Lee Bok-hyun, Financial Supervisory Service Chief, Attends 2nd Short Selling Forum

Unveils Illegal Short Selling Detection System (NSDS)

Real-Time Sharing of Loan Contracts and Trade Execution Data

Focus on Possible Resumption of Short Selling in June

Lee Bok-hyun, Governor of the Financial Supervisory Service (FSS), held another 'Short Selling Forum' on the 25th, following one in March. This is interpreted as a firm intention to conclusively end the exhausting debates related to illegal short selling. At the 2nd Short Selling Forum held at 10 a.m. in the Korea Exchange Conference Hall in Yeouido, Seoul, Lee shared the plan to build an illegal short selling prevention IT system with individual investors and gathered their opinions. Governor Lee emphasized, "To end the fruitless debates on illegal short selling, the financial authorities intend to listen carefully to the opinions of individual investors and the securities industry and reflect them in finalizing the plan." Based on the details disclosed by the FSS, the Korea Exchange will proceed with building a real-time illegal short selling detection system. Alongside this, the Financial Services Commission will accelerate preparations for legislation mandating the 'self inventory management system.'

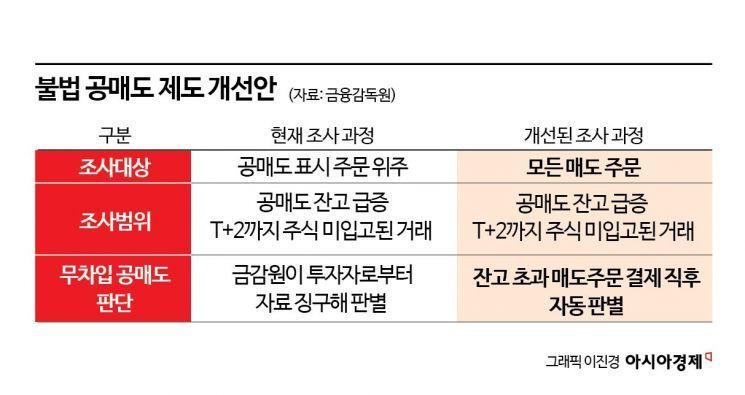

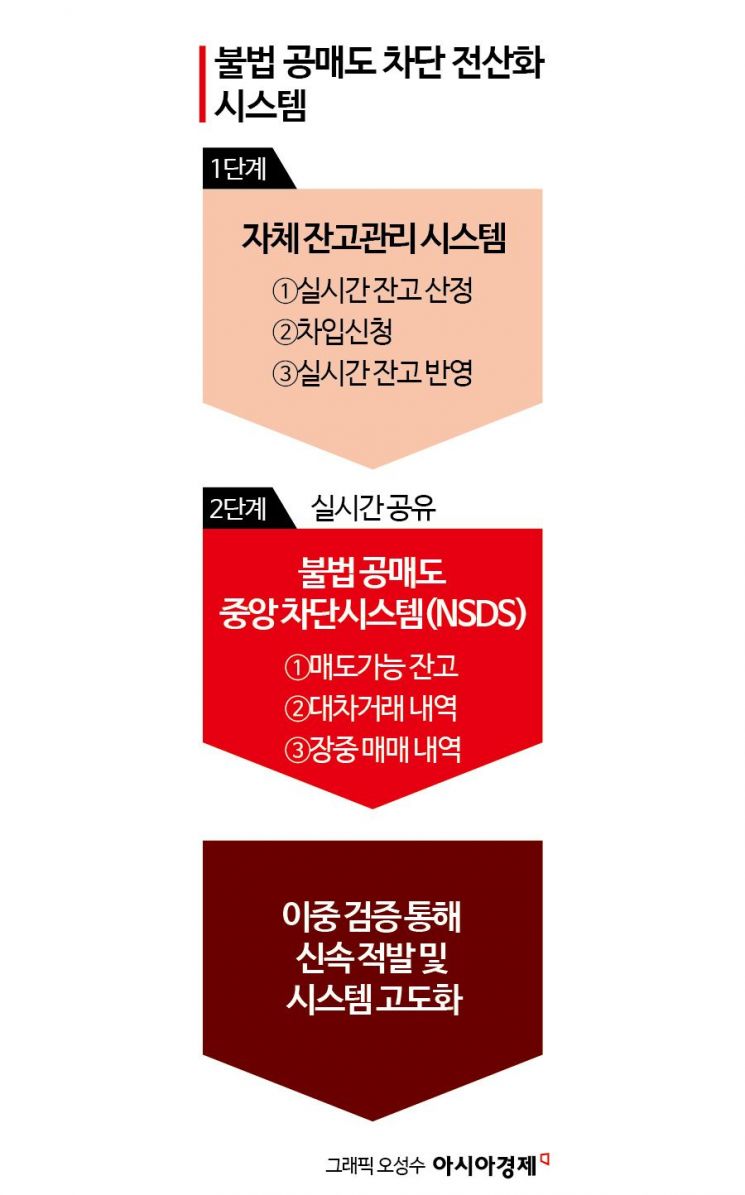

The improvement plan announced by the FSS is called the 'Illegal Short Selling Central Blocking System (NSDS - Naked Short Selling Detecting System)'. Institutional investors' short selling involves borrowing stocks first (securities lending contract) and then placing sell orders through securities firms. NSDS verifies both the securities lending contracts and trade executions of institutional investors through the Korea Exchange in a dual-check manner. It effectively determines naked short selling in real time.

The IT system construction is mainly composed of two frameworks. First, institutional investors build a 'self inventory management system' within their organizations to preemptively block naked short selling. The 'self inventory management system' monitors naked short selling through three stages (① real-time inventory calculation ② borrowing application ③ real-time inventory reflection).

For example, if a trader places a short sell order for 100 shares of Samsung Electronics, the relevant department ①calculates the short selling inventory in real time. If only 50 shares are available, the sell order is automatically rejected. If the sell order proceeds, the securities lending department initiates the borrowing process by borrowing 50 shares from stock lenders, triggering the second stage of monitoring. The short selling order is approved only after the securities lending department completes ②borrowing the remaining 50 shares from stock lenders. At this point, borrowing confirmations, recall details, and other data are ③reflected in real time, and if the inventory is exceeded, the short selling order is automatically rejected.

