Ministry of Health and Welfare Reports Financial Projection Results to Annual Special Committee

Raising Mandatory Enrollment Age Limit to 64 Accelerates Fund Depletion

'Pay More, Receive Same' Plan Also Delays Fund Exhaustion by 5-7 Years

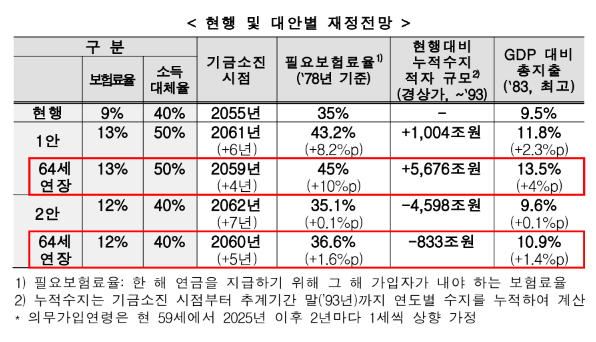

The government predicted that if the pension reform plan of 'pay more, receive more' discussed by the National Assembly's Pension Reform Special Committee Public Deliberation Committee is followed, the pension depletion point could be delayed by about 4 to 6 years. Additionally, if pension reform is pursued under this plan and the mandatory enrollment age is raised to 64, the cumulative pension reform deficit is projected to reach 5,676 trillion won by 2093 according to fiscal estimates.

On the 30th, the Ministry of Health and Welfare reported the results of the 'Public Deliberation Agenda Alternative Fiscal Estimates' at the Pension Special Committee held at the National Assembly. According to the government's fiscal estimates, while pursuing reform can delay the pension depletion point, raising the mandatory enrollment age and other factors offset the effects.

The fiscal estimate, based on the so-called income guarantee plan known as 'pay more, receive more,' which raises the income replacement rate to 40-50% and gradually increases the insurance premium from 9% to 13%, projected the fund depletion point to be in 2061, about 6 years later than currently expected. However, the cumulative deficit (up to 2093) is expected to increase by 1,004 trillion won compared to the current level. If the mandatory enrollment upper age limit, which received strong support in the Public Deliberation Committee, is raised to 64, the fund depletion point is expected to come earlier in 2059 by 2 years, and the cumulative deficit is projected to increase to 5,676 trillion won.

The so-called 'pay more, receive the same' plan, referred to as the 'fiscal stability plan,' which was also discussed in the Public Deliberation Committee, was also estimated. Under this plan, which raises the insurance premium rate to 12% while maintaining the income replacement rate at 40% as it is currently, the pension depletion point is expected to be delayed by 7 years to 2062, and the cumulative deficit (up to 2093) is predicted to decrease by 4,598 trillion won. However, if the mandatory enrollment upper age limit is raised to 64, the pension depletion point shortens by 2 years to 2060, and the deficit reduction effect decreases to 833 trillion won.

Regarding the income guarantee plan, the Ministry of Health and Welfare stated, "Due to the insufficient increase in the insurance premium rate compared to the rise in the income replacement rate, the cumulative deficit and the required insurance premium rate after fund depletion will significantly increase," adding, "This worsens the fiscal situation compared to the current status, does not meet the purpose of pension reform for fiscal stability, and only increases the burden on future generations." Regarding the fiscal stability plan, they said, "Raising the insurance premium rate while maintaining the income replacement rate improves the current low-burden (9%) high-benefit (40%) structure and helps fiscal stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)