Emart and Lotte Mart Expected to Show Slight Performance Improvement

Effects of Leap Month, Increased Holidays, and Restructuring

Large discount stores, facing consumer downturn due to high inflation and e-commerce offensives, are expected to show slightly improved performance in the first quarter of this year. This is because there were more weekdays, holidays, and business days than last year, and the restructuring efforts steadily pursued since last year to improve profitability are showing results. Large discount stores plan to tighten the reins on performance recovery through promotional events in the second quarter, when outings become more frequent.

According to the large discount store industry on the 30th, Emart and Lotte Shopping are expected to announce their first-quarter results as early as next week. Both companies announced their first-quarter results on May 15 last year.

According to financial information firm FnGuide, Emart and Lotte Shopping’s first-quarter performance is expected to improve overall compared to the first quarter of last year. Emart’s first-quarter forecast is sales of 7.2836 trillion KRW and operating profit of 22.6 billion KRW. Compared to the same period last year, sales (7.1354 trillion KRW) increased by 2.08%, and operating profit (13.7 billion KRW) rose by 65.18%.

Lotte Shopping is expected to record first-quarter sales of 3.6542 trillion KRW and operating profit of 123.9 billion KRW. This also represents an increase of 2.6% in sales (3.5616 trillion KRW) and 10.12% in operating profit (112.5 billion KRW) compared to the same period last year.

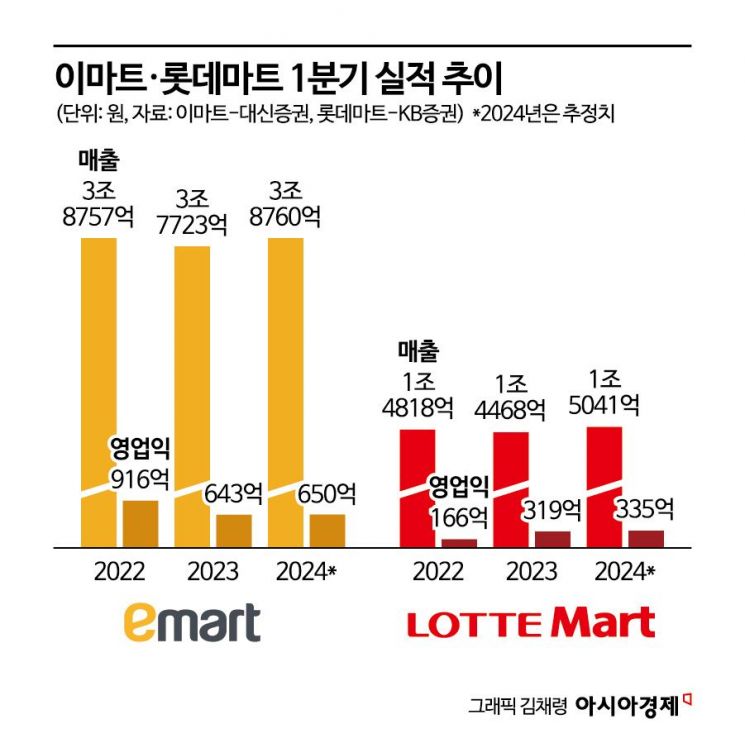

The performance of large discount stores is also expected to improve slightly. Daishin Securities forecast that Emart’s discount store segment will achieve first-quarter standalone sales of 3.876 trillion KRW, up 2.7% from 3.7723 trillion KRW in the same period last year, and operating profit of 65 billion KRW, a 1% increase from 64.3 billion KRW in the same period last year.

IBK Investment & Securities also expects Emart’s performance to hold up well, citing ▲ increased number of leap month and holiday business days ▲ improved profitability of the online business division ▲ improved performance of major business units due to efficient cost control as reasons.

In particular, the fact that there were more holidays and business days than last year is positive. From January to March last year, there were three weekday holidays excluding Saturdays and Sundays, but this year there are four. Additionally, this year is a leap year, so February had 29 days. A representative from a large discount store said, "Even one more business day or weekday holiday can have a significant impact on sales," adding, "Especially in the first quarter this year, there were two instances where weekday holidays were consecutive with weekends, so we have high expectations for this."

Lotte Mart is also receiving positive signals. KB Securities forecasts that Lotte Mart’s first-quarter sales will be 1.5041 trillion KRW, up 3.9% from 1.4468 trillion KRW in the same period last year, and operating profit will rise 5% to 33.5 billion KRW from 31.9 billion KRW in the first quarter of last year.

Homeplus, which closes its fiscal year in February, has not yet announced last year’s results. However, it is expecting performance improvement due to sales growth, as the first week of this year’s ‘Super Sale HomeRun’ saw sales increase by up to 20% compared to the same period last year.

Large discount stores are undergoing internal structural improvements to overcome severe consumer downturn. Emart recently completed voluntary retirement. From July this year, it plans to launch an integrated corporation with corporate supermarkets (SSM) and accelerate management efficiency from the second half of this year. Lotte Mart expects that the integration of marts and supermarkets and the grocery-focused store strategy will gradually show effects.

The industry views that difficulties are inevitable for the time being as high inflation and e-commerce offensives continue. In particular, with the entry of Chinese e-commerce, domestic e-commerce such as Coupang is also expanding sales, making ‘price competition’ between online and offline distribution channels unavoidable. A representative from a large discount store said, "The aggressive entry of Chinese e-commerce into the Korean market is threatening the competitiveness of both offline and online businesses," adding, "With Emart’s voluntary retirement costs reflected, the second quarter is also expected to be challenging."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)