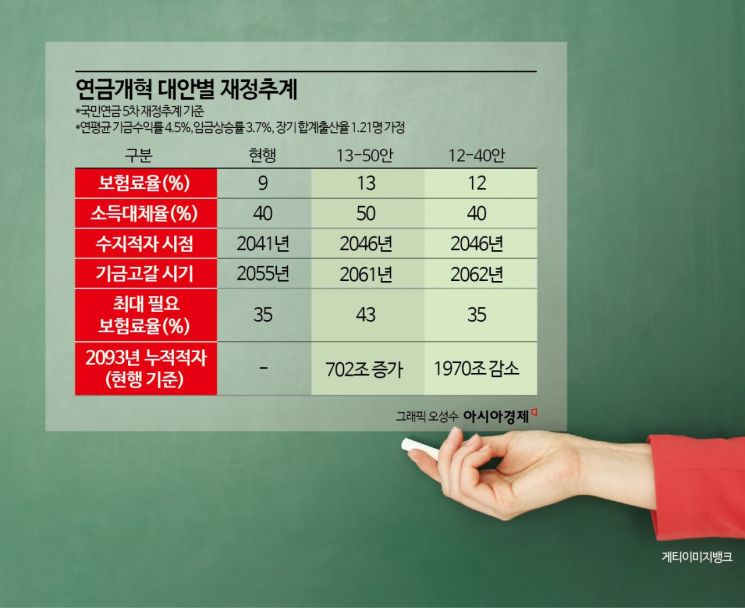

The ultimate goal of fund management is, after all, to extend the lifespan of the National Pension, which is the retirement fund for all citizens. The National Pension is heading toward a 'scheduled death.' Calculations based on the current contribution rate of 9% and income replacement rate of 40% show that the fund will turn to deficit from 2041 and be depleted by 2055. The '12-40 plan' (12% contribution rate, 40% income replacement rate) and '13-50 plan' (13% contribution rate, 50% income replacement rate) currently being discussed by the National Assembly's Pension Special Committee only delay the depletion by 6 to 7 years and lack fundamental structural reform. Moreover, the '13-50 plan' is expected to increase the deficit by 702 trillion won (as of 2093) compared to the current plan and require a maximum contribution rate of 43% (as of 2078). This is why there is cynical reaction, especially among younger generations, asking, "Is there no option to neither pay nor receive?"

Regarding this, Director Lee said, "When the National Pension was designed, it was not anticipated that our society's 'low birthrate and aging' would become this severe," and added, "There should not be pension reforms that force even greater sacrifices on future generations than now." He particularly criticized the '13-50 plan,' summarized as the 'income guarantee theory.' Regarding the discussion of 'public investment' of the fund during the public debate process, he said, "It is regrettable that there was no deep discussion on improving fund profitability," and criticized, "If profitability had been considered even a little, such talk would not have come up."

Finally, Director Lee said, "The current pension reform is meaningful in that it is close to entering double-digit contribution rates for the first time in 26 years since 1998, and we cannot expect to be satisfied at the first attempt," adding, "I sincerely hope the National Assembly will not be fixated on the two proposals currently on the table but reach an agreement that ensures the fairest possible burden sharing between generations."

▶ Lee Seuran, Director of the Pension Policy Bureau at the Ministry of Health and Welfare

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)