ESG Bonds, Gradual Growth Expected Amid Increasing Social Demand for ESG

Focus on Successful ESG Structural Improvement Following Mandatory Climate Disclosure Implementation

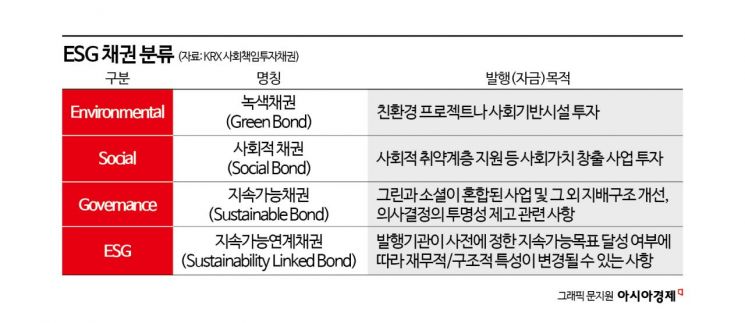

Interest in ESG (Environmental, Social, and Governance) bonds is increasing. The growing social demand for ESG management is influencing corporate capital raising, leading to a gradual rise in the popularity of ESG bonds. In particular, the mandatory climate disclosure is expected to exert significant pressure to strengthen ESG, impacting capital markets and certain industries through ESG bond issuance.

According to the Korea Exchange on the 26th, the outstanding balance of listed ESG bonds was approximately KRW 249.38 trillion as of the previous day. This represents a 20% increase from last year's KRW 208.24 trillion. By bond type, the breakdown was ▲Social Bonds KRW 205.25 trillion ▲Green Bonds KRW 2.68 trillion ▲Sustainability Bonds KRW 1.783 trillion ▲Sustainability-Linked Bonds KRW 210 billion. Additionally, global ESG bond issuance also increased. In the first quarter of this year, ESG bond issuance reached USD 322 billion, marking over a 10% increase compared to USD 290.6 billion in the same period last year. This exceeds the five-year average since 2019.

Especially, the 'Korean Green Bond Issuance Interest Subsidy Support Project' implemented last year has steadily increased domestic green bond issuance. Through this support project, companies can receive up to KRW 300 million in interest cost subsidies depending on their size when issuing green bonds. From last year through the first quarter of this year, the scale of Korean green bond issuance was about KRW 5.6 trillion, accounting for approximately 80% of the total green bond issuance of KRW 7 trillion. Hwa-jin Lee, a researcher at Hyundai Motor Securities, analyzed, "Korean green bonds will have a positive effect on both issuers and investors. This can lead to increased awareness of sustainable management activities and enhanced corporate value, while also providing economic incentives by enabling capital raising under favorable conditions such as low interest rates."

Industry experts predict that ESG bonds will continue to grow as the energy paradigm shifts toward decarbonization and the global ESG disclosure framework takes shape. The researcher added, "The recent robust U.S. economic situation is weakening market expectations for the Federal Reserve's interest rate cuts, which could negatively affect future ESG bond issuance. However, market research firm S&P Global anticipates growth in ESG bond issuance driven by accelerated transitions to renewable energy."

While companies are raising capital for ESG management through ESG bonds and other means, last month the U.S. Securities and Exchange Commission (SEC) announced ESG disclosure standards mandating listed companies to comply. The Financial Services Commission also released a draft at the 4th meeting of the ESG Finance Promotion Task Force on the 22nd and plans to unveil the final version on the 30th. Domestic companies will now be required to disclose climate-related risks and opportunities that influence investors' decision-making to the market.

In response, experts have shared opinions on the expected effects of mandatory climate disclosure and its impact on industries. Se-yeon Park, a researcher at Hanwha Investment & Securities, stated, "Export-driven industries such as automotive, battery, and semiconductor sectors already incorporate Life Cycle Assessment (LCA) and Scope 3 calculations for carbon emission reductions during trade negotiations, so the impact of mandatory disclosure will be limited." However, he added, "Consulting demand through climate disclosure-related consulting firms, law firms, accounting firms, and ESG rating agencies is expected to grow significantly." He also noted, "The disclosure standards require climate governance responses centered on the board of directors, which will increase companies' motivation to actively attract outside directors rather than internal directors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)