This is the short selling IT system announced by the financial authorities last year. Despite being a triple-layered structure to block naked short selling, there was strong opposition from individual investors when the 'self inventory management system' plan was announced, due to distrust in institutional investors' own systems. The key point of the FSS's recent announcement is sharing the details of institutional investors' self inventory management systems with the Korea Exchange. This means perfectly verifying even blind spots through a central system. The Korea Exchange receives real-time transmissions of institutional investors' △available sell inventory △securities lending transaction details △intraday trading details.

This enables automatic detection of settlement failure naked short selling, which was previously difficult to catch. It also exposes cases where institutional investors disguised short sell orders as regular sell orders to evade the uptick rule. The NSDS system operates 24/7 in real time. It can detect violations faster and more comprehensively than the previous method of collecting related documents such as securities lending contracts for self-investigation.

An FSS official explained, "If institutional investors' self inventory management systems operate properly, naked short selling cannot occur, but the purpose of NSDS is to enhance these systems and ultimately prevent illegal short selling in advance."

The FSS plans to complete the NSDS construction within this year as soon as possible in consultation with the Korea Exchange. However, building a new IT system requires securing a budget, conducting tests, and verifying stability. Considering this, the earliest NSDS operation is expected in early next year. The mandatory legislation for building the 'self inventory management system' must be passed for NSDS construction. Currently, related bills are pending in the National Assembly. The Financial Services Commission intends to focus on passing the law by amending lawmakers' bills without proposing separate legislation.

With the system for blocking illegal short selling ready, attention is also on whether short selling will resume in June. President Yoon Suk-yeol stated at the Financial Services Commission's work report (public livelihood forum) in January this year, "Currently, short selling is banned until June, but if a definite measure to prevent illegal short selling and its side effects is not established, there is absolutely no intention to resume it thereafter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)