Improved Performance Due to Increased Ultra-High Voltage Cable Orders

Opportunities from Aging Power Grid Replacement and Data Center Construction

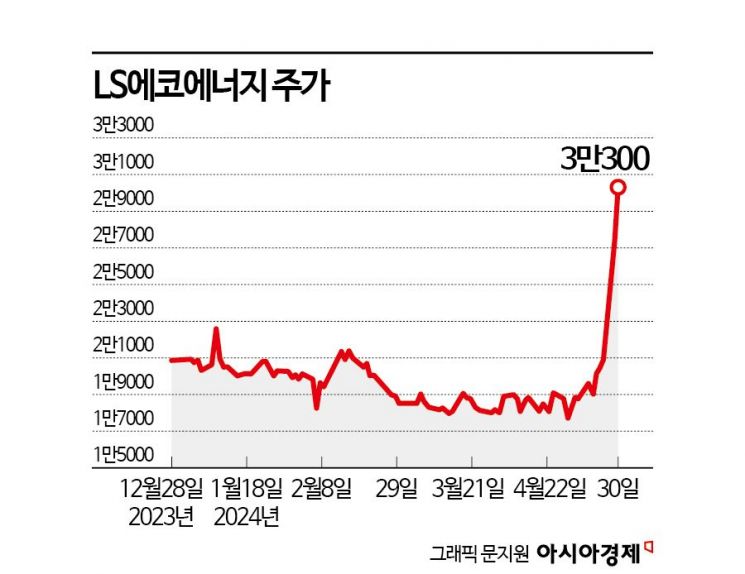

Since changing its name and promoting new businesses this year, LS Eco Energy's stock price has continued its soaring trend. There are expectations that its performance will improve due to increased electricity usage from aging power grid replacement, offshore wind power, and data center construction.

According to the financial investment industry on the 2nd, LS Eco Energy's stock price has risen 45% since the beginning of this year. During the same period, the KOSPI index only increased by 1.6%. After closing at 20,900 KRW at the end of last year, it surpassed the 30,000 KRW mark within four months. On the 30th of last month, it reached an all-time high of 32,450 KRW during trading hours.

With the confirmation that the first quarter performance exceeded market expectations, optimism for improved results this year is growing. In the first quarter of this year, sales reached 179.9 billion KRW, and operating profit was 9.7 billion KRW. Compared to the same period last year, sales increased by 2.0%, and operating profit rose by 84.0%. Kangho Park, a researcher at Daishin Securities, analyzed, "The first quarter operating profit exceeded the previous estimate of 6.1 billion KRW."

LS Cable Asia, a subsidiary of LS Cable, changed its name to LS Eco Energy earlier this year. The name change reflects the company’s intention to expand its business from power and communication cables to submarine cables and rare earth elements, aiming to become an eco-friendly energy company.

Optimistic forecasts for LS Eco Energy continue to emerge. Sangheon Lee, a researcher at Hi Investment & Securities, explained, "Not only is there replacement of aging power grids, but the supply of renewable energy such as offshore wind power is expanding, and power usage is increasing globally due to data center construction driven by artificial intelligence (AI), leading to a rise in power grid construction projects worldwide."

The company is benefiting from supply shortages in the power cable market. LS Eco Energy is the leading power cable company in Vietnam. Last year, its power cable division recorded an operating profit margin of 9.2%. It is expected to continue this profitability improvement trend this year. The customer base for power cables is expanding beyond the Vietnam Electricity Authority to include European power authorities. In Singapore, power grids are being built with underground ultra-high voltage cables without transmission towers, and in Denmark, demand for ultra-high voltage cables is increasing due to offshore wind farm construction and undergrounding of overhead transmission lines. Leveraging synergies with its parent company LS Cable, LS Eco Energy is participating in large-scale power projects. Based on collaboration among affiliates, orders are expected to increase in Asia and Europe.

Sowon Kim, a researcher at Kiwoom Securities, analyzed, "The company produces ultra-high voltage and medium-low voltage power lines, communication lines, and basic wire materials. The business structure, which was centered on medium-low voltage power lines, is expected to expand with the growth of the power market driven by the Vietnamese government's power development plans, leading to increased demand for high value-added products including ultra-high voltage power lines."

The outlook for new businesses is also bright. Jonghwa Sung, a researcher at eBest Investment & Securities, explained, "The growth potential of major new businesses such as rare earth oxide trading and rare metal alloy business in Vietnam is enormous," adding, "The future potential value expansion is significant." He further noted, "Vietnam has an estimated rare earth ore reserve of 22 million tons, second in the world after China. Considering the Vietnamese government's plans to increase rare earth production and offshore wind power capacity, these will serve as growth drivers for a long time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)