As financial authorities announce new approval criteria for internet-only banks, competition for the fourth internet-only bank is expected to intensify.

On the 26th, a financial authority official stated, "We are reviewing the new approval criteria and plan to disclose it soon." With four consortia already declaring their intentions to launch the fourth internet-only bank, the possibility of the fourth internet-only bank becoming a reality within this year has increased significantly.

The new criteria are expected to include improvements regarding capital requirements and credit evaluation models. The official said, "The existing entry requirement of 25 billion KRW in capital is insufficient," adding, "Based on past cases, sufficient capital strength is necessary." The likelihood of adding plans for loans to middle- and low-credit borrowers appears low at this time.

In particular, financial authorities believe that the fourth internet-only bank needs to demonstrate 'innovation' and 'differentiation.' While KakaoBank, K Bank, and Toss Bank have been evaluated as successfully establishing themselves in the market, they have been criticized for lacking significant differentiation from traditional banks compared to their early stages.

A Financial Services Commission official explained, "There needs to be innovative and new areas beyond mortgage loans or personal loans, and if that happens, risk management and capital strength could differ," adding, "We are internally reviewing these overall aspects (of the criteria)."

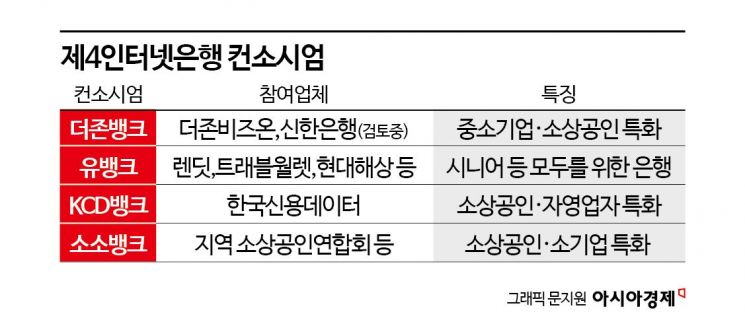

Once the new criteria are disclosed, the consortia that have declared their intentions to launch the fourth internet-only bank are expected to become more active. Currently, four consortia have expressed their intention to pursue approval for the fourth internet-only bank: Duzon Bank, U Bank, KCD Bank, and Soso Bank.

Duzon Bank, promoted by Duzon Bizon, an enterprise resource planning (ERP) specialist company, has emerged as a strong contender, reportedly with Shinhan Bank's participation likely. Duzon Bizon previously established a joint venture, Duzon Fintech, with Shinhan Bank in 2021. Especially, since Duzon Bizon serves about 130,000 ERP client companies, it is expected to have strengths in the small and medium-sized enterprise financial sector.

The U Bank consortium includes online investment-linked finance company Lendit, fintech platform Jarvis & Villains, Travel Wallet, and Hyundai Marine & Fire Insurance. While other banks focus on small business owners, U Bank is expanding its target to foreigners and the elderly, emphasizing its proprietary credit evaluation model as a strength. The U Bank consortium is also in discussions to involve commercial banks.

KCD Bank is positioning itself as specialized in small business financing. Korea Credit Data, which is promoting the establishment of KCD Bank, operates 'Cash Note,' a management app used by about 2 million small business owners and self-employed individuals. Soso Bank is also preparing to establish an internet-only bank since last year, with regional small business associations collaborating. An industry insider said, "Everyone is preparing for approval while waiting for the new evaluation criteria, so once the announcement is made, active movements will begin."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)