KB Financial Group and Shinhan Financial Group, continuing their competition as 'leading banks,' are drawing attention by showing different trends in 'corporate loans,' the biggest concern in the banking sector. Industry insiders attribute this to the differing responses of the two companies to the decline in capital ratios caused by incidents such as the Hong Kong H-Share Index (Hang Seng China Enterprises Index·HSCEI) based equity-linked securities (ELS) crisis.

According to the financial sector on the 3rd, corporate loans (large corporations, small and medium enterprises, and individual business owners) in Korean won loans of the four major commercial banks (KB, Shinhan, Hana, Woori) as of the end of the first quarter increased by about 16.9 trillion won compared to the end of the previous quarter. This far exceeds the increase in household loans (about 2.4 trillion won) of the four banks during the same period.

The banking sector is putting its life on corporate loans because profitability in the household loan sector, which was a traditional source of income, has significantly deteriorated due to the ongoing high-interest-rate environment and the resulting real estate market slump. Each bank has been actively responding by expanding related organizations and focusing on expanding corporate loans since the beginning of the year.

However, there is a considerable difference in loan volumes by bank. Shinhan Bank expanded corporate loans by about 6.3 trillion won in the first quarter alone, recording the highest growth rate. Large corporate loans increased by about 2.7 trillion won, showing the largest increase, followed by small and medium-sized corporations and individual business owners (about 3.6 trillion won).

On the other hand, KB Kookmin Bank, the largest domestic commercial bank, saw corporate loans increase by only 1.9 trillion won, ranking fourth. Large corporations increased by 900 billion won, small and medium enterprises by 400 billion won, and individual business owners by about 600 billion won, but the overall increase was less than that of Shinhan, as well as Hana Bank (4.6 trillion won) and Woori Bank (4.1 trillion won). This is while each company is putting its life on corporate loans to discover new sources of income.

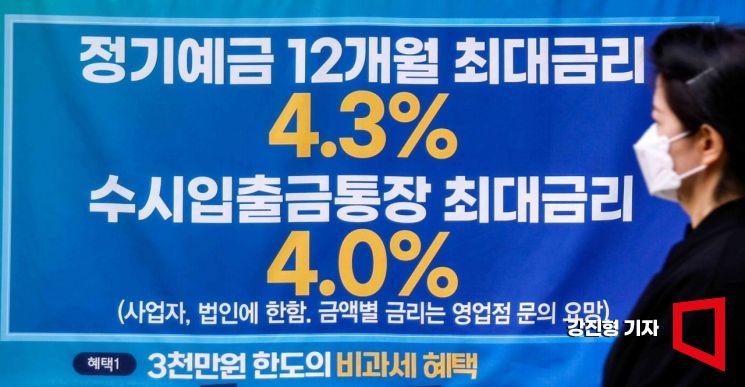

On the 4th, as loan interest rates fell and the interest rate spread between deposits and loans narrowed, a banner displaying deposit interest rates was posted on the exterior wall of a commercial bank in Seoul. Photo by Kang Jin-hyung aymsdream@

On the 4th, as loan interest rates fell and the interest rate spread between deposits and loans narrowed, a banner displaying deposit interest rates was posted on the exterior wall of a commercial bank in Seoul. Photo by Kang Jin-hyung aymsdream@

Industry insiders believe that the differing responses of the two companies regarding the 'Common Equity Tier 1 (CET1)' ratio caused these differences. CET1 refers to the ratio of a financial company's common equity capital to risk-weighted assets (RWA). RWA is calculated by summing credit, market, and operational risks. CET1 is an indicator that gauges a financial company's loss absorption capacity, and each company uses it as a benchmark for shareholder return policies.

The regulatory ratio set by financial authorities is 7%, but financial holding companies actually maintain levels around 12-13%. As of the end of the first quarter, KB Financial's CET1 fell by 19 basis points (1bp=0.01%) from the previous quarter to 13.40%, while Shinhan Financial's dropped by 4 basis points to 13.09%. Both companies maintained the 13% level, but the decline was larger for KB Financial.

This appears to stem from differences in the denominator, RWA. As of the end of the first quarter, KB Financial Group's RWA was 333.7536 trillion won, an increase of 12.4347 trillion won from the previous quarter. Shinhan Financial Group's RWA was 324.6542 trillion won, up 10.4735 trillion won.

Although both major holding companies saw RWA increase by over 10 trillion won, since KB's loan balance increased by only about 2 trillion won, it is reasonable to assume that the increase in operational RWA had a greater impact than credit RWA. Currently, provisions related to the Hong Kong ELS crisis amount to 862 billion won for KB Financial, about three times higher than Shinhan's 274 billion won. The financial authorities' discussions starting as early as this month on sanctions and fines related to the Hong Kong ELS may also increase operational RWA.

Shinhan Financial, which bears relatively less burden from the Hong Kong ELS, was able to expand corporate loans while partially accepting the decline in CET1 due to the rise in credit RWA. In contrast, KB Financial, which experienced a larger drop in CET1, is interpreted as being reluctant to increase credit RWA loans to maintain the ratio.

An official from the financial sector said, "If the obligations and roles of financial institutions include shareholder returns and fund intermediation functions, KB placed relatively more weight on the former, while Shinhan emphasized the latter," adding, "Since each company was in different situations, this is a natural flow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)