Rising Delinquency Rates Among Credit-Vulnerable Groups Such as Small Corporations and Personal Loans

FSS: "Domestic Banks Have Sufficient Loss Absorption Capacity"

The delinquency rate on domestic bank loans has risen to its highest level in five years. Among corporate loans, the delinquency rate for small and medium-sized corporations stood out, while among household loans, the delinquency rate for non-mortgage loans such as credit loans showed a notable increase. Overall, there is a trend of rising delinquency rates among credit-vulnerable borrowers.

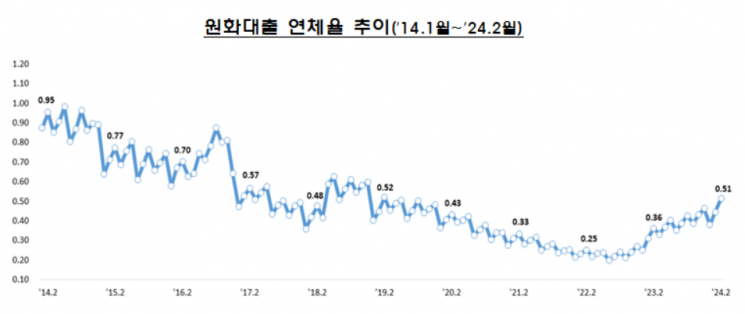

According to the "Status of Domestic Bank KRW Loan Delinquency Rates as of the End of February 2024" released by the Financial Supervisory Service on the 24th, the delinquency rate rose by 0.06 percentage points from 0.45% at the end of the previous month to 0.51%. Compared to the same period last year (0.36%), it increased by 0.15 percentage points. The delinquency rate reaching the 0.5% level as of the end of February is the first time in five years since 2019 (0.52%). Looking at the delinquency rate trend over the past six months, it rose from 0.39% in September last year to 0.46% in November, then dipped to 0.38% in December before rebounding to 0.45% in January this year.

By sector, the delinquency rate for corporate loans at the end of February was 0.59%, up 0.09 percentage points from 0.5% at the end of the previous month and 0.2 percentage points from 0.39% at the same time last year. The delinquency rate for large corporate loans (0.18%) increased by 0.06 percentage points from 0.12% at the end of the previous month and rose 0.09 percentage points compared to 0.09% at the same time last year. The delinquency rate for small and medium-sized enterprise (SME) loans was 0.7%, up 0.1 percentage points from 0.6% at the end of the previous month and 0.23 percentage points from 0.47% at the same time last year. Among SMEs, the delinquency rate for small and medium-sized corporations (0.76%) rose 0.24 percentage points compared to 0.52% in the same period last year, marking the largest increase among corporate loans. During the same period, the delinquency rate for individual business owner loans (0.61%) increased by 0.22 percentage points.

The delinquency rate for household loans was 0.24%, up 0.04 percentage points from 0.38% at the end of the previous month and 0.1 percentage points compared to 0.32% at the same time last year. The delinquency rate for mortgage loans (0.27%) rose 0.02 percentage points from 0.25% at the end of the previous month and increased 0.07 percentage points compared to 0.2% at the same time last year. The delinquency rate for household loans excluding mortgage loans, such as credit loans, was 0.84%, up 0.2 percentage points from 0.64% at the same time last year, showing the largest increase among household loans. Compared to 0.74% at the end of the previous month, it rose by 0.1 percentage points.

Bank delinquency rates have been on the rise since the second half of 2022. However, the Financial Supervisory Service explained that the current level is still low compared to the average delinquency rate (0.78%) over the 10 years before COVID-19 (2010?2019). A Financial Supervisory Service official stated, "The loss absorption capacity of domestic banks has greatly improved compared to the past, making it a manageable level," and added, "We will promote debt restructuring for vulnerable borrowers and strengthen asset soundness management through the sale and disposal of non-performing loans."

Meanwhile, the Financial Supervisory Service expects the delinquency rate to decline by the end of March. This is because, typically, at the end of a quarter, banks intensify the cleanup of delinquent loans (through sales and disposals), which tends to cause a significant drop in delinquency rates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.