Since Late Last Year, Credit Rating Outlooks for Securities Firms Have Been Downgraded

Concerns Over Real Estate PF Lead to 'Negative' Credit Rating Outlooks for Securities Firms

Claims of Insufficient Provisioning Persist

Concerns over the deterioration of real estate project financing (PF) are increasing downward pressure on the credit ratings of securities firms. Since the end of last year, there has been a continuous trend of credit rating outlook downgrades for securities companies. There are forecasts that additional downgrades of securities firms' credit ratings may occur in the future.

According to the financial investment industry on the 25th, NICE Credit Rating (NICE) recently downgraded the long-term credit rating outlook for Hana Securities' senior and subordinated bonds from 'Stable' to 'Negative.' NICE explained that the change in Hana Securities' rating outlook reflects the expanded uncertainty regarding the profit-generating capacity of the corporate finance (IB) division, which has driven growth so far, the need to monitor changes in competitive position and stability of the revenue base in some business sectors, and the possibility of additional losses related to domestic and overseas alternative investments.

Earlier last month, the international credit rating agency S&P Global adjusted the rating outlooks of Mirae Asset Securities and Korea Investment & Securities from 'Stable' to 'Negative.' S&P Global stated, "Due to the slowdown in domestic and international real estate markets, downward pressure on the securities industry is increasing," and added, "The negative rating outlook reflects S&P's view that real estate-related risks could burden the asset soundness and profitability of domestic securities firms over the next one to two years."

In November last year, Korea Ratings downgraded Daol Investment & Securities' corporate credit rating (ICR) and unsecured bond rating outlook from 'Stable' to 'Negative,' and also lowered Hi Investment & Securities' unsecured bond rating outlook from 'Positive' to 'Stable.'

There are forecasts that the downgrade of credit ratings could extend to other securities firms. Gong Mun-ju, a researcher at Yuanta Securities, said, "Currently, asset soundness is deteriorating mainly due to real estate PF, profits are decreasing due to the recognition of provisions, and many securities firms are meeting the criteria for credit rating agencies' review for downgrade," adding, "If profitability is not maintained to the extent that the securities firms can absorb real estate PF defaults and financial stability is negatively impacted, the possibility of credit rating downgrades for other securities firms is also open." He continued, "In the case of Hana Securities, despite being a bank-affiliated securities firm with Hana Financial Group as its major shareholder, the rating outlook was downgraded. Even if the possibility of support from a strong parent company is recognized, if actual support is not provided in a timely manner, the possibility of credit rating adjustments cannot be ruled out."

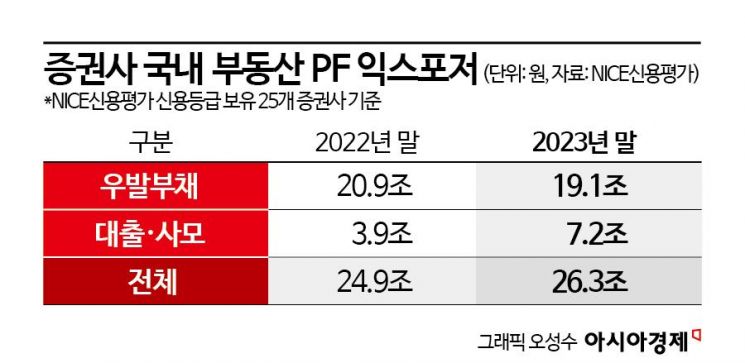

Credit ratings are also expected to fluctuate depending on the degree of real estate PF deterioration held by securities firms and their response capabilities, with the burden expected to intensify especially for small and medium-sized securities firms with a high PF ratio. According to NICE, as of the end of last year, the domestic real estate PF exposure of 25 securities firms with credit ratings held by NICE was 26.3 trillion KRW, a 6% increase compared to 24.9 trillion KRW at the end of 2022. The ratio of domestic real estate PF to equity capital was 32%, 38%, and 41% for mega firms, large firms, and small-to-medium firms, respectively. Researcher Gong explained, "Small and medium-sized securities firms have a higher quantitative burden compared to large firms due to the high ratio of real estate PF to equity capital," and added, "The high proportion of high-risk real estate PF, such as local and subordinated projects, is also a concern, and the negative impact from real estate PF is expected to be more pronounced compared to large firms."

Although securities firms are continuously setting aside related provisions, there are still criticisms that these are insufficient. Researcher Gong said, "Many securities firms reportedly increased provisions beyond their original plans in the fourth quarter of last year in response to financial authorities' demands, but the absolute size of provisions remains small," adding, "The average provision ratio against IB-related assets is only about 8%, and even assuming all provisions are allocated to real estate PF, the provision ratio is about 15%. Considering the high proportion of high-risk PF, this seems somewhat insufficient."

Due to real estate PF risks, the credit outlook for securities firms this year is not optimistic. Lee Yeri, a senior researcher at NICE, said, "The direction of credit ratings in the securities industry this year is negative," explaining, "There is an additional loss burden related to real estate PF, profitability and asset soundness are deteriorating, and the recovery of the real estate market is delayed, leading to a continued reduction in fee income in the IB division." She added, "Regarding individual companies' credit ratings, it is important whether core recurring income generated from brokerage, asset management, and financial sectors can cover losses related to domestic and overseas investment assets and selling and administrative expenses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)