Increase in Financial Transaction Limits... Counter Transactions Up to 3 Million Won

Guidebook for Representative Supporting Documents by Financial Transaction Purpose Also Prepared

Procedure Simplified Using Public MyData to Verify Financial Transaction Purpose

#Full-time housewife A, residing in a provincial area, has been using a limited-transaction account since 2016 due to difficulties in submitting objective supporting documents for verifying the purpose of financial transactions. Last year, her child entered a university located in Seoul and started living independently, so she has been sending monthly rent payments. However, since mobile banking transfers were limited to 300,000 KRW per day, she had to split the transfers over several days, causing much inconvenience.

Starting from the 2nd, citizens like full-time housewife A who use limited-transaction accounts will be able to transfer up to 1,000,000 KRW per day via mobile banking, and transactions up to 3,000,000 KRW will be possible through bank counters. Despite the growth of the national economy since the introduction of limited-transaction accounts in 2016, the transaction limits have remained unchanged, causing inconvenience as citizens had to conduct transactions within limits set eight years ago.

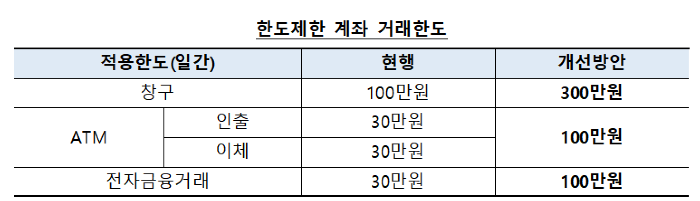

On the 1st, financial authorities announced improvements allowing customers with limited-transaction accounts to conduct transactions up to ▲1,000,000 KRW via internet banking ▲1,000,000 KRW via ATM ▲3,000,000 KRW at bank counters per day. The increased limits will be applied to existing limited-transaction accounts without customers needing to apply separately. Customers who do not agree to the blanket increase can apply separately at their bank to maintain the existing limits. Limited-transaction accounts were introduced for bank users who had difficulty opening deposit and withdrawal accounts due to inability to submit objective supporting documents verifying the purpose of financial transactions.

The banking sector determined the increased limits by comprehensively considering income level increases, comparisons with overseas cases, and average daily withdrawal and transfer amounts of deposit and withdrawal accounts, aiming to minimize public inconvenience while maintaining the purpose of eradicating fraudulent accounts. With the increased transaction limits of limited-transaction accounts, the inconveniences experienced by users during everyday financial transactions are expected to be greatly alleviated.

Clear guidance on representative supporting documents for each financial transaction purpose will also be provided through notices posted at bank counters and on internet websites. Although verification of supporting documents is required when opening deposit and withdrawal accounts or lifting limits on limited-transaction accounts, related documents were not properly communicated in advance, causing citizens to visit bank counters multiple times. Going forward, customers will be able to prepare the required documents in advance through these notices, significantly improving predictability.

However, since various cases may arise in verifying the purpose of financial transactions, customers may prepare other supporting documents beyond those listed in the notices, and banks may request additional documents necessary for verification. Also, required documents may vary depending on each bank’s business characteristics, so customers should check the notices posted on the bank’s internet website in advance.

To reduce inconvenience when citizens submit physical documents verifying the purpose of financial transactions, banks will simplify procedures by utilizing public MyData (personal credit information management services) and other means. Previously, citizens had to prepare and submit physical documents directly when opening deposit and withdrawal accounts or lifting limits on limited-transaction accounts, and if some required documents were missing, they had to visit government offices or bank counters multiple times, causing inconvenience. Going forward, if customers wish, banks will be able to automatically collect necessary information for verifying the purpose of financial transactions through a simple consent procedure, minimizing cases where physical documents must be submitted directly.

Sanctions on accounts used for fraud will be strengthened to continue efforts to eradicate fraudulent accounts. As the limited-transaction account system is relaxed, measures to prevent voice phishing damage will be reinforced proportionally. To prevent accounts used for fraud from being reused as fraudulent accounts, withdrawal and transfer limits on such accounts remain reduced even after the suspension of payments is lifted. In such cases, withdrawal and transfer limits will be applied as the previous financial transaction limits (▲internet banking 300,000 KRW ▲ATM 300,000 KRW ▲counter transactions 1,000,000 KRW).

Meanwhile, financial authorities expect that this improvement plan will enhance public convenience while maintaining the limited-transaction account system. The Financial Services Commission, Financial Supervisory Service, and banking industry will continuously monitor the implementation effects of this improvement plan. Additionally, secondary financial institutions such as agricultural cooperatives, fisheries cooperatives, forestry cooperatives, credit cooperatives, Saemaeul Geumgo, and the Korea Post will implement this improvement plan by August 28, the enforcement date of the amended Act on the Prevention of Telecommunications Fraud Damage Refunds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)