Major Shareholder (96% Stake) Nihon Look Holdings

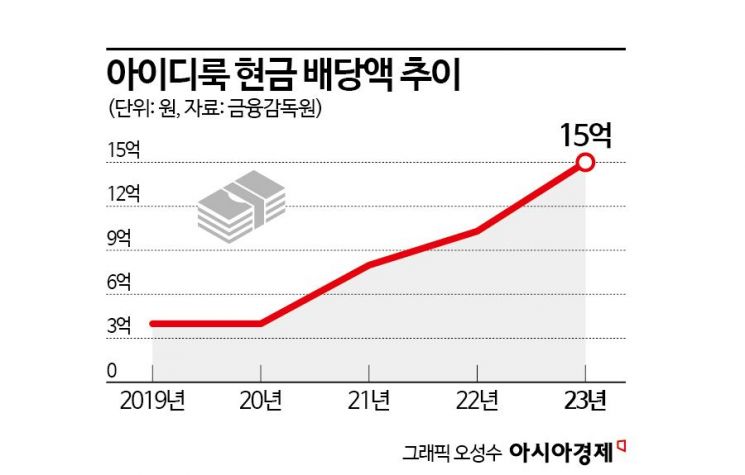

Dividend Increased from 1 Billion to 1.5 Billion Won... Dividend Payout Ratio 9%

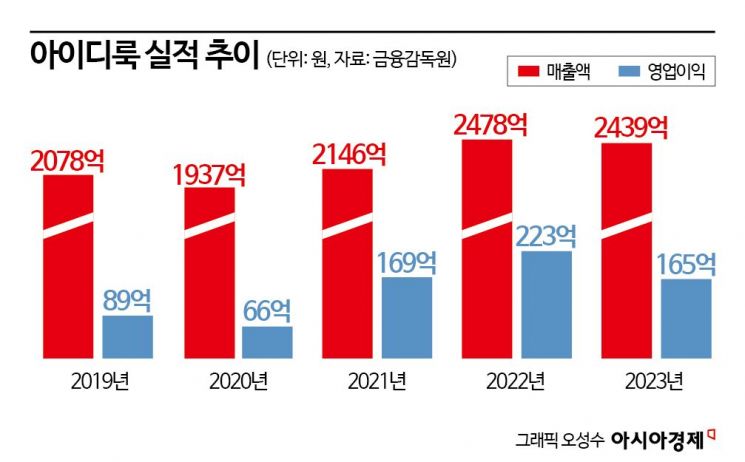

Last Year's Performance Declined... 'A.P.C. Golf' Effect Fades

Idilook, a company selling imported clothing brands, significantly increased its dividend payout ratio last year despite sluggish performance. Idilook sells more than 10 contemporary (semi-luxury) brands such as 'Maje,' 'Sandro,' 'Claudie Pierlot,' 'A.P.C (A.P.C.),' and 'A.P.C Golf,' with its largest shareholder, Japan's Look Holdings, owning 96% of the shares.

According to the Financial Supervisory Service's electronic disclosure system on the 30th, Idilook's cash dividend amount last year was 1.5 billion KRW. This is a 50% (500 million KRW) increase from 1 billion KRW in 2022. The dividend payout ratio (total cash dividends paid out of net income) jumped significantly from 5% to 9%. Although net income decreased by 3 billion KRW from 19.2 billion KRW in 2022 to 16 billion KRW last year, the dividend amount increased, resulting in a higher payout ratio.

Idilook was established in January 1988 for the manufacture and sale of women's clothing, and on November 2, 1998, its trade name was changed from Ssangbangwool Look to Idilook. The largest shareholder is Japan's Look Holdings, which holds 96% of the shares, and the dividends received from Idilook by this company have steadily increased since 2020.

From 2015 to 2020, the cash dividend amount was fixed at 400 million KRW, but in 2021 it doubled to 800 million KRW. The dividend amount increased significantly as operating profit and net income expanded in 2021. At that time, Idilook's net income surged about 150%, from 6.2 billion KRW to 15.3 billion KRW. Reducing operating expenses by cutting the number of employees from 414 in 2020 to the 170s in 2021 was effective. Employee salary expenses decreased from 11 billion KRW in 2020 to 7.4 billion KRW the following year.

Although the dividend policy has been greatly expanded, it is uncertain whether the performance will support it. Idilook's separate basis sales and operating profit last year were 243.9 billion KRW and 16.5 billion KRW, respectively. Sales slightly decreased from 247.8 billion KRW in 2022, and operating profit (23.2 billion KRW) shrank by more than 28%.

In 2022, Idilook recorded its highest performance since its founding, with sales increasing by about 30 billion KRW and operating profit by about 5 billion KRW compared to the previous year. The French brand A.P.C., imported by the company, gained popularity to the extent of forming a fandom among the MZ generation (Millennials + Generation Z), and the golf wear brand A.P.C Golf, launched the same year, drove the performance.

A.P.C Golf was created by Idilook's proposal to the French headquarters as the number of new golf entrants among the MZ generation increased due to the COVID-19 pandemic. Idilook planned and produced a significant portion of A.P.C Golf's products. At that time, the golf apparel market was targeted mainly at those over 40, lacking designs preferred by the younger 20s and 30s age group.

In contrast, A.P.C Golf incorporated the classic designs and sensibilities of the existing A.P.C into golf wear to be enjoyed in everyday life, attracting great attention from MZ golfers. After its debut at department stores in February 2022, it recorded the highest single-day sales ever for a golf wear brand. It was so successful that it was "re-exported" to Japan and France.

However, with the COVID-19 endemic (periodic outbreak of infectious diseases), golf demand sharply declined last year, reversing the atmosphere. The prolonged economic downturn significantly reduced the golf population, leading to decreased demand for golf wear. A fashion industry insider said, "Although the market size has grown with increased inflow of people in their 20s and 30s into the golf market, consumption is not occurring," adding, "Latecomers to the market will likely face significant inventory losses."

In fact, as the golf craze subsides, golf wear brands are struggling. Maison Kitsun?, a foreign semi-luxury brand that expanded into the golf wear market like A.P.C Golf, recently announced it would exit the golf business in the domestic market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)